Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

What is this?

Less

More

Memberships

Invest & Retire Community

3.5k members • Free

Evolution Trading Free *CLOSED

9 members • Free

407 contributions to Invest & Retire Community

Morningstar (MORN)

It looks and feels like they finally shook off all weak hands. I started buying.

PYPL

I ended up with 200 shares of PYPL and I am underwater. Have been listening to the news and apparently PYPL is joining with Coinbase so I am holding on tight. Any thoughts?

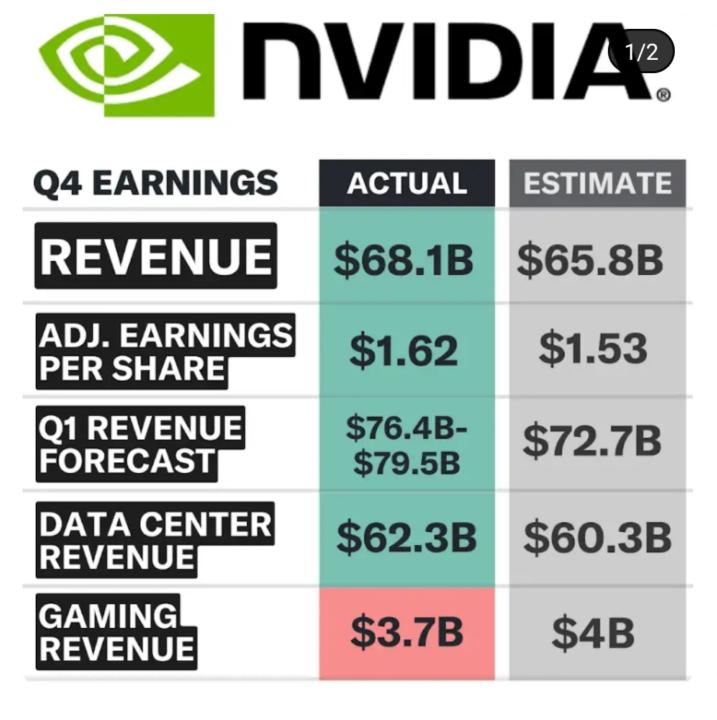

Nvda Q4 earning

Will Nvidia lifts all tides? Their guidance is raised 5bbbbillions from estimate!! 👍💪💪💪

Northern Oil and Gas (NOG)

They report today, and expectations are pretty high. I am holding over the ER. About 7% divi at this price.

PFE and MRK

I checked prior discussions on MRK and PFE before posting. We’ve covered both Pfizer and Merck extensively since 2023 across various threads, and a new post in those would likely get buried or lack context. MRK and PFE report earnings this week and next, respectively. Both stocks have been climbing steadily, mirroring gains in XLV (Health Care Select Sector SPDR Fund) and XBI (SPDR S&P Biotech ETF). It seems they’re finally attracting buyers. Both companies face a common challenge: patent expirations. To address this, they’re actively acquiring other firms to bolster their pipelines. I’m looking forward to their earnings reports. Thoughts on their outlook or recent moves?

1-10 of 407

@leon-k-2154

A developing trader who is looking to exchange ideas with other developing traders and learn from those who are ahead of me in the game.

Active 1d ago

Joined Nov 5, 2023

Powered by