Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

What is this?

Less

More

Memberships

Invest & Retire Community

3.5k members • Free

748 contributions to Invest & Retire Community

South Korean stock market halted after 8% crash

Apparently, South Korea's KOSPI index, plunged over 8% - its worst single-day drop since 1997 - triggering a 20-minute trading halt due to circuit breakers, erasing about $270 billion in market value. Triggered by escalating Middle East tensions, including threats to the Strait of Hormuz, the crash stems from surging oil prices (Brent near $85/barrel) hitting South Korea's import-dependent economy, while chip stocks like Samsung fell sharply amid global sell-offs. Despite the panic, sectors like defense and shipping gained on safe-haven demand, underscoring how geopolitical shocks amplify volatility in export-reliant markets; this event aligns with broader Asian declines and fuels recession fears worldwide.

😱 Fear and Greed

💰 Every trader faces them — not on the chart, but in the mirror. Fear and greed are not emotions. They are behavioral forces that quietly rewrite your trading plan mid-session. 😬 Fear makes you exit too early. You see a red candle and think “What if I lose everything?” 🤑 Greed keeps you in too long. You're in profit, but whisper to yourself “Just a bit more…” ❗️ These emotions pretend to protect you — but in reality, they sabotage your trades. They make you overreact, second-guess, and break your own system. ✍️ Emotional discipline is the foundation of any serious trading strategy. You can have the best indicators, the cleanest setup — but if you panic at every dip or chase every pump, your edge is gone. 💡 So what do you do? 🔢 Build emotional checkpoints into your system. Before entering or exiting a trade, ask: “Is this part of my plan — or am I reacting emotionally?” 🔢 Use journaling — not just for trades, but for tracking emotional states. Over time, you’ll spot patterns and triggers. 🔢 Practice "planned detachment." Treat each trade like a statistical event — not a personal victory or failure. 🧠 Fear and greed won’t vanish — but you can neutralize them. Turn your emotions into data — and your edge becomes psychological as well as technical.

Congrats to the Top 10 Contributors for Feb 2026 and announcing March 2026 Prize

In Investing Accelerator, we are starting a new monthly prize pool for top 10 most active members Congratulations to the following 10 people for being the most contributing members of the community: 1) @Rong Zhou 2) @Leon K 3) @Lindsay Talbot 4) @Sharon Yuen 5) @Monica Bernard 6) @Kim Huynh 7) @Cris Bob 8) @Sukhwinder Dhanoa 9) @Kevin Esmati 10) @Sandra Van Den Ham I (Michael) will contact you in the chat to provide you with the gifts. You will receive: 1 share of IBIT $37 USD To show proof of purchase, you must post in the community that you received the share. For next month March, the prizes will be: 1 share of IBIT (iShare Bitcoin Trust by BlackRock) (https://www.skool.com/investing-accelerator/-/leaderboards) Investing Accelerator Incentives: Get Richer by Helping Others Succeed 1. 🎁 Join Investing Accelerator for Free: Share the "How to Join Investing Accelerator for Free" guide with a friend. If they join, you both earn the referral fee. Learn More (https://www.skool.com/invest-retire-community-1699/how-to-join-investing-accelerator-for-free) 2. ⏱️ Speed & Success Bonus: Complete the program within 90 days and pay off the remaining balance to get 10% off the balance. 3. 📈 Trading Milestone Rewards: - First 30% Return from a Single Trade: Share your success in the community to receive a free stock. - 30% Portfolio Return in One Year: Achieve a 30% annual return to earn another free stock (once per year). 4. Student Referral Program: Refer a friend to join Investing Accelerator and you both earn $1,000 USD + a free stock each. Learn More (https://5mininvesting.com/free-case-study/)

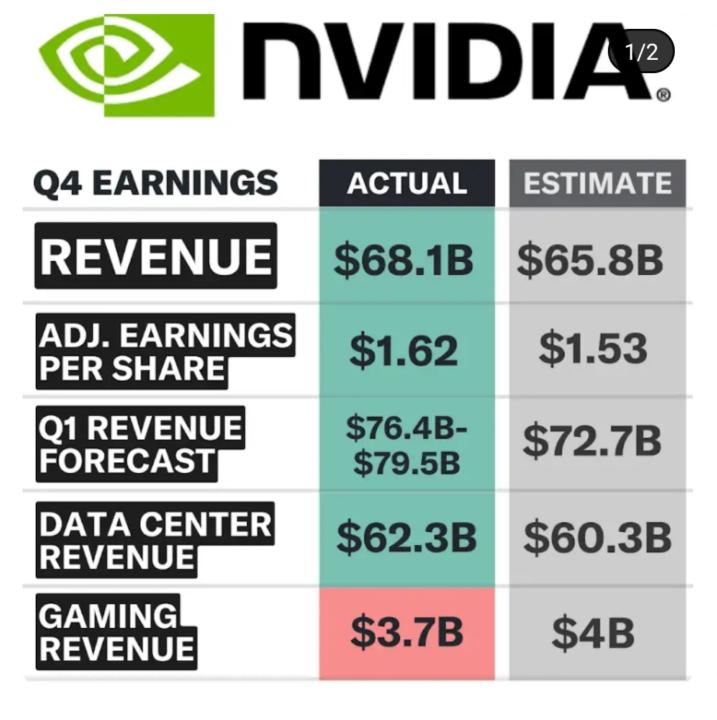

Nvda Q4 earning

Will Nvidia lifts all tides? Their guidance is raised 5bbbbillions from estimate!! 👍💪💪💪

Macro - Iran under attack (28 Feb)

It looks like both Israel and the US are hitting Iran. Markets likely to be volatile. Gold and Oil likely to spike until things settle.

1-10 of 748

@kim-huynh-9986

Semi-retired pharmacist. Passionate in learning and earning passive investment income.

Active 25m ago

Joined Feb 17, 2023

Canada GTA

Powered by