Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

Invest & Retire Community

3.3k members • Free

25 contributions to Invest & Retire Community

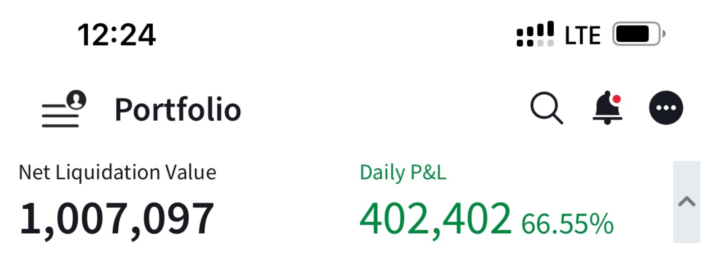

Biggest one day gain for this portfolio

This is the biggest one day gain for 2025 for this specific portfolio. +$402,000 in one single day While Donald Trump has been crashing the market from Jan till Mar, I've been working to revise my model such that it captures both the long and short opportunities. My various analyses predicted that Apr 9 would be an overall bullish week, which convinced me to buy. This led to the biggest one-day gain +$402,000. I also purchased some shares for my son and daughter, and one of his positions made +55% one day after purchasing it. Sometimes, it is very difficult to predict the turning point. It is a combination of luck and good analysis. Cheers, Eric ------- Eric Seto Chartered Professional Accountant (CPA) Chartered Investment Manager (CIM) Founder of 5MinInvesting.com In April, my goal is to help 10 people without a financial background to master investing through Investing Accelerator. Investing Accelerator is designed for people without a financial background. The goal is to achieve 30% return per year. In the first phase, you will learn long term investing and targeting 30% for tax free compound growth. This will help accelerate your overall wealth. In the second phase, you will learn monthly passive income to provide a more predictable cash flow (target 30% per year) which can cover your expenses. This will help accelerate your retirement goals. If you are interested, then let's hop on a call to see if you can benefit from the strategies in Investing Accelerator and get 30% per year. During the call, we will map out exactly how you can achieve 30%, what you are lacking, how you can improve. If you have any questions about the program, you can ask during the call as well. Schedule a call here: https://bit.ly/48mJlgR Remember to go to the Classroom tab for additional investing resources. (If you want to be a shareholder of Investing Accelerator and get 20.5% dividend (monthly distribution), $200K investment would be $40K in dividends per year. you watch the investor presentation here: https://bit.ly/3CKVp0R)

6 likes • Apr 13

When anybody announces their returns as a pure dollar amount, it's important to know the underlying total value of the portfolio (If you click on the image, that information is there) so you can calculate a percentage return, otherwise the number is for shock value. Second, it's important to know the largest one day LOSS for the same portfolio, because these extremes often go hand in hand in this volatile market. Tariffs ON, tariffs OFF. It would be super helpful to have details on the exact trades that led to this fantastic return!

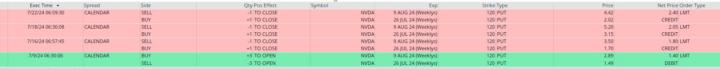

MPI. Closed trades. NVDA

I had it in two accounts. In this one it was clean and simple; though poorly executed, but still profitable. I'll post the other one when close. 1.40 -> 1.80 1.40 -> 2.05 1.40 -> 2.20

What percentage of your funds would you allocate for LEAPs?

If you have a 10k account, what percentage is a good and safe amount to allocate towards LEAP options?

69% Gains on TQQQ in one month

Hey Eric! I just exited TQQQ call position with 69% Gains on TQQQ in one month. I re-entered TQQQ to continue the bull run until July 15th or so and now have additional funds to enter in NVDA call options Dec 2026 strike $80. I believe this is a good move but I could be wrong, though I believe NVDA will continue to rise because of their current positions in the chip industry and as they just collaborated with MISO ROBOTICS, who is an upcoming company dealing with robots cooking in our fast-food restaurants on the west coast and have already proven to increased income by 26% at places like Chipotle, White Castles, and several other burger restaurants. MISO ROBOTICS do not have an IPO as of yet but will in next couple years.

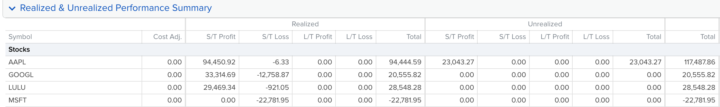

+$117,487.86 on AAPL

Adding a bit more information on the previous result where I made 60.48% this year so far. It contains index funds and also a few big tech stocks such as AAPL, and others. Here you will see part of the account statement after I implemented Version 4 of the strategy for my index fund portfolio (plus a few big tech stocks). AAPL +$117,487.86 GOOGL +$20,555.82 LULU +$28,548.28 MSFT -$22,781.95 Plus my index fund positions are not closed yet. LULU is an one-off position for this portfolio as I happened to capture that earning move. Cheers, Eric ------- Eric Seto Chartered Professional Accountant (CPA) Chartered Investment Manager (CIM) Founder of 5MinInvesting.com Free webinar - how to get 30%: https://5mininvesting.com/free-case-study/ In June, my goal is to help 10 people without a financial background to master investing. Investing Accelerator is designed for people without a financial background. The goal is to achieve 30% return per year. In the first phase, you will learn long term investing and targeting 30% for tax free compound growth. This will help accelerate your overall wealth. In the second phase, you will learn monthly passive income to provide a more predictable cash flow (target 30% per year) which can cover your expenses. This will help accelerate your retirement goals. If you are interested, then let's hop on a call to see if you can benefit from the strategies in Investing Accelerator and get 30% per year. During the call, we will map out exactly how you can achieve 30%, what you are lacking, how you can improve. If you have any questions about the program, you can ask during the call as well. Schedule a call here: https://bit.ly/48mJlgR Remember to go to the Classroom tab for additional investing resources.

2 likes • Jun '24

I was looking a little more closely at the spreadsheet above and the performance graph. 1. The loss on GOOG was 40%. 2. No cost basis for the MSFT, just a $22781.95 loss. Maybe a debit spread of some sort that expired worthless? 3. Not sure why the AAPL trade was listed as unrealized AND realized. Maybe this was before exiting the position? 4. I do not understand these column labels(: , still trying.

1-10 of 25

@andrew-galpern-8038

I live in San Francisco and have been investing for 20+ years. Most recently, I've been looking at vertical option spreads and technical analysis.

Active 253d ago

Joined Apr 11, 2024

Powered by