Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

Dads Supporting Dads

43 members • Free

PricingSaaS

954 members • Free

5 contributions to PricingSaaS

Making usage based pricing predictable

What are people's thoughts on building predictability into usage based pricing? Example: Price based on N-month rolling average, resets every N months. N could be 3, 6, 12 but the point is to eliminate variability in pricing month to month. For context, this is mainly from the perspective of small businesses where as software customers they're not even used to paying subscription so it's a huge mindset leap to be charged usage that varies on top of subscription payments. In this case usage based pricing helps to capture different value for different size offices and is directly correlated to the amount of revenue generated. But I'm also interested to know what else is being done in the wild outside of the small business scenario. There may be a great read on this that I've simply missed so feel free to point me in that direction if you're aware.

1 like • 7d

In our scenario the fencing metric follows seasonal cycles which aren't particularly spikey. Rather, if our features are delivering on the value prop, the metric should grow over time. We do have other feature-specific usage metrics that would be much more spikey but we're less concerned about making those predictable - won't dive in unless people want to! Would like to hear more, Akshay. High spikes might increase the need for predictability but also make it harder to "smooth out" or require more precision on measurement cadence. But I'm interested to see if folks are doing anything novel to address the lack of predictability of UBP in cases where that's a concern for their customer base.

Pricing Updates this Week (and a question)

Happy Friday y'all! Recorded a quick video breaking down 5 pricing and packaging updates from the last week. Random question, but I'd love to have a rotating cast of guests to analyze changes with. Any takers?

Looking for guidance: Enterprise WTP research

Hi everyone, and happy holidays! I am kicking off Q1 with a revamp of my current company's enterprise offering structure, from packages to pricing structure. Like many others, we are looking to move away from user-based pricing. I am planning to run WTP research through qualitative interviews to help us better understand the value within our product for large enterprises and to validate the options we have for new metrics to bring into a value-aligned pricing structure. My ask: Does anyone have resources they have found particularly insightful in informing how to set up successful qualitative enterprise WTP studies? Any lessons learned that could help me here? Any input is appreciated! Additional context: We're a Series A SaaS/"on-prem" hybrid product with deep open-source roots (https://www.localstack.cloud/).

2 likes • 18d

Just curious, why only prospects? Don't feel existing customers have insights on how value scales and which metrics might better capture that? They're WTP answers might be anchored by what they pay today but still usually helpful to contrast prospect WTP to existing customer responses and to consider where divergence comes from.

0 likes • 18d

@Alexa Gjonca All comes down to how the questions are asked, sequenced and the extent to which you can derive directional sense from a qualitative discussion (e.g., asking preference on a scale of 1 to 5 where possible). So like you said, once you've drafted survey, easier to comment on that.

Pricing for Membership (B2B on-line training)

Hi all. I have a question about "pricing" that is not related to SaaS, but rather to transforming Professional Services into ARR. Two years ago we started an initial experiment: delivering live online training to IT professionals working in SMEs, using a membership-based approach. Our value proposition: - 8 courses scheduled throughout the year - Two yearly membership options for the customer: - 1) Membership for 1 participant: X€ - 2) Membership for up to 3 participants: 1.6 × X€ (It worked. And we were so happy that we (I) made the BIG mistake: not considering at all - for the second year - the physiological Churn Rate..) For next year, we want to apply the same business model to end-user training (Office M365 Apps). OUR PRODUCT: 8 courses scheduled in advance for all of 2026 OUR TARGET: small/micro companies (2 to 10 potential users) OUR COST STRUCTURE: main costs are fixed (trainer, organization), so the number of people per company in each class is not an issue. PRICING IDEA: offer customers a flat yearly price, divided into tiers that help maintain profitability. We are considering pricing per Company, based on the total number of attendees per course. For example: - 1–2 attendees - 2–5 attendees - 5–10 attendees - I would appreciate any suggestion on how to keep the pricing simple and fair for both sides I have already interviewed about 5 customers who are interested in the concept, but I have not shared any pricing with them yet. Do you thing that pricing per tier is the best options or do you think we have to think in a different way? Thanks in advance to all. Claudio

0 likes • Dec '25

When you interview your next set of customers, don't "share pricing with them", ask them directly how they think the course should be priced (price model) and possibly even what their WTP is (price level). I agree with @Michael Narkiewicz though, it isn't clear how your 8 courses continue to deliver value over time. Hard to say without more details but you should consider what you need to continue to create and provide to this audience to make the platform more sticky. What makes them keep coming back? And for all founders, we need to believe in what we're building but a healthy dose of skepticism in understanding our customers' value perception goes a long way. Your software is much better than the competition. 100% true. But the office managers typically using it are from a past generation, not familiar with modern UI and not able to properly benefit from the improvements. Value perception = zero. Just an example.

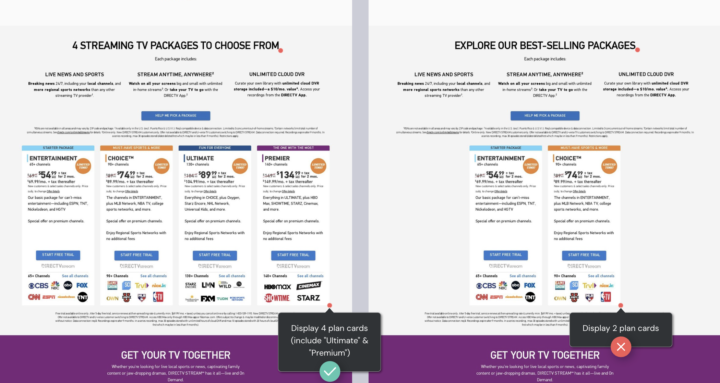

Is there a perfect amount of pricing plan tiers?

I have spent a lot of time digging into our DoWhatWorks database of A/B tests from the top brands in the world to answer this question. It's a complicated one, with variance by industry and many other variables. That being said, in general, here are a few takeaways from the data... - 4 pricing plans seem to be a sweet spot that performs well for most brands and wins against 1, 2 or 3 plans - 2 pricing plans, seems to have a slight edge over 1 or 3 pricing plans. - 5 pricing plans often wins over 1, 2 or 3 pricing plans. Below you see a test from DirectTV where they tested into 4 pricing plans over 2. Again, there is a lot of nuance here, but some interesting directional guidance.

1 like • Dec '25

Ah got it! That's really cool. So wins in this case would be what these sites are reporting or choosing based on these tests? Either way, a lot of value in understanding "what works" for the success stories. I am personally finding there are critical scale considerations for those of us still making the climb.

2 likes • Dec '25

@Ashish Gupta I haven't actually watched them but look in the classroom section of PricingSaaS and you'll find Ulrik's primers on pricing fundamentals. Bound to be some basics on how you design tiers there. Depending on what stage you're in, this may not be such a small deep dive if you want to do it right. But at its core, you want to identify clear segments within your customer base (could be based on a lot of things but most likely: how they engage with your products / features). So, segment A has a clear set of ways in which they use features differently than segment B. Obviously the features need not be mutually exclusive; segment B could need most of the same features but also need an additional set that segment A does not. Accordingly you should find how the willingness to pay differs across these segments based on the value they derive from the different sets of features they use and price accordingly. I'm using SaaS lingo here but applies to other industries / delivery models as well. The key is to really understand how these segments differ across dimensions that are most meaningful and not default to small, medium, large type, conventional segmentation from the get go. More conventional segments may end up being the proxy or the nomenclature you use but the magic happens in fully exploring your customer's use cases, business behaviors, collaboration criteria and a whole host of possible dimensions that affect how they engage with your product / service. It can sound intimidating but it doesn't have to be. Much of this should be the diligence any business is engaged in when refining their own business (let alone monetization) models. That scratches the surface but so much more to consider once you really get under the hood. And more knowledgeable folks will have different / better takes than this, I'm sure. Good luck!

1-5 of 5

Active 2d ago

Joined Dec 18, 2025

Powered by