Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

What is this?

Less

More

Memberships

Invest & Retire Community

3.5k members • Free

549 contributions to Invest & Retire Community

Congrats to the Top 10 Contributors for April 2025 and announcing May 2025 Prize

Congratulations to the following 10 people for being the most contributing members of the community: 1) @Rong Zhou 2) @Sandra Van Den Ham 3) @Monica Bernard 4) @Lindsay Talbot 5) @Velle SG 6) @Kim Huynh 7) @Kevin Esmati 8) @Eugene Voutchkov 9) @Sukhwinder Dhanoa 10) @Cris Bob I (Michael) will contact you in the chat to provide you with the gifts. You will receive: - 1 share of (NVDA) = $111.61 USD To show proof of purchase, you must post in the community that you received the share. For next month May , the prizes will be: - 1 share of (DHI) DHI - this is a home construction stock in US. We have been tracking it for a while within Investing Accelerator and the bottom is close to being complete You can be the next top contributor for the next 30 days (https://www.skool.com/invest-retire-community-1699/-/leaderboards) Investing Accelerator Incentives: Get Richer by Helping Others Succeed 1. 🎁 Join Investing Accelerator for Free: Share the "How to Join Investing Accelerator for Free" guide with a friend. If they join, you both earn the referral fee. Learn More (https://www.skool.com/invest-retire-community-1699/how-to-join-investing-accelerator-for-free) 2. ⏱️ Speed & Success Bonus: Complete the program within 90 days and pay off the remaining balance to get 10% off the balance. 3. 📈 Trading Milestone Rewards: - First 30% Return from a Single Trade: Share your success in the community to receive a free stock. - 30% Portfolio Return in One Year: Achieve a 30% annual return to earn another free stock (once per year).

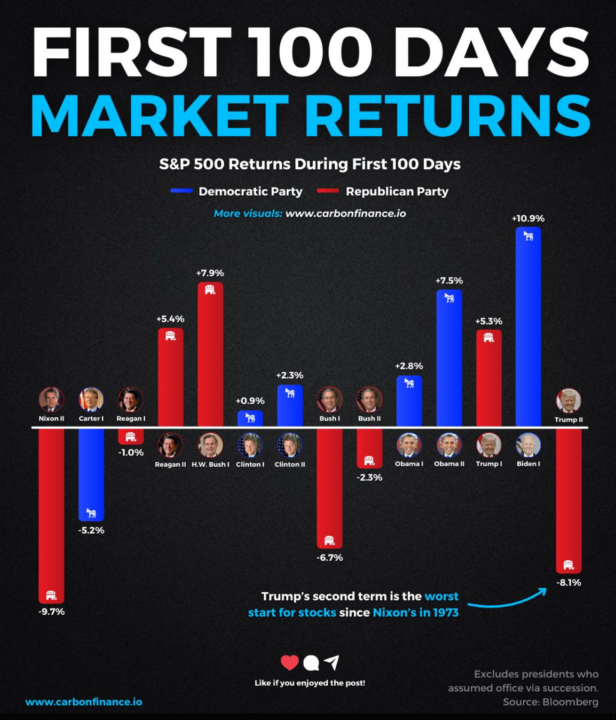

S&P 500 performed in the first 100 days

How the S&P 500 performed in the first 100 days under recent presidents

Scammer - Impersonating Eric Seto to sell you swiftedgedapita

Recently, there's a scammer DM-ing members in the group for an investment model called - swiftedgedapita Please do not reply and provide any personal information. The fake profile has been banned and removed from Skool

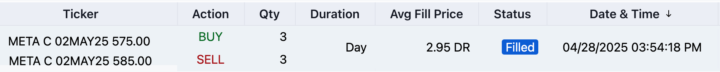

SPY $1000 Per Month

Today 4/4/25, I collected $800 premium on SPY @$480 strike 4/25/25 expiration. My goal is to continue to roll down & out until I cannot collect any more premium. Than I will take assignment and start selling covered call.

1-10 of 549

@eugene-voutchkov-2916

Learning stock & option trading for fun. Based in Alberta, Canada

Active 147d ago

Joined Dec 26, 2022

Edmonton, Alberta

Powered by