Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

What is this?

Less

More

Memberships

Invest & Retire Community

3.5k members • Free

992 contributions to Invest & Retire Community

Congrats to the Top 10 Contributors for Feb 2026 and announcing March 2026 Prize

In Investing Accelerator, we are starting a new monthly prize pool for top 10 most active members Congratulations to the following 10 people for being the most contributing members of the community: 1) @Rong Zhou 2) @Leon K 3) @Lindsay Talbot 4) @Sharon Yuen 5) @Monica Bernard 6) @Kim Huynh 7) @Cris Bob 8) @Sukhwinder Dhanoa 9) @Kevin Esmati 10) @Sandra Van Den Ham I (Michael) will contact you in the chat to provide you with the gifts. You will receive: 1 share of IBIT $37 USD To show proof of purchase, you must post in the community that you received the share. For next month March, the prizes will be: 1 share of IBIT (iShare Bitcoin Trust by BlackRock) (https://www.skool.com/investing-accelerator/-/leaderboards) Investing Accelerator Incentives: Get Richer by Helping Others Succeed 1. 🎁 Join Investing Accelerator for Free: Share the "How to Join Investing Accelerator for Free" guide with a friend. If they join, you both earn the referral fee. Learn More (https://www.skool.com/invest-retire-community-1699/how-to-join-investing-accelerator-for-free) 2. ⏱️ Speed & Success Bonus: Complete the program within 90 days and pay off the remaining balance to get 10% off the balance. 3. 📈 Trading Milestone Rewards: - First 30% Return from a Single Trade: Share your success in the community to receive a free stock. - 30% Portfolio Return in One Year: Achieve a 30% annual return to earn another free stock (once per year). 4. Student Referral Program: Refer a friend to join Investing Accelerator and you both earn $1,000 USD + a free stock each. Learn More (https://5mininvesting.com/free-case-study/)

Market turning around

After I closed the short position last week for a profit, I've switched back to long the market. Overall, the market is bouncing back up after the Monday scare. With a very good technical formation across tech companies, this is a good time to deploy excess cash to average into various discounted stocks in the market I mainly focus on blue chip companies as I like to play it safe More importantly, if the bear market lasts any longer, blue chip companies usually come back first. That's one of the main reasons I like blue chip companies the most - the ability to survive downturns. Here's the 33% discounted link to join Investing Accelerator for those who are ready. Cheers, Eric ---- Eric Seto Chartered Professional Accountant (CPA) Chartered Investment Manager (CIM) Founder of 5MinInvesting.com In March, my goal is to help 20 people with no financial background master investing. You will learn two strategies: • Long-term investing with options — learn how to find discounted blue chip stocks using technical and fundamental analysis You will also learn how to hedge during a bearish market to protect yourself • Monthly passive income — learn how to generate cash flow for retirement or replacing/boosting part of your salary using options Here's a step by step guide on how to join Investing Accelerator for free: https://www.skool.com/invest-retire-community-1699/how-to-join-investing-accelerator-for-free If you’re interested, you can hop on a free strategy call with me or Michael to see if you are a good fit. When you are ready, you can schedule a call here: https://bit.ly/48mJlgR Remember to go to the Classroom tab for additional investing resources.

Why I am back to bullish even with 15% tariffs?

During this weekend, I've made significant changes to my portfolio. Took a quick 3 week profits on my short position while the market is down Now, I am bullish on the overall market again. Here are two interesting ideas for you - Bitcoin - Microsoft Even though this bear market was relatively short-lived (3 weeks), I was able to hold cash and buy back at a relatively lower price using the profits from the short position The Supreme Court ruled that the Trump tariffs are illegal Trump tried to impose 10% tariffs and increase it to 15% tariffs globally. However, the market stayed strong. This is a signal that the market does not believe Trump can pull through on the global tariffs, giventhe Supreme Court's ruling So we are back to bullish for now. Remember short positions (or hedges) are only short term measures to protect yourself like insurance. Shorts / hedges are not meant to be held for a long period of time. Cheers, Eric ---- Eric Seto Chartered Professional Accountant (CPA) Chartered Investment Manager (CIM) Founder of 5MinInvesting.com In March, my goal is to help 20 people with no financial background master investing. You will learn two strategies: • Long-term investing with options — learn how to find discounted blue chip stocks using technical and fundamental analysis You will also learn how to hedge during a bearish market to protect yourself • Monthly passive income — learn how to generate cash flow for retirement or replacing/boosting part of your salary using options Here's a step by step guide on how to join Investing Accelerator for free: https://www.skool.com/invest-retire-community-1699/how-to-join-investing-accelerator-for-free If you’re interested, you can hop on a free strategy call with me or Michael to see if you are a good fit. Schedule a call here: https://bit.ly/48mJlgR

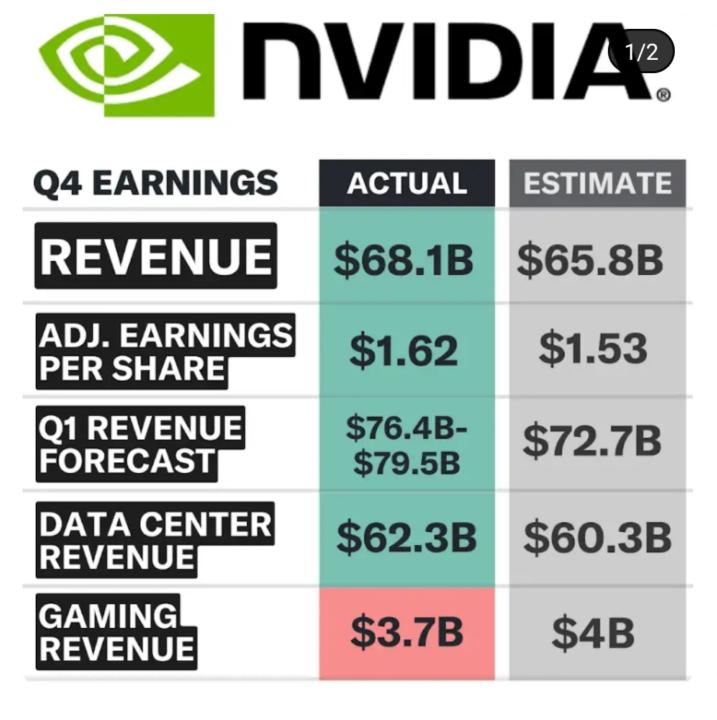

Nvda Q4 earning

Will Nvidia lifts all tides? Their guidance is raised 5bbbbillions from estimate!! 👍💪💪💪

1-10 of 992

@monica-bernard-3805

Love to learn and explore the possibilities in financial freedom.

Active 20h ago

Joined Nov 8, 2023

United States

Powered by