Write something

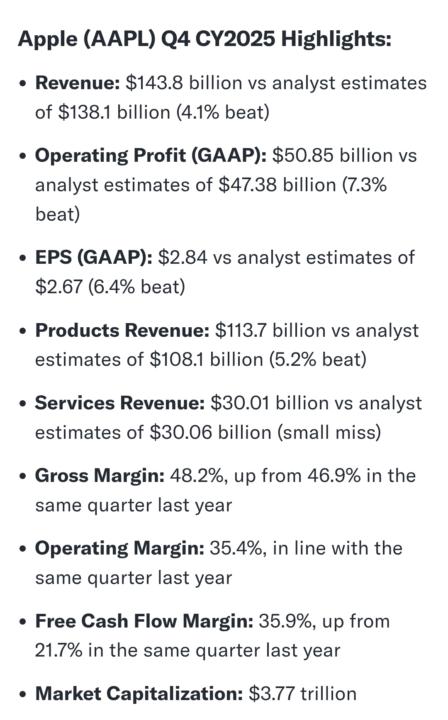

Apple/Tesla/Now/Microsoft/Meta - Q4s

Copied from Stockstory. Some are triple beats, some are double beats. Which one are you buying?

Morningstar (MORN)

It looks and feels like they finally shook off all weak hands. I started buying.

Plains All American Pipeline, L.P. (PAA).

It's a midstream infrastructure play. 8%+ divi. Not overpriced. Still have room for appreciation.

How to Stop Saving for #retirement FOREVER

One often wonders how much we need to save for retirement. I came across a very short and sweet YouTube video from Tyler Gardner. I thought I would share with you. Again, it is just a guide and should be rechecked from time to time as your situation will change. Attached is an image of YouTube, and an Excel template I created with easy inputs to facilitate the calculation. Enjoy Here is the source: https://www.youtube.com/shorts/qPh9MlDK-t8

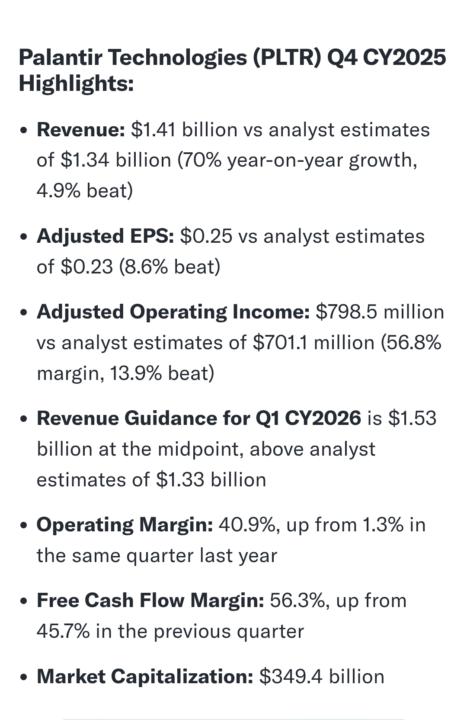

PLTR

PLTR just reported Q4 earning after hour today Feb 2nd. Here is an example of a what a growth stock look like is Palantir. Very very impressive! Revenue growth of 70% yr over yr! PLTR also raised guidance above analysts expectation by 15%...this is seldom seem! So this is a triple beats and raised guidance. I think Share price will remain overvalued and baked in. This stock trades at trailing PE over 300. Copied from StockStory.

1-30 of 402

skool.com/invest-retire-community-1699

Investment & Retirement Strategies for busy full-time professionals. Long-term investing & Monthly Passive income ideas.

Powered by