Write something

Professional vs Order-Taker

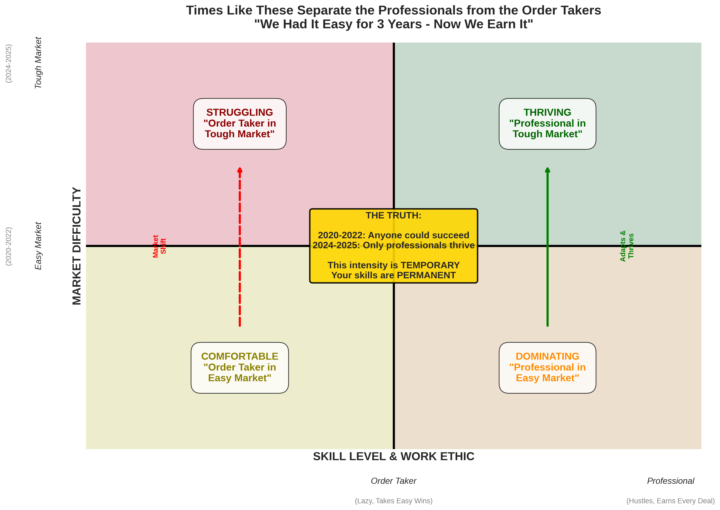

LWR community, Sharing something we presented internally for our Ops and Carrier Sales teams. This "master class" breaks down the difference between running freight like a professional versus simply taking orders and reacting to the market. (aka post and hope) I used Manus AI to help frame it in very simple, crayon terms. If you’re in the 3PL world and your carrier reps Never operated in a hot market, or forgot what discipline looks like when capacity tightens, this will hit home. Markets change. Professionals adapt. Order-takers get exposed. Dropping it here for anyone who wants it.

Diwali starts 10/20

Be cautios quoting outboud CA, OR, WA next week as Diwali begins and outbound capacity will tighten.

2

0

3PL M&A Hits Headwinds, Yet Niche Deals Still Shine

According to Capstone’s “Asset-Light 3PL M&A Update – September 2025”, the 3PL & logistics M&A landscape is under pressure, driven by persistent headwinds, but there are glimmers of opportunity for well-positioned players. What’s going on? Deal volumes are down: YTD M&A transactions in 2025 are ~15.5% lower than the previous year, lagging behind past trends. Capstone Partners Contributing factors include: • A prolonged freight recession weighing on revenue & margins • Volatile trade policy and tariff uncertainty making acquirers more cautious • Excess freight capacity, soft volume, and weak rate environments But niche players continue to attract interest. Businesses offering specialized services, whether in verticals (e.g. cold chain, managed fulfillment) or with strong tech/visibility capabilities, are seeing more consistent deal flow. The Courier / Time-Critical segment remains a bright spot: its B2B, specialized delivery focus gives it a degree of insulation from broader freight cyclicality. On the technology side, logistics tech / digital platforms are showing signs of rebound: M&A and equity capital activity is picking up in 2025, albeit somewhat unevenly. Why now are some 3PLs choosing to merge or be acquired? To shore up technology & visibility assets in an era where customers demand more oversight and real-time flexibility To expand network reach or add differentiated services (e.g. last-mile, cold chain, customs) that are less exposed to freight rate swings To achieve scale & cost synergies when growth is harder to come by To consolidate in fragmented niches, making mid-sized 3PLs more defensible https://www.capstonepartners.com/insights/report-3pl-ma-update/?utm_source=chatgpt.com

3PL Market Set to Grow Over 20% in Coming Years

A new market study projects the global 3PL services sector will expand from $8.5 billion in 2025 to $21 billion by 2033, a CAGR of 20.5%. Demand is being driven by e-commerce, faster delivery expectations, and cutting-edge logistics tech like AI and IoT. https://www.newstrail.com/third-party-logistics-services-market-hits-new-high-major-giants-dhl-ups-fedex/?utm_source=chatgpt.com

0

0

Tanker Needed (Fruit Juice TANKER )

Good day, LWR team! 👋 Looking for a Fruit Juice Tanker to handle a Fowler, CA - Newark, NJ Load today. Please DM me with options, referrals. Thank you!

1-9 of 9

skool.com/the-logistics-war-room-1319

For serious freight, brokerage & supply chain operators. Real strategies. Battle-tested workflows. 🌐

Powered by