Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by Pj

For serious freight, brokerage & supply chain operators. Real strategies. Battle-tested workflows. 🌐

Memberships

Skoolers

191.2k members • Free

Freight Skool Group

512 members • Free

66 contributions to The Logistics War Room

The Hidden Crisis That’s Slowly Choking U.S. Freight Capacity

There’s a quiet storm brewing: the escalating collapse of Class A CDL driver retention and recruitment. And in an inflationary 2026 economy? This might be the single biggest constraint on freight flow as we head further into 2026. The Numbers: - 80,000+ driver shortfall today, projected to hit 160,000 by 2030 (ATA) - 90%+ turnover at large truckload carriers (some long-haul fleets: 100-300%) - Average driver age: 47, with massive retirements looming while 18-35s avoid trucking - ~$12,799 cost per lost driver (before equipment recovery and late fees + ~G&A) - Wages declining: 2024 saw only 2.5% pay increase vs. higher inflation. Average weekly pay dropped 7.4% Q1-Q2 2024 ($1,730 → $1,602) Why This Matters Now: Since April 2025, inflation re-accelerated (core CPI 3.8%, diesel up 12% YoY). But here's what makes this critical: We're entering a tight capacity regime. Market structure indicators show that capacity availability is falling below critical thresholds. The kind of inflection point that precedes contract rate increases by months. This creates a collision of forces: - Capacity tightens just as the driver crisis intensifies - Wage pressure intensifies as drivers demand cost-of-living increases - Freight rates remain volatile, making mile-based pay even more unpredictable - Consumer demand rebounds, but carriers lack human capital to capture it - Small carriers close (depleted PPP/ERC funds), reducing industry capacity One BIG Problem: Process & Structure Failure: 1. Retention Crisis - 81.9% of job-seeking drivers prioritize predictable pay - 60% cite "lack of miles" as their compensation issue - Mile-based pay creates financial insecurity no bonus can fix 2. Process Inefficiencies - Job postings surged 63.5% in 2024 alone (Apr-Dec), signaling intensifying competition among carriers - Companies lose drivers between the application and onboarding - The company that responds first "wins" when drivers apply to multiple jobs simultaneously

0 likes • 12d

Carriers aren't reacting to the driver crisis like it’s a temporary blip anymore. They’re starting to solve it like it’s the structural supply-side threat: Schneider National: Predictable home time = 15% turnover reduction Roehl Transport: Paid training + mentorship = 20% better new driver retention J.B. Hunt: Digital driver app = measurably higher satisfaction

👋 Hi, I’m Carlos!

Hi my name is Carlos. I live in Dominican Republic and I plan on making $6,000 per month dispatching trucks. I want to get these 3 things from this course/community: 1. More knowledge 2. Connect with more people 3. Get my first carrier I am very passionate about this industry and highly motivated to begin my career in dispatching. I look forward to learning from this community, sharing knowledge, and growing professionally in this field.

Quiet signal worth paying attention to

The U.S. has suspended immigrant visas across 75 countries, including Pakistan, Moldova, Uzbekistan, Uganda, Somalia, and North Macedonia. (https://interactive.guim.co.uk/datawrapper/embed/J5axN/3/) While the administration cites welfare concerns, this could indirectly affect the CDL driver workforce, as 18% of U.S. truck drivers are foreign-born, and many come from countries on this list. Combined with the August 2025 work visa pause for truck drivers, this adds another layer of restriction that might affect the driver market over time: - Fewer new drivers entering the system - Slower capacity replacement for fleets - Added pressure on an already fragile carrier base Layer this on top of carrier exits, high operating costs, and reduced truck orders, and it's another factor pointing toward capacity tightening. Link to article: https://www.yahoo.com/news/articles/trump-administration-suspends-immigrant-visas-191646725.html

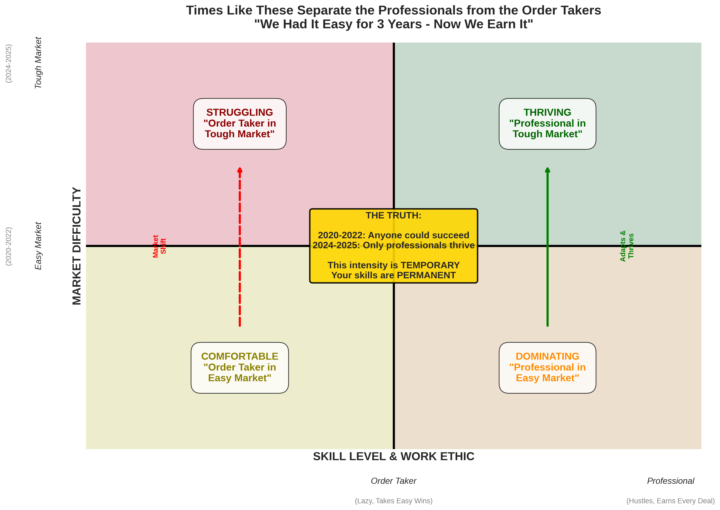

Professional vs Order-Taker

LWR community, Sharing something we presented internally for our Ops and Carrier Sales teams. This "master class" breaks down the difference between running freight like a professional versus simply taking orders and reacting to the market. (aka post and hope) I used Manus AI to help frame it in very simple, crayon terms. If you’re in the 3PL world and your carrier reps Never operated in a hot market, or forgot what discipline looks like when capacity tightens, this will hit home. Markets change. Professionals adapt. Order-takers get exposed. Dropping it here for anyone who wants it.

Welcome to The Logistics War Room: Introduce Youself! (Start Here👇)

This is a community built for operators, not theorists. This isn’t another feel-good group filled with recycled advice and surface-level tactics. This is where execution wins. Where strategy meets intensity. Where we sharpen the edge daily—and get shit done. Step 1: Introduce yourself below! If you’re here, it means you’re either already dangerous—or getting there. (👇 copy/paste template👇) - Where are you from? - What’s your battlefield (brokerage, carrier, shipper, ops)? - What immediate help do you need? Step 2: Discover How to Unlock all the Classroom Resources Here’s what this community is about: - Sharing real, tested strategies in sales, brokerage, ops, and staffing. - Exposing what’s broken in the industry and how to fix it. - Building workflows, teams, and systems that actually scale. - Connecting with people who take this game seriously. - Colaboration over competatition.

1-10 of 66

@pj-zarskus-4489

Relentless operator. I scale brokerages, carriers & sales teams with real systems, global talent, and execution that buries theory.

Active 6h ago

Joined Apr 5, 2025

Powered by