Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

What is this?

Less

More

Memberships

Sacred Wealth Systems

89 members • Free

46 contributions to Sacred Wealth Systems

Before the week closes I want to hear from 🫵🏽

Hey tribe , Seeking feedback! If everyone can go to the share your credit and funding wins and share your experience in this community so we can continue to develop and bring you what you want it would be appreciated!! Also 2 Mondays from now we have a special guest hosting mindset Mondays to get everyone in alignment . Lastly, on this upcoming mindset Mondays we will be announcing and gifting NOVEMbers Prize winners and announcing Decembers contest

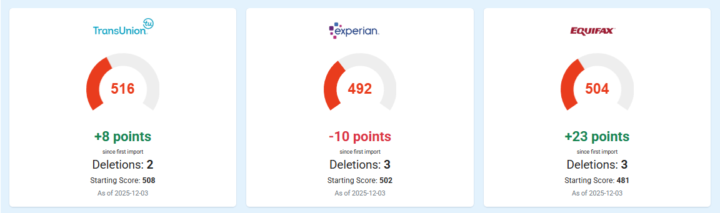

🚀 CASE REVIEW – ROUND #3 RESULTS!

📈 Credit Score Improvements Equifax (EQ): 504(+23 points) TransUnion (TU): 516 (+8 points) Experian (EX): 492 (-10 points) ✨ Round 3 Results: TOTAL ITEMS DELETED: 8 TOTAL CHARGE-OFF AMOUNT REMOVED: $10,399.00 ✔️ Charge-Off Accounts Deleted: 6 ✔️ Hard Inquiries Removed: 3 💡 Important FCRA Insight Under the Fair Credit Reporting Act (FCRA), consumers have the right to dispute any inaccurate, incomplete, outdated, or unverifiable information on their credit reports. When addressing charge-off accounts or unauthorized hard inquiries, begin by carefully reviewing reports from all three major credit bureaus and noting any discrepancies. Gather supporting documentation such as proof of payment, account statements, correspondence from creditors, or records confirming correct personal information. Next, prepare and submit formal dispute letters to each relevant bureau, clearly explaining the issue, referencing any prior disputes, and including all supporting evidence. Credit bureaus must investigate within 30 days and provide the results, along with updated reports if corrections are made. If an issue remains unresolved, follow up directly with the creditor or escalate the matter to the Consumer Financial Protection Bureau (CFPB).

1

0

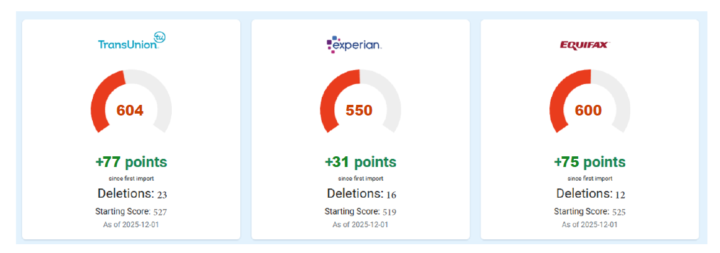

🚀 CASE REVIEW – ROUND #1 RESULTS!

📈 Credit Score Improvements Equifax (EQ): 600(+75 points) TransUnion (TU): 604 (+77 points) Experian (EX): 550 (+31 points) ✨ Round 2 Results: TOTAL ITEMS DELETED: 53 TOTAL CHARGE-OFF AMOUNT REMOVED: $42,178.00 ✔️ Charge-Off Accounts Deleted: 11 ✔️ Hard Inquiries Removed: 32 ✔️ Personal Information Items Deleted: 10 💡 Important FCRA Insight Under the Fair Credit Reporting Act (FCRA), consumers have the right to dispute inaccurate, incomplete, outdated, or unverifiable information on their credit reports. To address charge-off accounts, unauthorized hard inquiries, or incorrect personal information, start by carefully reviewing your reports from all three major bureaus and identifying any errors. Gather supporting documentation such as proof of payment, account statements, creditor correspondence, or official records verifying correct personal details. Prepare and submit formal dispute letters to each relevant bureau, clearly explaining the issue, referencing prior disputes, and including all evidence. Credit bureaus are required to investigate within 30 days and provide results, including updated reports if corrections are made. If disputes are not resolved, follow up directly with creditors or escalate to the Consumer Financial Protection Bureau (CFPB) as needed.

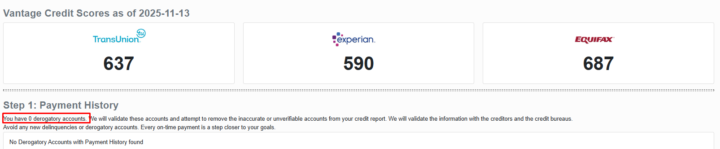

🚀 CASE REVIEW – ROUND #2 RESULTS!

📈 Credit Score Improvements Equifax (EQ): 687 (+113 points) TransUnion (TU): 637 (+37 points) Experian (EX): 590 (+3 points) ✨ Round 2 Results: TOTAL ITEMS DELETED: 12 TOTAL CHARGE-OFF AMOUNT REMOVED: $9,938.00 ✔️ Charge-Off Accounts Deleted: 3 ✔️ Hard Inquiries Removed: 5 ✔️ Personal Information Items Deleted: 4 💡 Important FCRA Insight Under the Fair Credit Reporting Act (FCRA), every consumer has the legal right to dispute any credit information that is inaccurate, incomplete, outdated, or unverifiable. Once questionable charge-off accounts or other negative items are identified: Formal dispute letters must be submitted to all relevant credit bureaus. Each letter should reference prior disputes and clearly explain why the information remains contested. Supporting documentation—such as proof of payment, account statements, creditor correspondence, or evidence of reporting errors—should be included to strengthen the dispute and ensure compliance with FCRA standards.

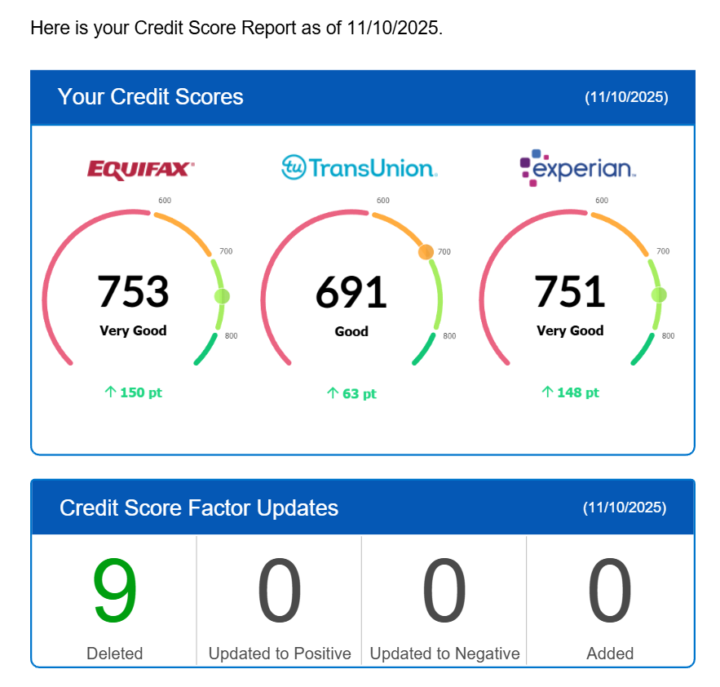

🚀 CASE REVIEW – ROUND #15 RESULTS!

Credit Score Improvements EQ - Score 753(+150) TU - Score 691(+63) EX - Score 751(+148) ✨ Round 15 Results: Total Items Removed:9 Total Charge-Off Amount Deleted$17,888 ✅ Charge-Offs Removed: 9 💡: Under the Fair Credit Reporting Act (FCRA), every consumer has the right to dispute any information that appears inaccurate, incomplete, outdated, or unverifiable. Once the charge-off accounts in question are identified, formal dispute letters must be submitted to each credit bureau, clearly referencing the prior disputes and detailing the reasons the accounts remain contested. Each letter should include supporting documentation, such as proof of payment, correspondence with creditors, or evidence of reporting errors, to substantiate the claim.

1-10 of 46

@chrissa-mae-tumlos-9388

Credit Repair Specialist - Disputer

Active 12h ago

Joined Jun 19, 2025

Powered by