Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

What is this?

Less

More

Memberships

Sacred Wealth Systems

89 members • Free

83 contributions to Sacred Wealth Systems

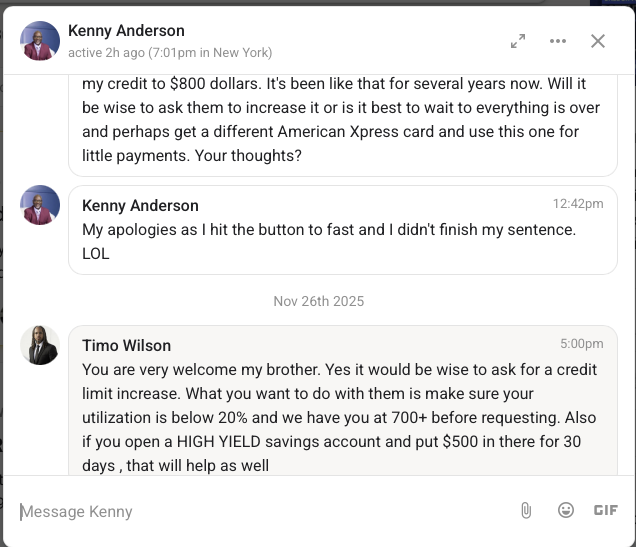

American Express CLI

Our new member @Kenny Anderson asked a really good question. Credit limit increases with Amex after they cut your limit back. Step 1: Ensure credit is over 700 Step 2 : Open high yield Savings account w/ $500 let sit for 30 days Step 3 : Lock TU and EQ Step 4 : Call for CLI and increase you income by 20% when you apply Step 5 : You should get approved! Hope this helped!

MINDSET MONDAY RECORDING ( Don't Miss )

Today's Mindset Mondays Recording was a blast. Spoke about IDENTITY SHIFT that leads to Great Credit and Capital Ready Entrepreneur Power House Mindset. I revealed the Sacred Wealth Daily 5 that every member should follow & The Sacred Wealth Triangle. Let me know in the comments what held you back in 2025 that ties back to a core belief that this community can support you on.

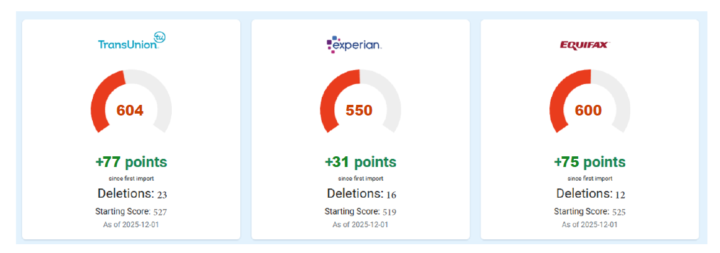

🚀 CASE REVIEW – ROUND #1 RESULTS!

📈 Credit Score Improvements Equifax (EQ): 600(+75 points) TransUnion (TU): 604 (+77 points) Experian (EX): 550 (+31 points) ✨ Round 2 Results: TOTAL ITEMS DELETED: 53 TOTAL CHARGE-OFF AMOUNT REMOVED: $42,178.00 ✔️ Charge-Off Accounts Deleted: 11 ✔️ Hard Inquiries Removed: 32 ✔️ Personal Information Items Deleted: 10 💡 Important FCRA Insight Under the Fair Credit Reporting Act (FCRA), consumers have the right to dispute inaccurate, incomplete, outdated, or unverifiable information on their credit reports. To address charge-off accounts, unauthorized hard inquiries, or incorrect personal information, start by carefully reviewing your reports from all three major bureaus and identifying any errors. Gather supporting documentation such as proof of payment, account statements, creditor correspondence, or official records verifying correct personal details. Prepare and submit formal dispute letters to each relevant bureau, clearly explaining the issue, referencing prior disputes, and including all evidence. Credit bureaus are required to investigate within 30 days and provide results, including updated reports if corrections are made. If disputes are not resolved, follow up directly with creditors or escalate to the Consumer Financial Protection Bureau (CFPB) as needed.

The Race is NOT for the Swift

Read this book Summer of 2017 in Solano State Prison at 19 years old sitting at the top bunk bed with a bunkeee who was a lifer and spent 42 years in Prison (from 18 yo to 60 yo). While I thought about him spending his whole adulthood locked up I read this book and started to apply the knowledge in it (with a few of my own personal tweaks to his system) and told myself I will never come back here and I will become financially free. From 2017 til this day I still apply the information and even added to it an it has paid of tremendously! Grab this book if you havent already. (MOTIVATONAL PURPOSES) Patience is a Virtue & Headlong decisions cost you! Run the race with endurance, DON'T SPRINT! Shalom Sacred Tribe🙏🏽

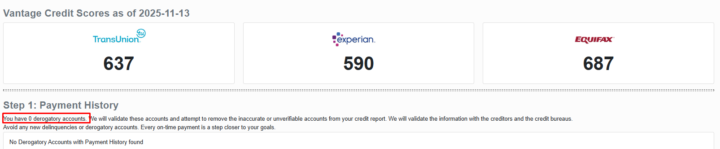

🚀 CASE REVIEW – ROUND #2 RESULTS!

📈 Credit Score Improvements Equifax (EQ): 687 (+113 points) TransUnion (TU): 637 (+37 points) Experian (EX): 590 (+3 points) ✨ Round 2 Results: TOTAL ITEMS DELETED: 12 TOTAL CHARGE-OFF AMOUNT REMOVED: $9,938.00 ✔️ Charge-Off Accounts Deleted: 3 ✔️ Hard Inquiries Removed: 5 ✔️ Personal Information Items Deleted: 4 💡 Important FCRA Insight Under the Fair Credit Reporting Act (FCRA), every consumer has the legal right to dispute any credit information that is inaccurate, incomplete, outdated, or unverifiable. Once questionable charge-off accounts or other negative items are identified: Formal dispute letters must be submitted to all relevant credit bureaus. Each letter should reference prior disputes and clearly explain why the information remains contested. Supporting documentation—such as proof of payment, account statements, creditor correspondence, or evidence of reporting errors—should be included to strengthen the dispute and ensure compliance with FCRA standards.

1-10 of 83

@nachaamyah-manawachaa-8521

A Man of THE MOST HIGH (Rom.8:14)

Active 3d ago

Joined Aug 13, 2025

Redding, California

Powered by