Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by Saâd

Investing insights, halal crypto & equities, and a community of conscious Muslim investors. Built in Switzerland, for Muslims worldwide.

Memberships

Manychat Masterclass (Free)

1.9k members • Free

Skoolers

190.4k members • Free

161 contributions to Swiss Islamic Finance

Equities

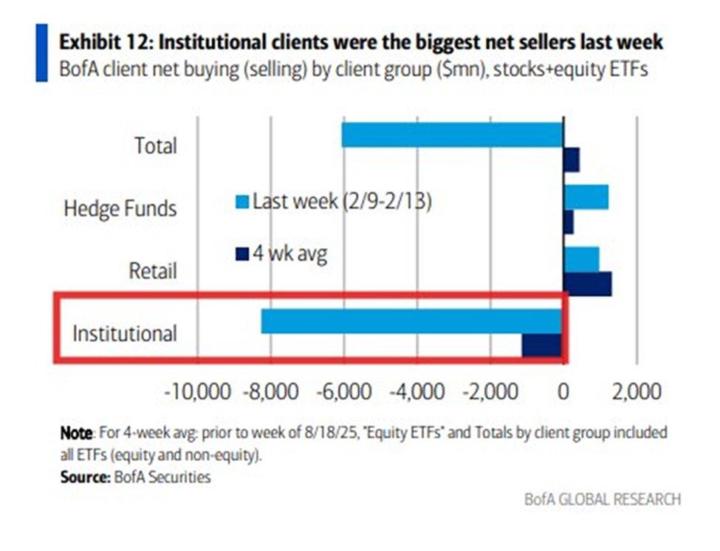

BREAKING: Institutional investors sold a net -$8.3 billion of US equities last week, the 2nd-largest weekly sale on record. Meanwhile, retail investors bought +$1.0 billion, posting their 5th consecutive weekly purchase. Hedge funds bought +$1.2 billion.

0

0

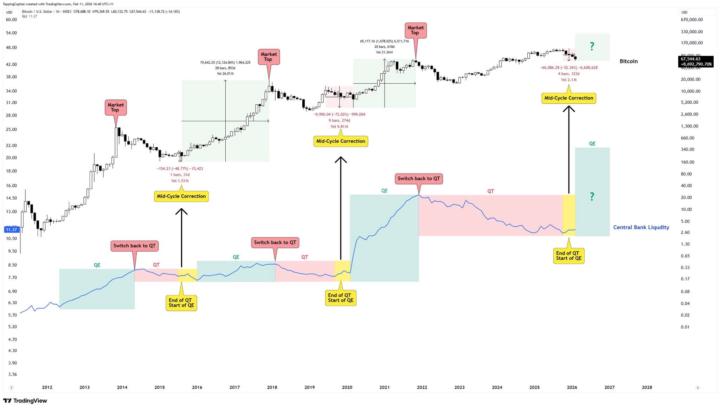

Digest this chart

Basically survive until the blue box of QE. And. Buy during the yellow box Hope to see you still here in blue box 🙂

1

0

Where I see BTC bottom this cycle (based on historical data)

PIN THIS UP. 2014: From failed rally to 1st bottom 65% From failed rally to real bottom 82% 2018: From failed rally to 1st bottom 66% From failed rally to real bottom 82% 2022: From failed rally to 1st bottom 63% From failed rally to real bottom 68% 2026: 63% - 37k 68% - 30k 82% - 18k (highly unlikely imo but you never know) This is pure historical data, does it have to wor 100%? We don't know. Don't trust me. Go and draw the levels out yourself. But you will be foolish not to factor it into your consideration. Can we bounce from 60k? What happens if we bounced hard to 97k and take it off? What if we dump right through? What is a good probable time to see real bottom? This is probably the thing you need to know this bear market. Don't overthink it.

ETH

Short term wise Sto rsi 4 hr is oversold and is now curling down. Let it do it work and if we hit oversold this weekend with a dump, enter. Its a bounce play, not long term hold.

0

0

USDT Dominance

As mentioned, very close to bottom according to this chart and we had a sharp reaction from the resistance. Either we revisit the resistance for a double top and begins the recovery or we continue to chop. It seems the worst is over, for now. We can allow some strength into March before continuing the downtrend.

1

0

1-10 of 161

@saad-dhif-5173

We help Muslims grow wealth ethically in crypto, equities, and beyond.

Active 2d ago

Joined Nov 15, 2025

Zurich