What To Think About If You're Borrowing Money...

Commercial Mortgage Loans... Which lender should you use, and who is going to negotiate the loan terms with them? Watch the short video here https://youtu.be/3SfpFOexjA0?si=L2BamvkLw5ifQtd3

3

0

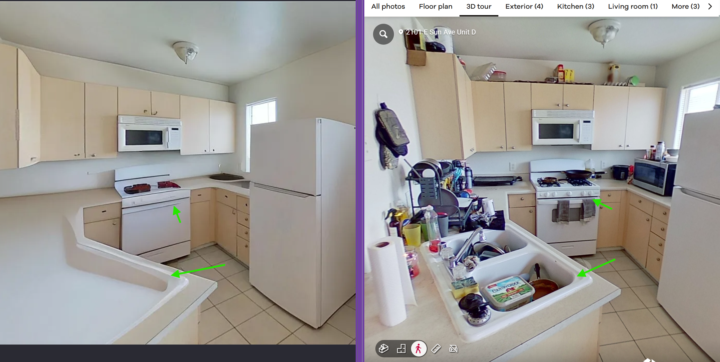

🎭🏘️ Real estate listings are marketing… not truth.

It’s easy to forget this when you’re scrolling photos and thinking, “Wow, this is a solid property.” Clean finishes, good angles, nice lighting. Your brain starts selling the deal to you before the numbers ever show up. That’s the danger. 🧠 We’re emotional. 💼 Investing has to be logical. When you’re evaluating a deal, you’re not buying kitchens, counters, or curb appeal. You’re buying monthly cash flow. Everything else is just packaging. 📸 And packaging lies sometimes. Photos get staged, edited, cropped, or flat-out manipulated to make a deal appear better than it actually is. It’s the same reason restaurants obsess over food presentation 🍽️ It influences perception before substance. 🚦So slow down. 📊 Look for the NOI first. If the income doesn’t work, the deal stops there. 👇 Check out the images below. We noticed something felt “off” about the counter and moved on. Turns out it wasn’t a "renovation"… it was sloppy Photoshop 😅 Takeaway: Trust the numbers before you trust the photos.

Thinking of submitting POL

I found a 2 unit property. not exactly what most are working towards here or what I have for long term plans, But I think it will be a good small scale start. Its off market. Offering $80k with $240 rehab ARV will be $450-$485k. 2 - 3 bed 1 bath units rent would be $1800 for each unit. Thoughts?

4

0

1-30 of 83

skool.com/commercial-real-estate-101

Skip the houses. 🏠

Buy apartments, RV parks & self storage.

Commercial real estate made simple.

Powered by