Where does your product catalog live?

One of the hardest things to sort out in pricing seems to be wrangling the product catalog. Sales need it in CRM/CPQ systems. Finance need it in Billing/ERP systems. Product/Pricing need it in ... where? When products have usage-based pricing or entitlements, many ERPs can't handle it, and the product catalog spreads into a third system that handles usage, credits, entitlements, etc. We see how this crosses organization boundaries, lacking a single clear owner, and keeping everything in sync becomes super important - and very difficult to keep 100% correct over time. And most likely, someone in your organization is using Excel in some part of this process. Curious to hear how others split the product catalog, both horror stories and success stories.

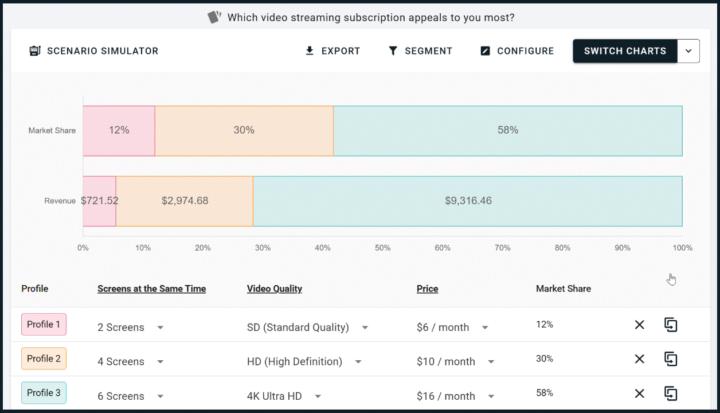

Optimizing Pricing Plans with a Revenue Simulator

I feel like revenue simulators are the most underrated pricing research method -- you get insights similar to A/B testing but without needing deep pockets and a huge customer base to test against. More of the teams I work with have been asking to run simulator projects recently, for stuff like introducing a new pricing plan, optimizing their recommendation engine, launching optional add-ons, etc. Especially with so much pricing experimentation going on around AI feature releases, it feels like revenue simulators are kinda having their moment right now. I put together a detailed example (with plenty of GIFs and screenshots) showing how a revenue simulator works, how you set up a study like this, and what kind of outcomes you can expect to get it: https://fullstackresearcher.substack.com/p/how-not-to-price-your-new-ai-feature

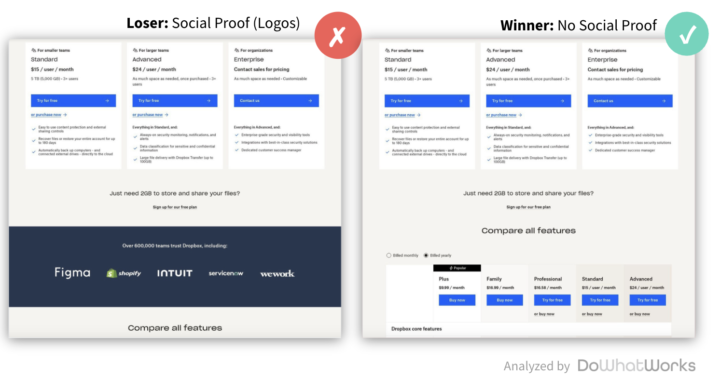

Why do logo bars lose on pricing pages?

Why do logos keep losing on pricing pages when A/B tested? Dropbox is one of hundreds of brands that have tested out of a logo bar on their pricing page. This post isn’t going to be about the value of logos. It’s about understanding user intent/flow. A prospect reaches a pricing page. They look at the plans… Then they scroll down. They are looking for an answer they didn’t find. Some point of clarity on one of the plans. Do you have this feature? Do you have localization? How do your credits work? Very rarely is someone just generically browsing for some additional trust signal. This is why lean pricing pages, like you see from brands like Lovable, (Plans → Security features → FAQ) tend to perform really well. When it comes to website design and industry best practices, a huge variable is connecting your design, navigation, and flow to user intent.

2

0

Key Takeaways: Intelligent Usage Metrics

Thanks so everyone who attended Office Hours yesterday! It was a lively session that was jam-packed with insights from @Ulrik Lehrskov-Schmidt and @Emil Eriksson. Breaking down my 5 top takeaways below for those who couldn't make it: 1️⃣ Measure internally at maximum granularity, but expose a metric customers intuitively understand. Emil made the point clearly: internally you want usage data as granular as possible to understand costs, but what you surface to customers must map to an outcome that makes sense in their world. His example of Lovable charging fractional credits — where one prompt costs 15 credits and another costs half a credit — illustrates what happens when that translation layer is missing. The customer experience becomes a black box. 2️⃣ Build a usage baseline before you price anything. Emil's strongest practical advice was to run shadow pricing for a few months against real usage data, then sit down with friendly customers and say "here's what you would have paid." This prototype-testing approach — borrowed from product design — de-risks the model before launch and creates internal buy-in across finance, product, and sales. @Steve Blanck from M-Files distilled it well: the first ask of any internal stakeholder should simply be "get the data." 3️⃣ Credit systems beat pure metering for handling seasonality and revenue predictability — but only if they self-balance. Ulrik laid out a specific architecture: monthly credit subscriptions that roll over (so customers don't over-calculate), combined with an auto-rebalancing mechanism where the next contract period adjusts to match actual prior usage. This "transposed usage-based pricing" flattens revenue volatility, reduces renewal friction, and — in his experience — keeps balance-sheet carry-over under 5% of ARR. The key design details: monthly credits rot after 12 months, annual credits roll once then expire, and you recognize revenue at the average price-per-credit in the customer's balance.

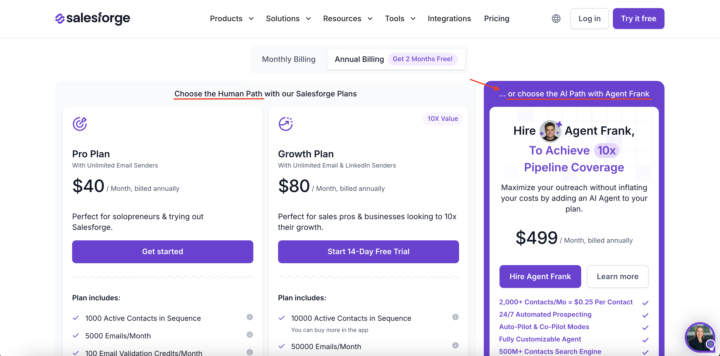

We aren't talking about AI optics in the buying decision

Salesforge is the only company I have seen do this ⬇️ On their pricing page, they clearly delineate the “human path” and the “AI path” and have pricing packages for each. They charge a premium for the AI agent. $499/m vs. $80/m for their top “human” package. Part of this is a growing trend we see in the data around high WTP (Willingness to Pay) for AI capabilities that solve for specific jobs. But it's not just about the functionality. It's also about the optics. Venture-backed brands looking towards their next series not only want the functionality but they want to tell a story of how they are using agentic software as part of their scalable growth playbook. Enterprise organizations don’t want to be left behind. Pressure from the top is high to deploy more agents to solve different organizational pain points. The teams that best adopt and execute agentic software into the organization's processes are rewarded and given more resourcing. Even if many of the agentic tools require meaningful human oversight today, the idea that the tech can learn and evolve with your team, and ultimately be highly scalable, is an investment many software leaders are eager to make. What do you think? https://www.linkedin.com/posts/caseyhill_salesforge-is-the-only-company-i-have-seen-activity-7432076873213419520-QXfY?utm_source=share&utm_medium=member_desktop&rcm=ACoAAAULZvkBJhmWcLLU-35ban2YYnjvvzf_6Mc

1-30 of 85

skool.com/pricingsaas

The first stop for SaaS pricing and packaging.

Powered by