Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Invest & Retire Community

3.5k members • Free

343 contributions to Invest & Retire Community

#MarketNews

🛢At International Energy Week, bears outnumbered bulls 3-to-1 as oil traded near $75 a barrel amid uncertainty over 103 million b/d supply in a $2.5 trillion global market. 📉 An AI-driven selloff is hammering stocks across sectors as investors dump companies tied to or threatened by artificial intelligence, dragging the Nasdaq 100 down over 2% 💰 As Bitcoin nears $60,000, a drop toward the $58,000 200-week average could spark billions in leveraged liquidations. 💵 Shares of Coinbase Global Inc. surged nearly 20% on more than 2× average volume despite weak earnings, as dip buyers bet the crypto downturn was priced in and positioned for a rebound.

1

0

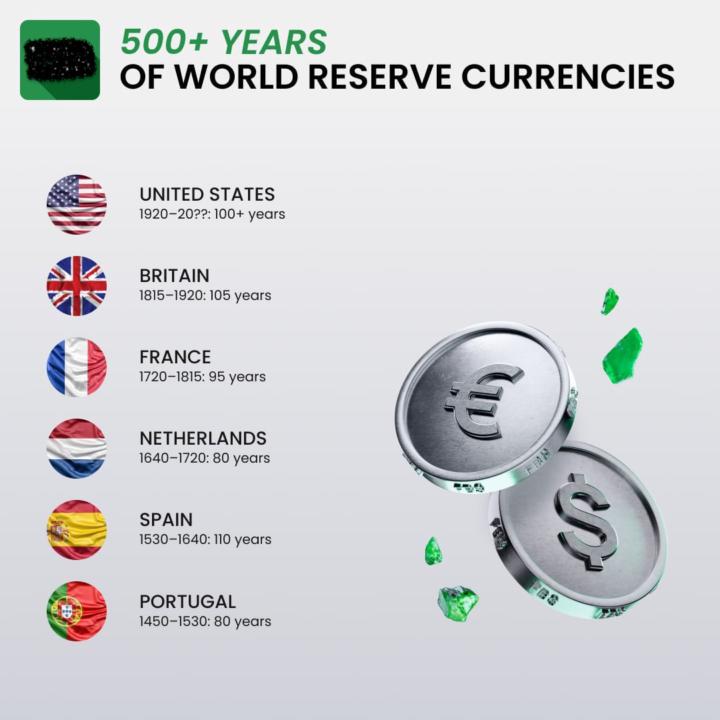

🪙 The Next Reserve Currency?

⚠️ For over 500 years, the world has seen a succession of reserve currencies held by various countries. Here's how it was: 🇵🇹 The Portuguese were the first to set the trend, with their currency being the world's reserve currency between 1450 and 1530. Portuguese real was in demand as the country dominated world trade and exploration 🇪🇸 Spain took over as the world's reserve currency from 1530 to 1640 as they became dominant in world trade and held vast amounts of gold and silver. 🇳🇱 The Dutch took over from 1640 to 1720 because of their economic and financial strength, including their dominance in the financial industry. 🇫🇷 France's currency took over from 1720 to 1815, largely due to their military and economic power. 🇬🇧 After Napoleon's defeat, the British pound took the leadership from 1815 to 1920 due to Britain's status as the world's economic powerhouse and its vast colonial empire. 🇺🇸 The United States then became the boss from 1920 to the present day. This change occurred mainly due to the growth of the US economy after World War I and the United State's role as a dominant military power. 🇨🇳 However, China is about to take the US's place, with its yuan becoming the next candidate.

1

0

Possible Discount Pricing

Looking at AXP, V, MA and JPM. What are your thoughts on their current pricing?

We might be bearish for 1-2 more weeks

The market last week was initially going up However, it crashed during Thursday and Friday. For this week, we are most likely continue to be bearish. I am keeping my short position for another week or two, depending on market conditions Shorts are used as a hedge for your portfolio. Small short positions are great as you hold cash while the market is going down. Larger short positions are only for experience investors who know what they are doing and want to make a profit on rare but profitable movements of the market. You will learn various techniques to hedge in Investing Accelerator, which is useful to protect yourself during a bear market. If you wantthe lifetime membership for InvestingAccelerator, here's the 33% discounted link $499 a month for 12 months (LINK) Cheers, Eric --- Eric Seto Chartered Professional Accountant (CPA) Chartered Investment Manager (CIM) Founder of 5MinInvesting.com In February, my goal is to help 10 people with no financial background master investing. You will learn two strategies: • Long-term investing with options — learn how to find discounted blue chip stocks using technical and fundamental analysis You will also learn how to hedge during a bearish market to protect yourself • Monthly passive income — learn how to generate cash flow for retirement or replacing/boosting part of your salary using options Here's a step by step guide on how to join Investing Accelerator for free: https://www.skool.com/invest-retire-community-1699/how-to-join-investing-accelerator-for-free If you’re interested, you can hop on a free strategy call with me or Michael to see if you are a good fit. Schedule a call here: https://bit.ly/48mJlgR To date, we have 740+ students in Investing Accelerator.

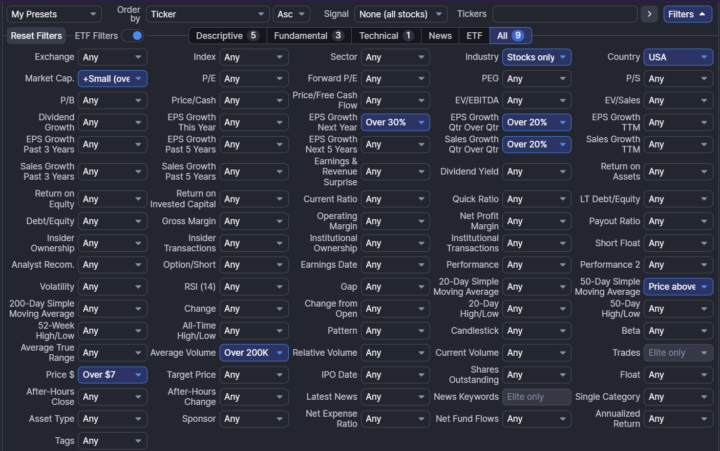

Using EPS estimates to help me identify stocks that could grow (even) more in the coming year

Previously, I didn’t really have a clear process for finding stocks — I mostly stuck to names I was already familiar with. The problem is, that approach doesn’t always line up with the best opportunities, especially from a technical standpoint. Recently I’ve started using screeners to expand my search and identify better setups. One thing I’ve learned is to look at EPS estimates. Obviously, they’re not always perfect, but institutions tend to put their money where earnings growth is happening. So knowing where positive EPS estimates are showing up feels like an important piece of the puzzle. Just sharing a few of the tickers I’ve come across recently that I’ll be digging into more closely to start planning — they range from small caps upward. I’ll keep sharing what I find — would love to know what’s on your radar too. For those who are interested, i took a screenshot of the filters I used in FINVIZ --- and you'll notice i chose EPS Growth Next Year = Over 30% A few tickers that I have selected to study more closely so far. Some are already setting up technically so I have my work cut out for me - although I will be leveraging chatgpt to help me with my deep dive into the fundamentals (esp growth rates). AFRM ALHC AMPX CALX CECO FTAI GKOS HROW LIF LITE MC MEG NTST NVDA OUST PLTR SSRM TPC

1-10 of 343

@sharon-yuen-2415

Hi, I'm a distracted trader that follows any new shiny objects whenever I don't get an results. Hopefully, this would be my last shiny object. :)

Active 3h ago

Joined Sep 6, 2025

Canada

Powered by