Pinned

👋 Welcome to the LandMan Community — Start Here

If you’re new, welcome. You’re in the right place. LandMan is a community for real operators focused on finding, valuing, funding, and closing land deals. 🚀 FREE: First Deal Fast Track Orientation Your first step is the First Deal Fast Track (free). This orientation shows you how the course works and how to use the LandMan Community alongside it. 📘 What You’ll Learn M1: Pick a market + pull your first list M2: Run comps (APCP method) M3: Make your first offer M4: Fund the dealM5: Close with confidence ✅ How to Use the LandMan Community • Start with Module 1 and move in order • Take action as you learn • Ask questions and share progress • No pitching. No spam. Real operators only 👇 Introduce Yourself Below • Name • Market(s) • Experience level • What you’re working toward right now Welcome to LandMan Community. Let’s build.🔥

Land man Challenge access

Hello guys, I bought the Fast Track Course that includes the challenge but do not have access. Don't know who to reach out to for assistance.

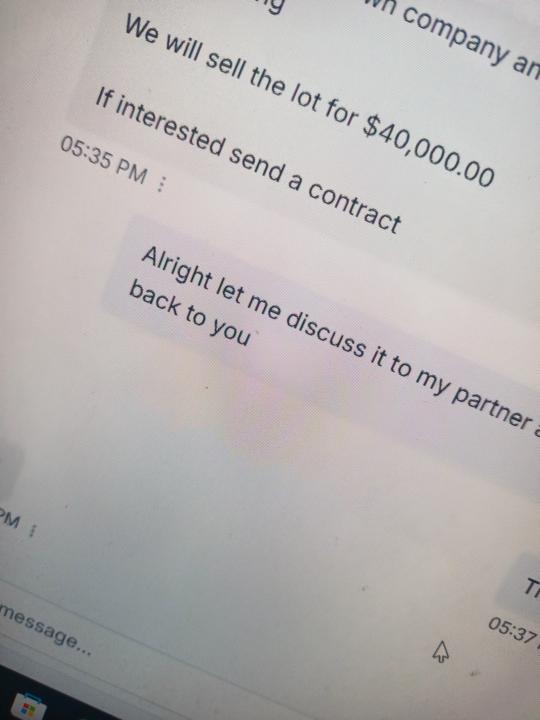

I have a Duplex lot Seller at $40K 😱!

Hello Guys, if anyone has the buyer above $40k for a duplex lot RM-2 Zoning in 33974, Lehigh acres Please reach out to me I got a motivated seller who want to sell right away. We can JV the deal 🤝

1

0

Intro

Hey everyone 👋Glad to finally be here — I just joined Landman Fast Track last night and I’m really excited to dig in. Markets: Florida, North GA, NC, and TN (hitting TN pretty hard right now) Experience: I’ve closed around 10 wholesale land deals so far across those markets Up to now I’ve mostly been using a spray-and-pray approach, and while it’s worked, I’m at the point where I want to be more intentional. I’m looking to dial into niche markets, get better with double closes, and start partnering on some potential subdivision deals I already have in the pipeline. Really motivated to level up, learn from Clay and the group, and connect with others who are doing this the right way. Looking forward to it 🙌

1-30 of 321

skool.com/landman-community

Welcome to the Landman Community. 🚀

Free community to learn about land the right way, through real deals, real numbers, and real execution.

Powered by