Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

What is this?

Less

More

Memberships

InvestCEO with Kyle Henris

38.1k members • Free

Invest & Retire Community

3.2k members • Free

Investing Accelerator

417 members • Free

75 contributions to Invest & Retire Community

BREAKING: Within the past 72 hours: Apple News

Within the past 72 hours or so: - Apple's AI Chief steps down - Apple's Head of UI Design leaves to Meta - Apple's Policy Chief steps down - Apple's Head of General Counsel steps down They need a new Steve Jobs.

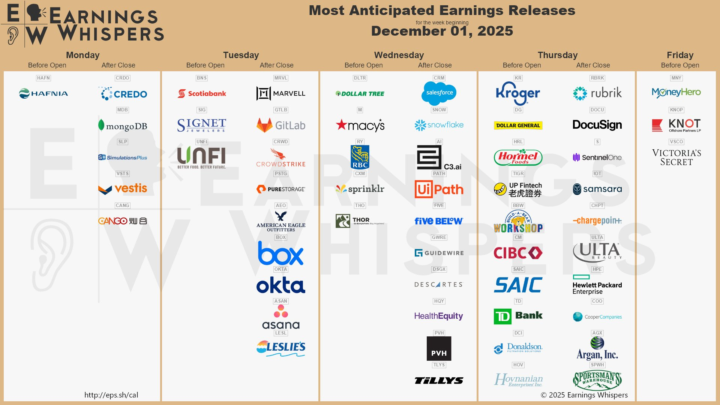

🗓 Important events this week!

Tuesday, December 02: 🇺🇸 USD - Core PPI m/m - 16:30 GMT+3; 🇺🇸 USD - Core Retail Sales m/m - 16:30 GMT+3; 🇺🇸 USD - PPI m/m - 16:30 GMT+3; 🇺🇸 USD - Retail Sales m/m - 16:30 GMT+3; Wednesday, December 03: 🇦🇺 AUD - GDP q/qy - 03:30 GMT+3; 🇨🇭 CHF - CPI m/m - 10:30 GMT+3; 🇺🇸 USD - ADP Non-Farm Employment Change - 16:15 GMT+3; 🇺🇸 USD - ISM Services PMI - 18:00 GMT+3; Thursday, December 04: 🇺🇸 USD - Unemployment Claims - 16:30 GMT+3; Friday, December 05: 🇨🇦 CAD - Employment Change - 16:30 GMT+3; 🇨🇦 CAD - Unemployment Rate - 16:30 GMT+3; 🇺🇸 USD - Core PCE Price Index m/m - 18:00 GMT+3; 🇺🇸 USD - Prelim UoM Consumer Sentiment - 18:00 GMT+3; 🇺🇸 USD - Prelim UoM Inflation Expectations - 18:00 GMT+3;

The job of an investor is to avoid the bear market

The job of an investor is to avoid the bear market. This sounds counterintuitive because we are all taught "we just need to buy and hold. Time in the market is better than timing the market." However, we also need to explain the following: "Why does Warren Buffett have such a large pile of cash as one of the most successful investors?" "Why does Michael Burry take on large short positions against the AI bubble?" "Why do people wait for Black Friday to buy and buy more during heavily discounted periods?" The answer is simple and obvious. It pays to time the market correctly. If you hold cash and wait till Black Friday, things go on sale by 20, 30, or even 50%. If you hold cash and wait for a crash, company shares go on sale by 20, 30, or even 50%. That's why I focus on buying blue chip stocks at a discount. This is why Warren Buffett has a very large cash pile. This is why patience pays when it comes to investing and... Your job as an investor is to have cash when the bear market happens. Right now, the market is still bullish. So we are all in it for the Santa rally until we see a bearish catalyst. So here's the BOXING DAY discount to join Investing Accelerator, where you get an interest-free instalment over 12 months & 33% discount off the regular price: https://5mininvesting.thrivecart.com/boxing-day/ After you join, you can schedule a free one-on-one call to ask any questions you have about your life, your situation, and retirement. You can also use this call for technical support if you wish to have it later. Cheers, Eric ---- Eric Seto Chartered Professional Accountant (CPA) Chartered Investment Manager (CIM) Founder of 5MinInvesting.com In December, my goal is to help 20 people without a financial background to master investing through Investing Accelerator. Investing Accelerator is designed for people without a financial background.

BITCOIN DID NOT CRASH, It was executed!

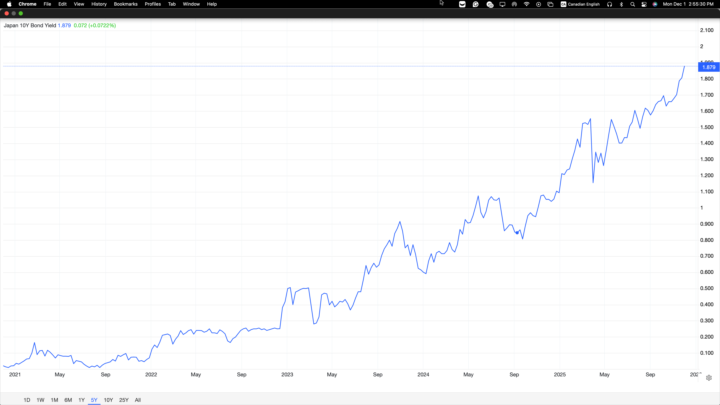

- BITCOIN DID NOT CRASH. It was executed. - On December 1, 2025, Japan’s 10-year yield hit 1.877 percent—the highest since June 2008. - The 2-year rate touched 1 percent, a level not seen since before Lehman Brothers failed. - For thirty years, the world borrowed free Japanese money to buy everything. Tech stocks, Treasuries, Bitcoin. That era ended last month. - The transmission was mechanical. Yields rise. Yen strengthens. Leveraged positions become unprofitable. Selling begins. Selling triggers margin calls. Margin calls trigger liquidations. Liquidations trigger more selling. - October 10: $19 billion in crypto positions liquidated in 24 hours. The largest single-day wipeout in digital asset history. - November: $3.45 billion fled Bitcoin ETFs. BlackRock’s fund lost $2.34 billion. It's the worst month since inception. - December 1: Another $646 million liquidated before lunch. - Bitcoin’s correlation with the Nasdaq: 46 percent. With the S&P 500: 42 percent. - While prices collapsed, whales accumulated 375,000 BTC. Miners cut selling from 23,000 BTC monthly to 3,672. Someone is buying what institutions are selling. ** The pivot point: December 18. Bank of Japan policy decision. If they hike and signal more, Bitcoin tests $75,000. If they pause, a short squeeze could reclaim $100,000 within days. - This is not about cryptocurrency anymore; it was a global deleveraging event, and the Japanese bond market pulled the trigger.

1-10 of 75

Active 2h ago

Joined Jan 2, 2023

Powered by