Write something

Equities

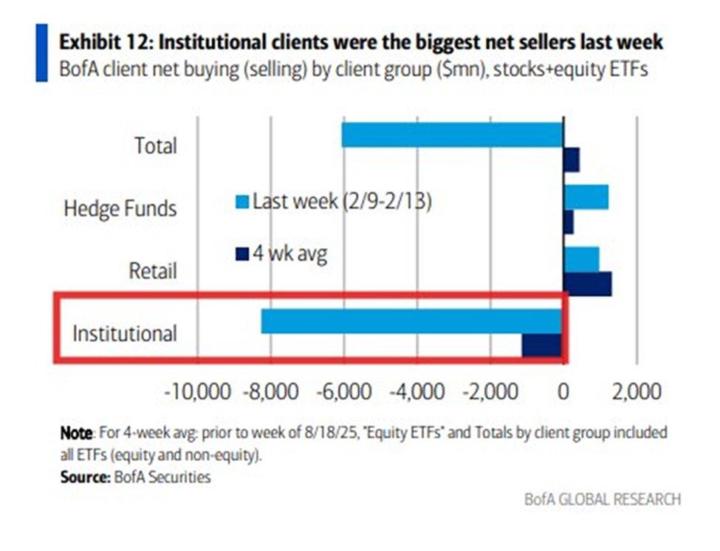

BREAKING: Institutional investors sold a net -$8.3 billion of US equities last week, the 2nd-largest weekly sale on record. Meanwhile, retail investors bought +$1.0 billion, posting their 5th consecutive weekly purchase. Hedge funds bought +$1.2 billion.

0

0

SP500

All these crypto dumping while sp500 barely sneezes. Remember stocks will lead crypto and only when stocks capitulate, QE starts then we enter into btc. Until then, cash is king. Ignore those saying inflation kills dollars. It's at most 3-5% per year. Look at what happens if you hedge with btc during this fall? Its many years of inflation! Cash has its use for a purpose and that's during bear market. I have been harping on the possibility that 2026 is the bear market due to mid terms years. You should be way ahead of your peers in this. When btc enters into the Generational buy levels, sentiment will be very bad. That's the time to enter. Soon.

0

0

Last Week in Stocks

-The 3 Mag 7 stocks all beat earnings but two of them dropped with $MFST having a double digit sell off. -Fed held interest rates which was expected -Silver and Gold saw record setting corrections as much as 30% in a single day for Silver after setting all time highs -Government seeing a partial shutdown with a high chance of being back open on Monday when the house can approve the Senates vote -Trump has nominated Kevin Warsh to replace Powell as head of the Fed -PPI inflation data came in hotter than expected with the US dollar making a little bit of a rebound at the same time as the metals selling off

0

0

USD/CHF - Nice rebound

Nice rebound on USD/CHF as I said last week. My zone is working perfectly. I target USD/CHF to perform around 0.80 at least.

USD/CHF - Update

Very nice reaction to my zone (see below weekly chart). We can expect the price to move around 0.84 but I am not sure yet. Question then will be should we hedge the USD exposure to protect our US Equities value? (From a Swiss citizen perspective). Chech my past analyses on USD/CHF, in the search bar you type "USD/CHF".

1-30 of 52

powered by

skool.com/swiss-islamic-finance-1703

Investing insights, halal crypto & equities, and a community of conscious Muslim investors. Built in Switzerland, for Muslims worldwide.

Suggested communities

Powered by