Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

Rebel Economist (Free)

1k members • Free

economyjournal

101 members • $9/month

Job Seekers Community

3k members • Free

Skool Speedrun (Free)

11.9k members • Free

Energy Data Scientist

372 members • Free

19 contributions to Energy Data Scientist

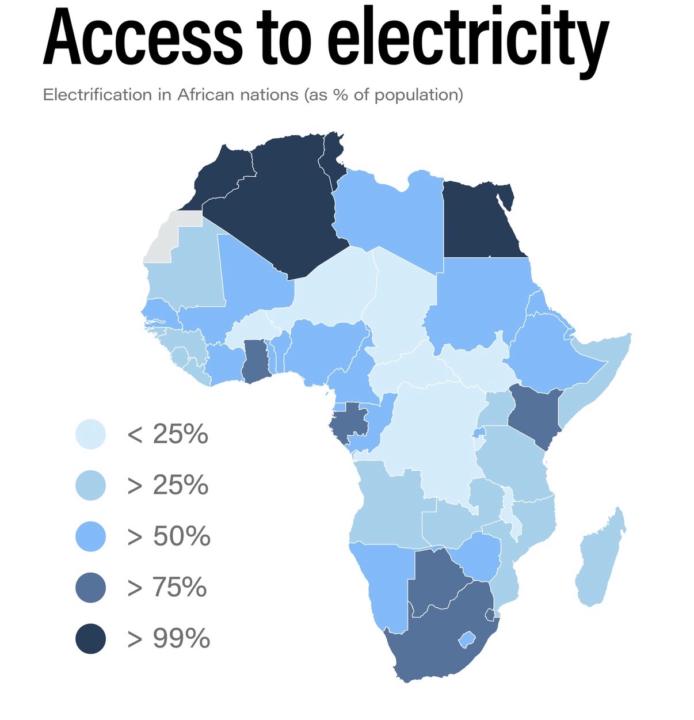

Access to Electricity in Africa

The attached plot shows the level of electricity in Africa. How best can it increase? using smart grids? micrograms?

Data Mining for Energy

Since linear and logistic regression are supervised models and are frequently used for exploratory analysis in data mining, would it be accurate to say that the distinction between data mining and machine learning is primarily methodological (discovery vs prediction) rather than algorithmic? Please feel free to share any experiences choosing to use data mining for Energy or any other industry.

1 like • 8d

It is mostly accurate: data mining is usually framed as uncovering patterns and useful insights in existing data, while machine learning is framed as learning a model that performs well on a defined task like prediction. The algorithms overlap heavily, so the difference is more about the goal than the math.

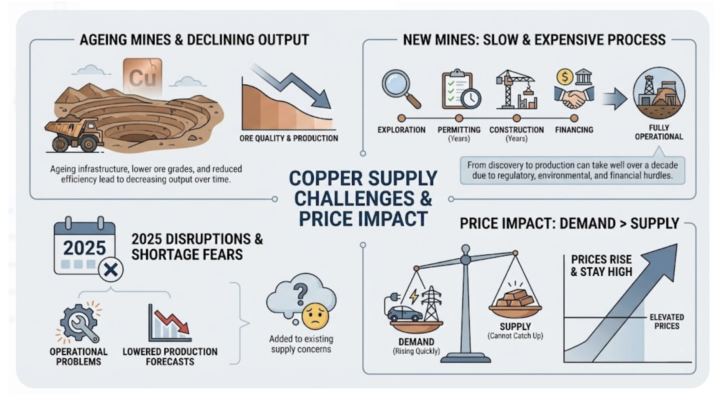

Why Copper Prices increased in 2025

A new report has been published and examines why the prices of copper increased in 2025. Copper is a metal which is used a lot in energy. It is essential for electricity systems and it is used in wiring, motors, and many machines and in Renewable energy systems and electric vehicles. Copper is central to electrification: it is used across clean-energy technologies, and grid expansion. If copper gets more expensive, power grids, renewable projects, electric vehicles, and data centres can cost more. Sharing also a slide about copper supply (source: LSEG) ---------------------------- You can access all energy reports by clicking the 'Classroom' menu and navigating to Section 6.2. These reports have been created using the sources below (Financial Times, etc), along with my comments , all written in simple, beginner-friendly language. If you have any questions feel free to ask. By the way these sources below, all request you to subscribe to read their articles. But you don't need to subscribe because you get all the necessary content by simply reading the reports that I publish and which you can find in Classroom section 6.2. Why read these reports: they are very helpful when you find yourself in discussions related to energy or economics. It displays market awareness. How to read these reports: one read is sufficient. They are written very simply. Also, for any questions feel free to message me. [1]: Financial Times: https://www.ft.com/content/29bc6bce-7188-43f2-9f15-6894cf7aa754 [2]: Bloomberg: https://www.bloomberg.com/news/articles/2025-11-07/copper-s-huge-tariff-bet-is-back-as-traders-bid-for-us-supplies? [3]: Wall Street Journal: https://www.wsj.com/finance/commodities-futures/copper-is-2025s-hottest-commodity-c7c21ec4

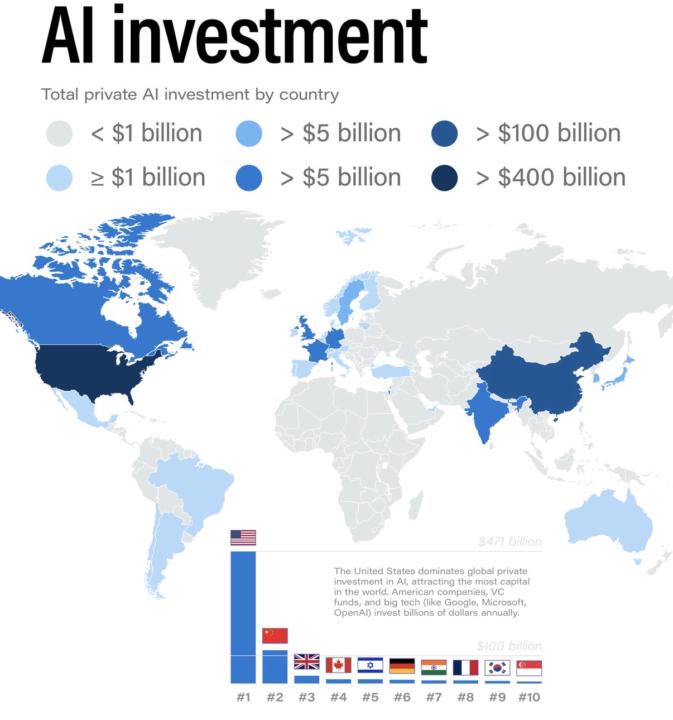

AI Infrastructure: Massive Investments

Massive investments in AI infrastructure. See attached image. a) How will this affect investments in the Energy Sector ? b) How will this affect demand for data scientists/ Software Engineers in Energy Sector? c) What salary ranges in the Energy Sector do we expect e.g. increase/ decrease etc? d) Which regions do you foresee maximum growth ?

0 likes • 25d

Africa will see very large investment in energy. The data backs up this optimism. I read IEA reports . They say: Private clean energy funding is $40 billion, and solar capacity is projected to grow by 42% in 2026. Africa is basically energy resources + AI . AI + Energy will offer significant growth.

Hedge Funds moving into Physical Energy Commodities

A hedge fund is an investment firm that tries to make profits using many different trading strategies. More and more hedge funds and trading firms are moving beyond “paper trading”. Paper trading is where they are buying and selling financial contracts linked to oil, gas, or power. It is about trading financial contracts (futures, options, swaps) where the trader never actually touches the physical asset. Traditionally, hedge funds are financial entities, not logistical ones. They almost exclusively trade "paper" while leaving "physical" trading to commodity trading houses (like Glencore, Vitol, or Trafigura) and industrial producers (like Exxon or Cargill). So, paper trading is when hedge funds are buying a contract on an energy commodity like oil, and buy it to bet that its price will go up. Before the contract expires, they sell the contract to someone else. The only thing that changes hands is cash. Hedge funds now are also moving into Physical Trading i.e. they are buying a number of actual barrels of oil, putting them on a ship, storing them in a tank, and delivering them to a refinery. Hedge funds historically avoided physical trading. Physical trading requires ships, warehouses, pipelines, and insurance. It involves dealing with weather delays, customs, and quality degradation (e.g., grain rotting). Hedge funds are built to move capital, not cargo. Also, hedge funds thrive on leverage. It is much easier to get 10x leverage on a financial futures contract than it is to get a bank to lend you money to buy physical coal. However, in recent years, hedge funds (like Citadel, Millennium, Balyasny, and Point72) have built out physical trading desks, particularly in energy (natural gas and electricity). The full report is inside Classroom ---> 6.2. Sources: [1]: Financial Times: https://www.ft.com/content/598c3bfc-008c-438f-837c-f7ec73a993f6 [2]: The Economist: https://www.economist.com/finance-and-economics/2025/06/26/why-commodities-are-on-a-rollercoaster-ride

1-10 of 19

@chinedu-okafor-3651

MSc Student Software Engineering Applied to Economics

Active 8d ago

Joined Oct 14, 2025

Nigeria