Write something

Pinned

Congrats to the Top 10 Contributors for Feb 2026 and announcing March 2026 Prize

In Investing Accelerator, we are starting a new monthly prize pool for top 10 most active members Congratulations to the following 10 people for being the most contributing members of the community: 1) @Rong Zhou 2) @Leon K 3) @Lindsay Talbot 4) @Sharon Yuen 5) @Monica Bernard 6) @Kim Huynh 7) @Cris Bob 8) @Sukhwinder Dhanoa 9) @Kevin Esmati 10) @Sandra Van Den Ham I (Michael) will contact you in the chat to provide you with the gifts. You will receive: 1 share of IBIT $37 USD To show proof of purchase, you must post in the community that you received the share. For next month March, the prizes will be: 1 share of IBIT (iShare Bitcoin Trust by BlackRock) (https://www.skool.com/investing-accelerator/-/leaderboards) Investing Accelerator Incentives: Get Richer by Helping Others Succeed 1. 🎁 Join Investing Accelerator for Free: Share the "How to Join Investing Accelerator for Free" guide with a friend. If they join, you both earn the referral fee. Learn More (https://www.skool.com/invest-retire-community-1699/how-to-join-investing-accelerator-for-free) 2. ⏱️ Speed & Success Bonus: Complete the program within 90 days and pay off the remaining balance to get 10% off the balance. 3. 📈 Trading Milestone Rewards: - First 30% Return from a Single Trade: Share your success in the community to receive a free stock. - 30% Portfolio Return in One Year: Achieve a 30% annual return to earn another free stock (once per year). 4. Student Referral Program: Refer a friend to join Investing Accelerator and you both earn $1,000 USD + a free stock each. Learn More (https://5mininvesting.com/free-case-study/)

Pinned

How to join Investing Accelerator for "free"

This post is for people who have more than $20,000 to invest. This is how you can get Investing Accelerator for "free" and get the market to pay for it for you. (If you didn't finish the free training, click here: https://5mininvesting.com/free-case-study/) So here's how you can get the investing strategy to pay for the tuition of the program from the second month onwards. Secret: You start with the monthly passive income strategy first. 1. You hop on a call with me (or Michael) to see if you are a good fit. If you are, you will get to choose a 12 month payment plan for Investing Accelerator. Link to schedule a call 2. This allows you to start investing and generating monthly passive income starting from month #2. 3. You go through the 7-week video training. It takes around 4 hours a week. If you got time, you can go through it faster. 4. You start with the monthly passive income strategy. You set up your account with your favorite broker. My favourite is Interactive Broker (IBKR). 5. You fill out a form to get the highest option level (required for monthly passive income) 6. I publish my monthly passive income trades monthly. At the end of 7 weeks, you copy 2 of the trades each month. Placing the trade should take you around 15-30 mins each month. 7. With $20,000 * 3% = $600 per month, this will pay for the tuition cost each month with money left over. Since this is a short-term strategy, you can deduct the tuition expense against your trading income. 8. By the end of 12 months, the market would have paid the entire Investing Accelerator tuition with $1,000 extra left over or more. Link to schedule a call It's that simple. If you plan to join Investing Accelerator, I expect you to just follow 1-2 of my trades each month for monthly passive income and let the market pay the tuition.

Pinned

Welcome to Invest & Retire

The goal of the community is to learn together for long term investing and monthly passive income strategies in the stock market. Rules: - Be positive - Contribute and ask questions - Avoid topics about day trading, penny stocks, small cap that are prone to manipulation - No self promotion Invite your friends to join: Since this is a free community, you will get rewards for asking your friends to join (e.g. gift cards, books and more). How to get your referral link: - Go to settings on the right - Click Invite - Either enter the email or "Get an invite link to share" - Follow up with any pending invites Classroom: Valuable content and recommended resources: - Strongly recommend going through the free chart course to learn how to find discounted stocks - Then you can grab the additional free resources in the Invest & Retire resources section - Then learn more about taxes Leaderboard: Under leaderboard, you will unlock various awards - You will unlock additional content about how to use a stock screener at level 3 - Every month, the top 10 leaders will also get prizes! We are all here to learn. So don't be shy and introduce yourself and make some friends Eric Seto

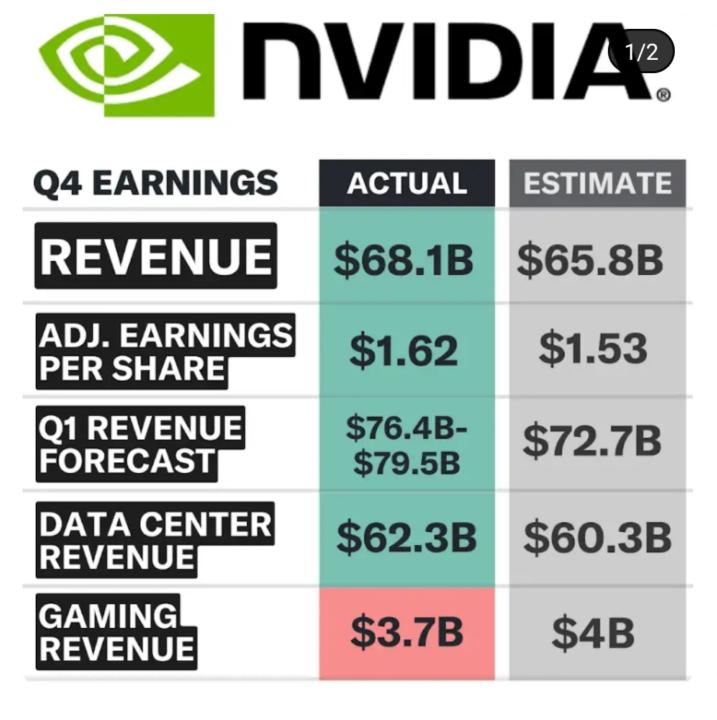

Nvda Q4 earning

Will Nvidia lifts all tides? Their guidance is raised 5bbbbillions from estimate!! 👍💪💪💪

1-30 of 2,973

skool.com/invest-retire-community-1699

Investment & Retirement Strategies for busy full-time professionals. Long-term investing & Monthly Passive income ideas.

Powered by