Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

What is this?

Less

More

Memberships

The AI Advantage

75.4k members • Free

Invest & Retire Community

3.5k members • Free

481 contributions to Invest & Retire Community

Congrats to the Top 10 Contributors for Feb 2026 and announcing March 2026 Prize

In Investing Accelerator, we are starting a new monthly prize pool for top 10 most active members Congratulations to the following 10 people for being the most contributing members of the community: 1) @Rong Zhou 2) @Leon K 3) @Lindsay Talbot 4) @Sharon Yuen 5) @Monica Bernard 6) @Kim Huynh 7) @Cris Bob 8) @Sukhwinder Dhanoa 9) @Kevin Esmati 10) @Sandra Van Den Ham I (Michael) will contact you in the chat to provide you with the gifts. You will receive: 1 share of IBIT $37 USD To show proof of purchase, you must post in the community that you received the share. For next month March, the prizes will be: 1 share of IBIT (iShare Bitcoin Trust by BlackRock) (https://www.skool.com/investing-accelerator/-/leaderboards) Investing Accelerator Incentives: Get Richer by Helping Others Succeed 1. 🎁 Join Investing Accelerator for Free: Share the "How to Join Investing Accelerator for Free" guide with a friend. If they join, you both earn the referral fee. Learn More (https://www.skool.com/invest-retire-community-1699/how-to-join-investing-accelerator-for-free) 2. ⏱️ Speed & Success Bonus: Complete the program within 90 days and pay off the remaining balance to get 10% off the balance. 3. 📈 Trading Milestone Rewards: - First 30% Return from a Single Trade: Share your success in the community to receive a free stock. - 30% Portfolio Return in One Year: Achieve a 30% annual return to earn another free stock (once per year). 4. Student Referral Program: Refer a friend to join Investing Accelerator and you both earn $1,000 USD + a free stock each. Learn More (https://5mininvesting.com/free-case-study/)

Diversification Against Inflation

Highlights 🛡️ Protect your wealth by investing in currencies, bonds, and especially food commodities amid inflation. ⚖️ Supreme Court ruling limits Trump tariffs; tariffs are more political bargaining chips than market factors. 🪙 Weakening US dollar is driving higher gold prices, fueled by international demand, not just dollar depreciation. 📉 The US dollar's purchasing power is collapsing, threatening living standards with ongoing devaluation. 🌾 Commodities linked to China’s imports and commodity-exporting currencies are key investment areas for 2024. 📉 Inflation expectations are outpacing wage growth, signalling reduced consumer spending ahead. 💣 US debt has crossed a “macro event horizon,” leading to inevitable monetary inflation and financial instability. https://youtu.be/Z9IC0TJO7Xs

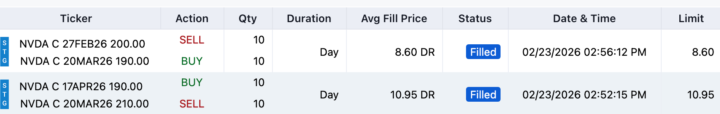

Trading call diagnol for NVDA earnings

Getting in early, as the market is selling off

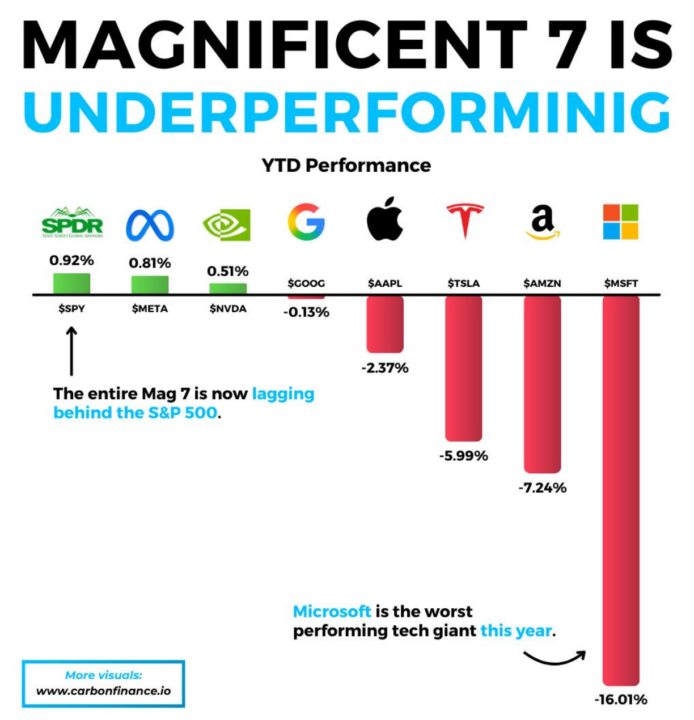

Magnificent 7 is underperforming

The Magnificent 7 have been investor favorites for years, backed by massive cash reserves and consistent growth. - Yet this year, every single one is underperforming the S&P 500. - Microsoft is trailing the most, down 16% YTD. The shift is not about fundamentals collapsing, but about spending.

10 Rules of IKIGAI

Ikigai (pronounced ee-key-guy) is a Japanese concept that translates to "a reason for being" or "a reason to wake up in the morning". It represents the intersection of four core elements—what you love, what you are good at, what the world needs, and what you can be paid for—leading to a fulfilling and purposeful

1-10 of 481

Active 2h ago

Joined Oct 7, 2024

Powered by