Write something

Careers: Massive Hiring in the UK Energy Sector

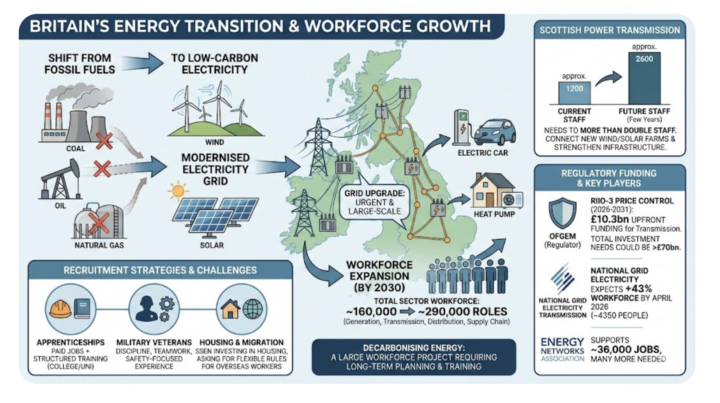

In the United Kingdom, the electricity grid is under urgent modernization. As a result a massive hiring boom is happening, with the sector workforce expected to grow significantly over the next years. Backed by billions in funding approved , major electricity grid operators like Scottish Power and National Grid are rapidly expanding but face a shortage of experienced staff! There has never been a more critical or lucrative time to join the energy sector. This massive hiring growth is a global phenomenon, driven by the urgent, worldwide transition to decarbonisation. As demand skyrockets and the industry faces a talent shortage, the barrier to entry has hit historic lows. The right time is now to pivot into a field that offers not just high pay, but long-term stability and the chance to work anywhere on the planet. To guarantee a role in any country within six months, focus on the industry’s most valuable intersection: energy and analytics. By learning Data Science, Machine Learning, and Optimisation specifically for energy, you enter a niche where skilled professionals are so scarce that securing a job often takes just one to five interviews! You can find everything you need to master these high-demand skills in the Classroom, which offers over 100 specialized courses designed to fast-track your career. Attached is a screenshot that illustrates the situation in the power grid sector in the United Kingdom. A detailed report on this topic has been added in Classroom section 6.3 (career support). Sources: 1. Financial Times: https://www.ft.com/content/281a5a46-b1a6-4ba3-868f-4745a0d2e1b0? 2. Investors' Chronicle: https://www.investorschronicle.co.uk/content/d0ecf236-45f5-4ca2-a897-c6533fc8d3ba? 3. Wall Street Journal: https://www.wsj.com/business/energy-oil/britain-pushed-ahead-with-green-power-its-grid-cant-handle-it-b674c413? 4. The Economist: https://www.economist.com/business/2025/01/05/a-new-electricity-supercycle-is-under-way

Certification

Kariyer ilerlemesinde alınan sertifikaların önemli olduğunu düşünüyor musunuz? Düşünüyorsanız hangi sertifikaları tavsiye edersiniz?

Career guide: Consulting paths for Energy Data Scientists

I’m sharing a career guide on consulting paths for Energy Data Scientists. It breaks down the three main routes: Strategy, Technical/Specialist, and Implementation consulting. And it explains what the work looks like, typical deliverables, and the skill sets needed. PDF attached. All career guides are in Classroom --> 6.3.

How do we define the "Energy Data Scientist" ?

The term 'Energy Data Scientist' means more than just a Data Scientist who works in an Energy Company. Given the skills that this Skool community teaches, what jobs does the Energy Data Scientist cover?

Interview Question on Crude Oil Options

--------------------------------------------------- QUESTION --------------------------------------------------- - Interview Question: A producer of crude oil (WTI) wants to protect their revenue against a potential drop in oil prices by the end of 2025. Based on the financial instruments presented in the attached slide, which option type should they use, and what is the specific condition regarding the market price relative to the given strike price for that option to yield a profit? Deadline to reply: 2-3 minutes - Correct answer: To hedge against falling prices, the producer should buy a Put Option. According to the slide, for this specific contract with an $80 strike price, the position becomes profitable only when the actual market price of WTI Crude Oil is less than $80. A 5-minute video has been uploaded here, that explains the answer in detail. Similar videos can be viewed in Classroom/ 6.3. --------------------------------------------------- DETAILS ABOUT THE JOB OPPORTUNITY --------------------------------------------------- - This interview question has appeared almost identical in the following cases: Interview Round: 2 (technical / commercial awareness) > Shell for the role of Quantitative Analyst , Energy Trading > Chevron for the role of Supply & Trading Analyst > Goldman Sachs for the role of Commodities Strategist (Strats) > Morgan Stanley for the role of Energy Derivatives Associate > S & P Global Platts, for the role of Energy Data Analyst - Salary approximate (gross salary , annual) for junior level (0-3 years experience) and without including the annual bonus. > in the USA around 130,000 USD > in the UK, around 70,000 GBP > In Switzerland, around 110,000 CHF > in UAE , around 250,000 AED > in India, around ₹17 Lakhs > in China, around ¥260,000 > in Africa (mostly S Africa) around R 500,000

33

0

1-30 of 34

powered by

skool.com/software-school-for-energy-7177

A beginner-friendly training program for a career in the energy sector. Regardless of your location, age, sex, education or experience level.

Suggested communities

Powered by