Write something

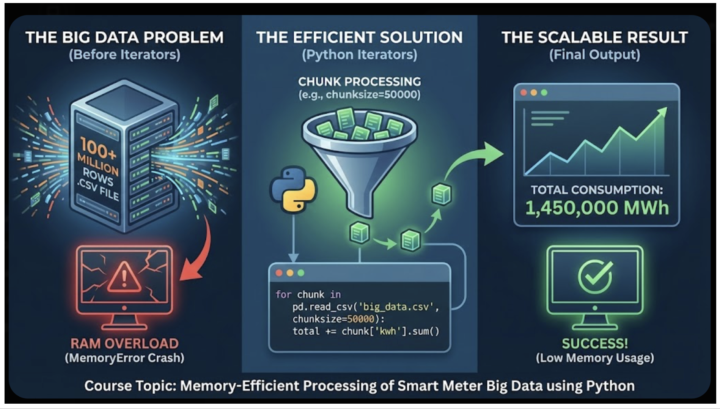

New Online Course: How Big data from Smart Meters are processed efficiently

I’ve just published a new online course about Memory-Efficient Processing of Big Data. This course teaches real-world skills as they are used in practice. Smart meters measure the electricity-consumption data every hour, and store the information in CSV files. These files eventually become very large (big data). The new online course is called "Smart Meter Big Data Efficient Processing" and it is in the Classroom in 1.36. This online course teaches a Python methodology that is used by energy companies in practice to read extremely large datasets (Big Data). Without this technique such files cannot be read because they cause a memory (RAM) error. Companies that sell electricity to consumers are known as 'Retailers' or 'Suppliers'. Such companies have CSV files with hundreds of millions of rows, where each row is the hourly kWh electricity consumption. If they try to load these CSV files, their computers will run out of RAM and crash. So these companies process these files using Python iterators, which enable a memory-efficient and fast processing method. In this course, I show you the industry-standard solution: using Python Iterators to process Big Data in "chunks". See the attached image; this is analysed in detail in the course.

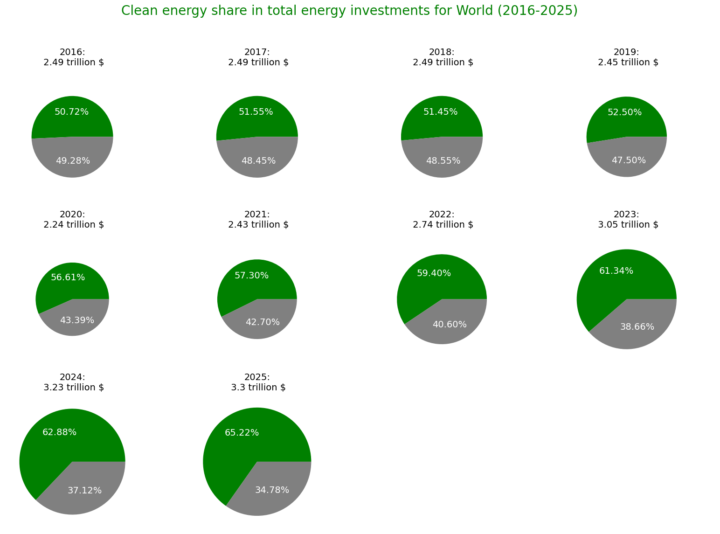

2016–2026 Green energy versus energy...

Course practice 1.35 This course, with its Python exercise, allows you to visualise 10 years of global trends and developments in clean energy production by major region (Africa, China, Europe, etc.). 1/ World 2/ Africa The improvements are clear to see!

Data Mining for Energy

Since linear and logistic regression are supervised models and are frequently used for exploratory analysis in data mining, would it be accurate to say that the distinction between data mining and machine learning is primarily methodological (discovery vs prediction) rather than algorithmic? Please feel free to share any experiences choosing to use data mining for Energy or any other industry.

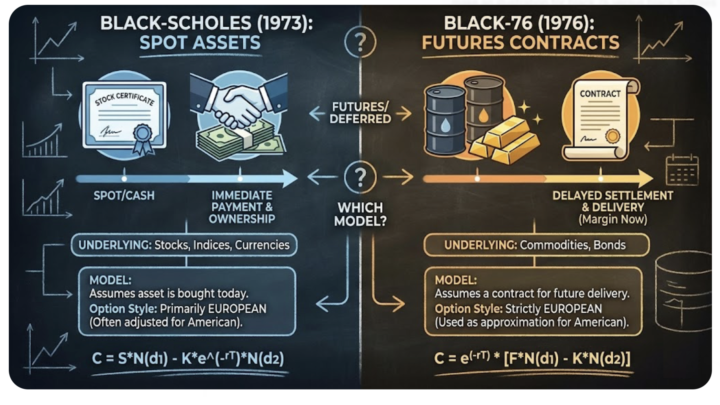

Valuation of Commodity Options - New Course

Online Course 5.20 is Now Live in the Classroom! The course includes a PowerPoint presentation, full Python implementation and many hours of video lectures. It is a beginner-friendly course on the valuation of Commodity Options (like options on crude oil), including full Python implementation. No stochastic calculus, and no fancy "martingale" mathematics. Just simple, practical language, explaining exactly how it is used in practice, in finance. Banks like JPMorgan use these exact models to help oil companies guarantee their income, even if oil prices crash. On the other side, oil refineries use this same math to lock in cheap fuel prices. What we need to remember (also great for interviews): When a company exercises a Commodity Option, it doesn't get the commodity (e.g. oil) immediately. Rather, it receives a Futures Contract. Once that contract expires, it then receives the commodity ( crude oil). So: Option --> Futures --> Commodity. The attached cheat sheet compares the two main pricing models in energy finance: 1. Black-Scholes: Used for Energy Equities (Stocks). 2. Black-76: Used for Commodities (Futures). What’s Inside Course 5.20: - Foundations: Spot Price vs. Futures Price vs. Strike Price. - The Math: Calculating "Premium" using the Black-76 Model. - The Code: Full Python implementation for pricing Call and Put options. - Valuation: Understanding Intrinsic vs. Extrinsic (Time) Value. - Mechanics: American vs. European options and Physical Settlement. - Real World: How an Option becomes a Future, and how a Future becomes Oil.

Everything you need to know about this community

Start or transition into a secure career in the energy sector, regardless of your location, age, sex, education level, or work experience. The energy sector is resilient and strong, with potential for growth and good compensation, with the ability to work remotely or in -person, whether you like coding or not. I am bringing you years of MSc + PhD + Postdoctoral Research + Consultancy (Industry) experience at a very low cost (a similar program would cost 100 times more with no exaggeration). No academic terminology. Real-world beginner-friendly practical skills to secure a career. Advanced courses for PhD preparation also available! This is the 'Energy Data Scientist' program. - At the top of the screen, the 'Map' shows the approximate location of all members of this community. - At the top of the screen, the 'Classroom' includes all the resources you need. - Everything in Classroom comes with support from Dr Giannelos. This includes daily Q&A, and a personalized curriculum. - Items 1.1 - 1.35 are online courses teaching data science for energy. - Items 2.1-2.6 are online courses teaching machine learning for energy. - Items 3.1-3.5 are online courses teaching software engineering for energy. - Items 4.1-4.44 are online courses teaching optimisation for energy. - Items 5.1-5.20 are online courses teaching energy-economics/finance. - Items 6.1a and 6.1b include reports on energy research, written in simple, beginner-friendly language. Access to energy-research is only possible by subscribing to databases like ieee-explore (would cost you hundreds of dollars per month). Dr Giannelos brings you the key points along with his commentary and extra details, all written in simple beginner-friendly language. This will offer you unprecedented insights that will help you stand out. - Item 6.3 includes career guides, job opportunities, and other career-related material. - Item 6.5 includes reports on energy-economics books, written in simple, beginner-friendly language (such access would cost you a lot!)

1-30 of 47

powered by

skool.com/software-school-for-energy-7177

A beginner-friendly training program for a career in the energy sector. Regardless of your location, age, sex, education or experience level.

Suggested communities

Powered by