Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

Data Analysis with R

413 members • Free

Data Alchemy

37.9k members • Free

Skill Data Networks

220 members • Free

THP Jump Training

79.6k members • Free

Energy Data Scientist

372 members • Free

23 contributions to Energy Data Scientist

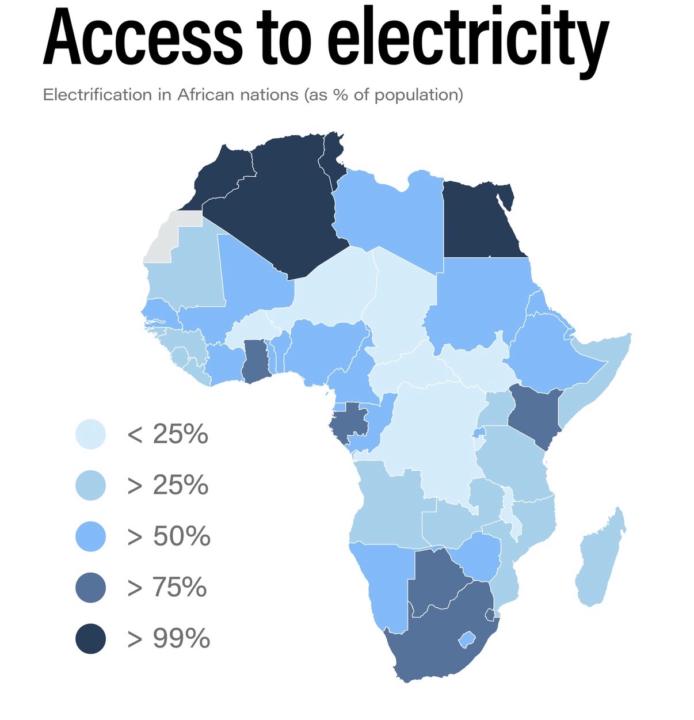

Access to Electricity in Africa

The attached plot shows the level of electricity in Africa. How best can it increase? using smart grids? micrograms?

Data Mining for Energy

Since linear and logistic regression are supervised models and are frequently used for exploratory analysis in data mining, would it be accurate to say that the distinction between data mining and machine learning is primarily methodological (discovery vs prediction) rather than algorithmic? Please feel free to share any experiences choosing to use data mining for Energy or any other industry.

Hedge Funds moving into Physical Energy Commodities

A hedge fund is an investment firm that tries to make profits using many different trading strategies. More and more hedge funds and trading firms are moving beyond “paper trading”. Paper trading is where they are buying and selling financial contracts linked to oil, gas, or power. It is about trading financial contracts (futures, options, swaps) where the trader never actually touches the physical asset. Traditionally, hedge funds are financial entities, not logistical ones. They almost exclusively trade "paper" while leaving "physical" trading to commodity trading houses (like Glencore, Vitol, or Trafigura) and industrial producers (like Exxon or Cargill). So, paper trading is when hedge funds are buying a contract on an energy commodity like oil, and buy it to bet that its price will go up. Before the contract expires, they sell the contract to someone else. The only thing that changes hands is cash. Hedge funds now are also moving into Physical Trading i.e. they are buying a number of actual barrels of oil, putting them on a ship, storing them in a tank, and delivering them to a refinery. Hedge funds historically avoided physical trading. Physical trading requires ships, warehouses, pipelines, and insurance. It involves dealing with weather delays, customs, and quality degradation (e.g., grain rotting). Hedge funds are built to move capital, not cargo. Also, hedge funds thrive on leverage. It is much easier to get 10x leverage on a financial futures contract than it is to get a bank to lend you money to buy physical coal. However, in recent years, hedge funds (like Citadel, Millennium, Balyasny, and Point72) have built out physical trading desks, particularly in energy (natural gas and electricity). The full report is inside Classroom ---> 6.2. Sources: [1]: Financial Times: https://www.ft.com/content/598c3bfc-008c-438f-837c-f7ec73a993f6 [2]: The Economist: https://www.economist.com/finance-and-economics/2025/06/26/why-commodities-are-on-a-rollercoaster-ride

Certification

Kariyer ilerlemesinde alınan sertifikaların önemli olduğunu düşünüyor musunuz? Düşünüyorsanız hangi sertifikaları tavsiye edersiniz?

Data Science + ML + Optimisation Careers

Can you share some combinations of Online Courses to take, for the career pathway of Data Science for Energy and/or ML for energy and/or Optimisation for energy?

1 like • Dec '25

@Edgar Jr. Energy companies want data science knowledge + energy knowledge, and I checked Datacamp and Microsoft Learn teaching only data science knowledge .Here, in this Skool, it teaches the intersection of energy and data science which is better for jobs in the energy-data-science field

1-10 of 23

Active 8d ago

Joined Sep 23, 2025

AZE