Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

What is this?

Less

More

Memberships

The Digital Marketing Bar

67.6k members • $17

Sell & Scale (Free)

7.1k members • Free

Ultimate Networking Blueprint

1.5k members • Free

The Freedom Hustle

175 members • Free

Invest & Retire Community

3.5k members • Free

The Trading Cafe

82.5k members • Free

Blockchainbuzz-Dev

1.1k members • Free

Investing Accelerator

457 members • Free

10 contributions to Invest & Retire Community

YouTube: AI replacing YOU? Why programmer jobs tanked and my solution to it (and inflation as well)

In this video, I will talk about the upcoming wave of unemployment driven by AI replacing core functions of our society and corporations We will talk about - The rise and decline of programming - The rise and decline of accounting (me) - The solution to Universal Basic Income and why we need it - How the monthly passive income strategy can help - How US inflation is hitting 3% in January 2025 - A review from a student in Investing Accelerator YouTube link: https://youtu.be/XuEOLxQEPT8 Cheers, Eric ------ Eric Seto Chartered Professional Accountant (CPA) Chartered Investment Manager (CIM) Founder of 5MinInvesting.com In February, my goal is to help 20 people without a financial background to master investing through Investing Accelerator. Investing Accelerator is designed for people without a financial background. The goal is to achieve 30% return per year. In the first phase, you will learn long term investing and targeting 30% for tax free compound growth. This will help accelerate your overall wealth. In the second phase, you will learn monthly passive income to provide a more predictable cash flow (target 30% per year) which can cover your expenses. This will help accelerate your retirement goals. If you are interested, then let's hop on a call to see if you can benefit from the strategies in Investing Accelerator and get 30% per year. During the call, we will map out exactly how you can achieve 30%, what you are lacking, how you can improve. If you have any questions about the program, you can ask during the call as well. Schedule a call here: https://bit.ly/48mJlgR Remember to go to the Classroom tab for additional investing resources. (If you want to be a shareholder of Investing Accelerator and get 20.5% dividend (monthly distribution), $200K investment would be $40K in dividends per year. you watch the investor presentation here: https://bit.ly/3CKVp0R)

Happy Chinese New Year

I wish you making good gains for the year of the Snake Happy Chinese New Year! Remember the stock market goes up and down. It is your relationship, your loved ones are the most important. Cheers, Eric ---- Eric Seto Chartered Professional Accountant (CPA) Chartered Investment Manager (CIM) Founder of 5MinInvesting.com In February, my goal is to help 20 people without a financial background to master investing through Investing Accelerator. Investing Accelerator is designed for people without a financial background. The goal is to achieve 30% return per year. In the first phase, you will learn long term investing and targeting 30% for tax free compound growth. This will help accelerate your overall wealth. In the second phase, you will learn monthly passive income to provide a more predictable cash flow (target 30% per year) which can cover your expenses. This will help accelerate your retirement goals. If you are interested, then let's hop on a call to see if you can benefit from the strategies in Investing Accelerator and get 30% per year. During the call, we will map out exactly how you can achieve 30%, what you are lacking, how you can improve. If you have any questions about the program, you can ask during the call as well. Schedule a call here: https://bit.ly/48mJlgR Remember to go to the Classroom tab for additional investing resources. (If you want to be a shareholder of Investing Accelerator and get 20.5% dividend (monthly distribution), $200K investment would be $40K in dividends per year. you watch the investor presentation here: https://bit.ly/3CKVp0R)

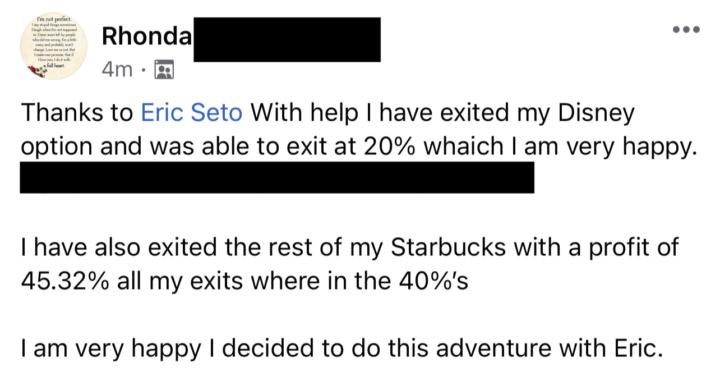

Rhonda made 20% from DIS and 40% from SBUX

748 - 749 Rhonda made 20% from DIS and 40% from SBUX For June, I forecast there will be no interest rate increase. And the market will remain bullish for June. In May, we previously entered into our favorite stocks at a discounted price a few weeks ago including MSFT, META, indexes, and more. So far, after tweaking my strategy a bit more, my return for May is +8% for the overall portfolio. May is the turning point, I forecast the majority of the profits should be made in the next few months. Cheers, Eric ----- Eric Seto Chartered Professional Accountant (CPA) Chartered Investment Manager (CIM) Founder of 5MinInvesting.com Free webinar - how to get 30%: https://5mininvesting.com/free-case-study/ In June, my goal is to help 20 people without a financial background to master investing. Investing Accelerator is designed for people without a financial background. The goal is to achieve 30% return per year. In the first phase, you will learn long term investing and targeting 30% for tax free compound growth. This will help accelerate your overall wealth. In the second phase, you will learn monthly passive income to provide a more predictable cash flow (target 30% per year) which can cover your expenses. This will help accelerate your retirement goals. If you are interested, then let's hop on a call to see if you can benefit from the strategies in Investing Accelerator and get 30% per year. During the call, we will map out exactly how you can achieve 30%, what you are lacking, how you can improve. If you have any questions about the program, you can ask during the call as well. Schedule a call here: https://bit.ly/48mJlgR Remember to go to the Classroom tab for additional investing resources.

The 7 Most Common Investing Mistakes....

Mistake #7: Not Reviewing Your Investments Regularly If you’ve gone to the trouble of establishing a clear investing plan – and you’ve put together a diversified, well-thought-out portfolio of investments...it’s important that you check in on those investments from time to time. Investors need to evaluate and “rebalance” their portfolios on a regular basis to make sure that the ratios of value in different investments have not become undesirable. In any given year, some of your investments will deliver better returns than others...and this can impact your portfolio’s balance if you don’t keep an eye on it. Here’s a simple example: If you have two investments in your portfolio and you wish to maintain a 50/50 split between the two, you can invest an equal amount in each to start. But that ratio – let’s say it’s $50,000 in each – will be impacted by the performance of those two investments. If the first one goes up 20% while the second breaks even, you’d now have $60,000 in one investment and just $50,000 in the second – meaning your split will have changed to 55/45. That’s a simple illustration, but you can see how – with more investments in your portfolio and greater differences in performance – your portfolio’s balance can easily get away from you. The simplest way to stay on top of this is to look at your portfolio’s balance at regular intervals – quarterly or annually – and then adjust as needed. You can make your adjustments by tweaking the contributions you make to each investment at the start of each interval or you can sell some of the winning investments and re-invest the proceeds in those who have fallen behind. This may seem a bit counterintuitive – because, at the end of the day you’ll be “rewarding” the losing investments in your portfolio. But the truth is reviewing and rebalancing at regular intervals is an important part of a disciplined investing approach.

Sometimes I wonder, if what we do is too complicated?

I have a few trading accounts most follow the calendar spread. Returns beat the market on a yearly basis. I have one that does not do to IRS and brokerage limitations. I am not able to do spreads. I can buy/sell, cash secure puts and covered calls. I tweaked this account to only trade leaps on five companies, rebalance anytime the option price lets me sell or buy with staying at the set allocation balance that's established each calendar year. To my surprise this has done dramatically better up 94% for last year, and already up 24.21% Everyday we are learning and new methods can be developed. If I see another double this year big changes will be coming..

1-10 of 10

@komal-aggarwal-4530

Small business owner. Working towards learning new strategies for passive income

Active 2h ago

Joined Dec 8, 2023

Powered by