🚀 CASE REVIEW – ROUND #3 RESULTS!

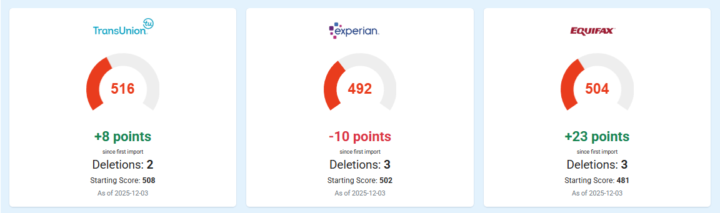

📈 Credit Score Improvements Equifax (EQ): 504(+23 points) TransUnion (TU): 516 (+8 points) Experian (EX): 492 (-10 points) ✨ Round 3 Results: TOTAL ITEMS DELETED: 8 TOTAL CHARGE-OFF AMOUNT REMOVED: $10,399.00 ✔️ Charge-Off Accounts Deleted: 6 ✔️ Hard Inquiries Removed: 3 💡 Important FCRA Insight Under the Fair Credit Reporting Act (FCRA), consumers have the right to dispute any inaccurate, incomplete, outdated, or unverifiable information on their credit reports. When addressing charge-off accounts or unauthorized hard inquiries, begin by carefully reviewing reports from all three major credit bureaus and noting any discrepancies. Gather supporting documentation such as proof of payment, account statements, correspondence from creditors, or records confirming correct personal information. Next, prepare and submit formal dispute letters to each relevant bureau, clearly explaining the issue, referencing any prior disputes, and including all supporting evidence. Credit bureaus must investigate within 30 days and provide the results, along with updated reports if corrections are made. If an issue remains unresolved, follow up directly with the creditor or escalate the matter to the Consumer Financial Protection Bureau (CFPB).

1

0

🚀 CASE REVIEW – ROUND #1 RESULTS!

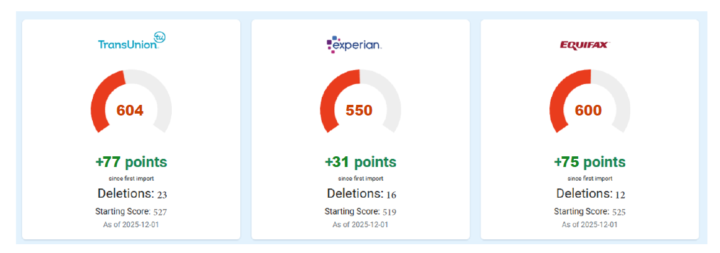

📈 Credit Score Improvements Equifax (EQ): 600(+75 points) TransUnion (TU): 604 (+77 points) Experian (EX): 550 (+31 points) ✨ Round 2 Results: TOTAL ITEMS DELETED: 53 TOTAL CHARGE-OFF AMOUNT REMOVED: $42,178.00 ✔️ Charge-Off Accounts Deleted: 11 ✔️ Hard Inquiries Removed: 32 ✔️ Personal Information Items Deleted: 10 💡 Important FCRA Insight Under the Fair Credit Reporting Act (FCRA), consumers have the right to dispute inaccurate, incomplete, outdated, or unverifiable information on their credit reports. To address charge-off accounts, unauthorized hard inquiries, or incorrect personal information, start by carefully reviewing your reports from all three major bureaus and identifying any errors. Gather supporting documentation such as proof of payment, account statements, creditor correspondence, or official records verifying correct personal details. Prepare and submit formal dispute letters to each relevant bureau, clearly explaining the issue, referencing prior disputes, and including all evidence. Credit bureaus are required to investigate within 30 days and provide results, including updated reports if corrections are made. If disputes are not resolved, follow up directly with creditors or escalate to the Consumer Financial Protection Bureau (CFPB) as needed.

🚀 CASE REVIEW – ROUND #2 RESULTS!

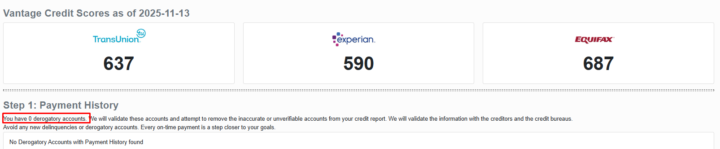

📈 Credit Score Improvements Equifax (EQ): 687 (+113 points) TransUnion (TU): 637 (+37 points) Experian (EX): 590 (+3 points) ✨ Round 2 Results: TOTAL ITEMS DELETED: 12 TOTAL CHARGE-OFF AMOUNT REMOVED: $9,938.00 ✔️ Charge-Off Accounts Deleted: 3 ✔️ Hard Inquiries Removed: 5 ✔️ Personal Information Items Deleted: 4 💡 Important FCRA Insight Under the Fair Credit Reporting Act (FCRA), every consumer has the legal right to dispute any credit information that is inaccurate, incomplete, outdated, or unverifiable. Once questionable charge-off accounts or other negative items are identified: Formal dispute letters must be submitted to all relevant credit bureaus. Each letter should reference prior disputes and clearly explain why the information remains contested. Supporting documentation—such as proof of payment, account statements, creditor correspondence, or evidence of reporting errors—should be included to strengthen the dispute and ensure compliance with FCRA standards.

🚀 CASE REVIEW – ROUND #1 RESULTS!

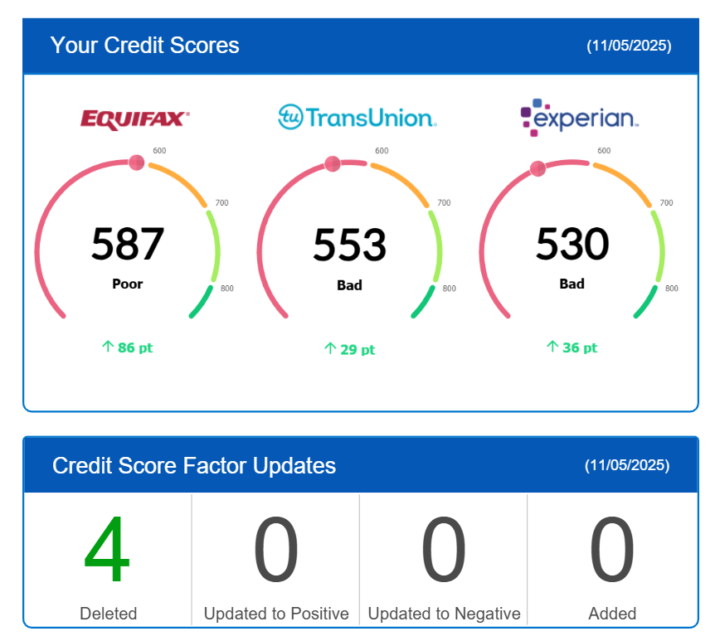

Credit Score Improvements EQ - Score 587(+86) TU - Score 553(+29) EX - Score 530(+36) ✨ Round 4 Results: Total Items Removed:5 Total Charge-Off Amount Deleted:$381 ✅ Collection Removed: 3 ✅ Charge-Offs Removed: 1 ✅ Personal Information Cleaned/Updated:1 💡:To lawfully dispute and request the deletion of inaccurate collection or charge-off accounts, as well as the removal of incorrect personal information from your credit report, you should first obtain a current copy of your credit report from each of the three major credit bureaus—Equifax, Experian, and TransUnion. Carefully review each report for any inaccurate, outdated, or unverifiable information. To begin the process, submit a written dispute to each credit bureau reporting the error, clearly identifying the item in question and providing a detailed explanation along with any supporting documentation that proves the inaccuracy or verifies your claim.

🚀 CASE REVIEW – ROUND #9 RESULTS!

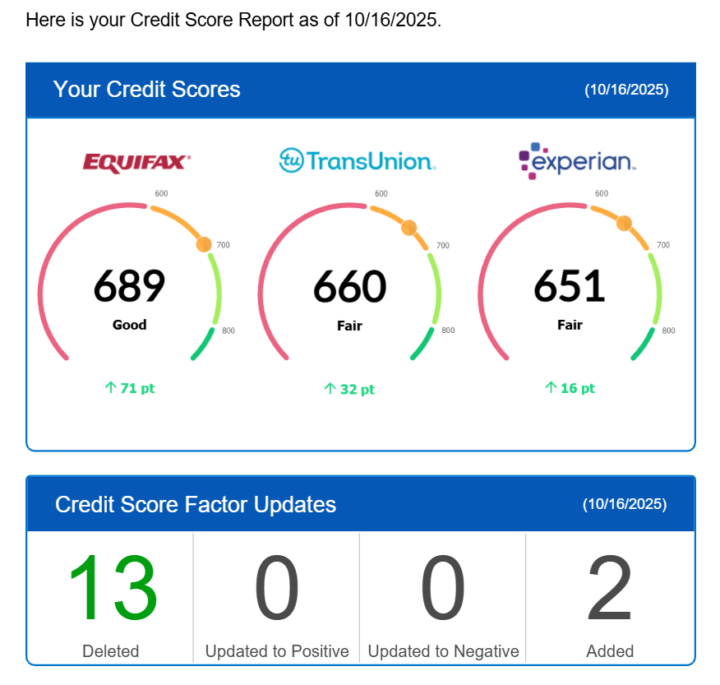

Overall Deletion Rate: 77% Credit Score Improvements Equifax (EQ): 689 (+71 points) TransUnion (TU): 660 (+32 points) Experian (EX): 651 (+16 points) ✨ Round 9 Results: Total Items Removed: 11 Total Charge-Off Amount Deleted: 💰 $9,151.00 ✅ Collections/Charge-Offs Removed: 5 ✅ Collections Removed: 3 ✅ Late Payments Updated to Positive (“Paid as Agreed”): 1 ✅ Personal Information Cleaned/Updated: 2 💡: The dispute process involves carefully reviewing your credit report to identify any inaccurate, outdated, or unverifiable information, such as fraudulent collection or charge-off accounts, incorrect personal details, or late payment entries that should reflect a positive payment history. Once these discrepancies are identified, formal dispute letters are submitted to each credit bureau—Experian, Equifax, and TransUnion—requesting a full investigation under the Fair Credit Reporting Act (FCRA). The bureaus are then required to verify the accuracy of each account with the original creditor or data furnisher. If they fail to provide proper documentation or proof of validity within the legal time frame, the disputed items must be corrected or deleted from the report. Additionally, accounts that were previously reported as late but have since been paid or settled can be updated to “Paid as Agreed” to accurately reflect responsible payment behavior. Through this process, consumers can restore the accuracy of their credit reports and improve their overall credit standing.

1-30 of 50

skool.com/fundops

From Zero To Six Figures in 0% Capital , Sacred Wealth Systems transforms your average credit profile into bank ready approvals!

Powered by