Write something

#Gold #BuyersSellers #Macro

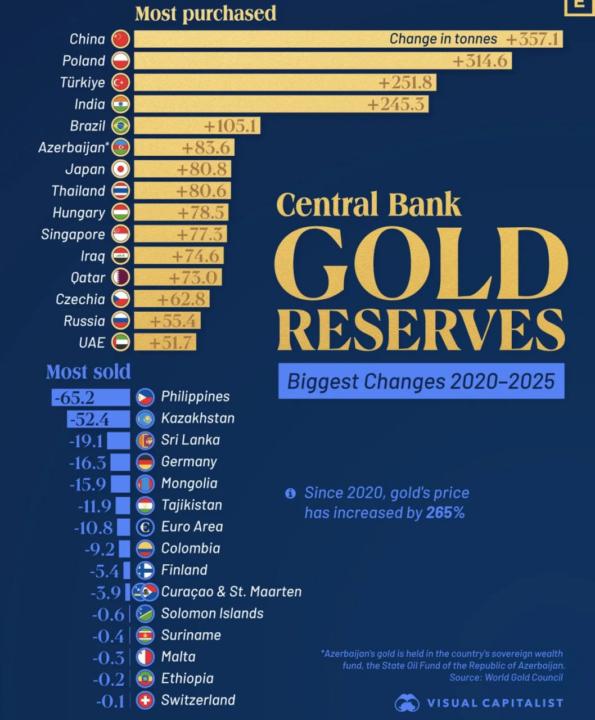

🪙The largest buyers and sellers of gold from 2020 through 2025 inclusive

0

0

$1M cash or $200K in semi-passive income per year? What would be more life changing?

Recently, I am trying to do a thought experiment What would be more life-changing? Option A: $1M cash where you can invest it Option B: $200K per year, mostly passive income I guess the straightforward answer would be depending if you can make 20% per year from the $1M cash. But I think the answer to the question is more complex than that. Some people might prefer $1M cash to start a business or pursue another opportunity Some people might prefer $200K passive income so they don't need to worry about income and go travel Which one is more valuable to you? Leave a comment in the post in the community. I read every comment. I would like to understand why. If you want to be part of Investing Accelerator, here's the 33% discounted link to join directly and skip the onboarding call (LINK) Cheers, Eric --- Eric Seto Chartered Professional Accountant (CPA) Chartered Investment Manager (CIM) Founder of 5MinInvesting.com In February, my goal is to help 10 people with no financial background master investing. You will learn two strategies: • Long-term investing with options — learn how to find discounted blue chip stocks using technical and fundamental analysis You will also learn how to hedge during a bearish market to protect yourself • Monthly passive income — learn how to generate cash flow for retirement or replacing/boosting part of your salary using options Here's a step by step guide on how to join Investing Accelerator for free: https://www.skool.com/invest-retire-community-1699/how-to-join-investing-accelerator-for-free If you’re interested, you can hop on a free strategy call with me or Michael to see if you are a good fit. Schedule a call here: https://bit.ly/48mJlgR To date, we have 740+ students in Investing Accelerator.

#Stocks #MAGS #ETF

📉The ETF for the "Magnificent Seven" stocks is testing its 200-day moving average for the first time in a year

0

0

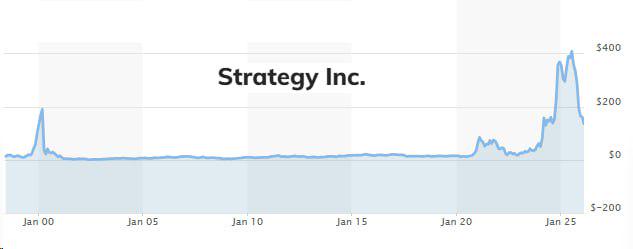

#MSTR #Crypto #PensionFund

🇺🇸The largest pension fund in the US, the California State Public Employees Retirement Fund, has resumed purchases of Strategy (MSTR) shares — last week it bought 22,000 shares — disclosure

0

0

1-30 of 2,244

skool.com/invest-retire-community-1699

Investment & Retirement Strategies for busy full-time professionals. Long-term investing & Monthly Passive income ideas.

Powered by