Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Invest & Retire Community

3.4k members • Free

25 contributions to Invest & Retire Community

Why do you need index funds... for the scatterbrains.

Safe index funds are the ones where it has a basket of stocks such as S&P 500. Dangerous index funds are spot indexes for Bitcoin (where it doesn't have diversification) If you sometimes forget to manage your own portfolio, then diversified index funds are perfect for you. When it comes to investing, there are investment vehicles where you must plan for an exit such as options / monthly passive income strategies / higher risk trades for individual stocks (such as AI). However, we are all so busy (doctors/engineers/programmers) and sometimes forget to monitor our position. If you know you are too busy to time an exit, then use index funds for the majority of your portfolio. If you entered into a low, great - you don't need to exit for many years to come If you entered at a high, just continue to dollar cost average and you will be fine long term. (This is not true for individual stocks - refer to EV and Fintech in recent years) Index funds (mostly) always come back, especially S&P 500. For the scatterbrains, use index funds. For individual trades, you can use automation and rules to make monitoring for an exit easier Cheers, Eric --- Eric Seto Chartered Professional Accountant (CPA) Chartered Investment Manager (CIM) Founder of 5MinInvesting.com Free webinar - how to get 30%: https://5mininvesting.com/free-case-study/ In March, my goal is to help 10 people without a financial background to master investing. Investing Accelerator is designed for people without a financial background. The goal is to achieve 30% return per year. In the first phase, you will learn long term investing and targeting 30% for tax free compound growth. This will help accelerate your overall wealth. In the second phase, you will learn monthly passive income to provide a more predictable cash flow (target 30% per year) which can cover your expenses. This will help accelerate your retirement goals.

2 likes • Apr '24

Massive market sell off last week, especially Friday 4/19/24 and particularly tech stocks. For example, Nvidia dropped over $84 Friday and I lost about 50% of my position in one day alone and about 60% over the week. I thought stock would rebound by week's end, but that did not happen. Other tech stocks similar, but not quite as dramatic.

Is your investing strategy Good Enough? Sharpe Ratio Explained with Excel Formulas and Examples

There's a saying that most people are unable to beat S&P 500. This is why learning how to calculate whether your investing strategy can beat the market is important. Sharpe ratio measures excess return divided by each unit of risk you take. If you achieve a high return but you take a lot of risk, it doesn't make it a great strategy (low Sharpe ratio). If you achieve a high return and you take very little risk, then it is a great strategy (high Sharpe ratio). In this video, I provide you with examples, benchmarks, and Excel formulas on how to calculate your own Sharpe ratio. https://youtu.be/8R04Q2k7JCQ Cheers, Eric --- Eric Seto Chartered Professional Accountant (CPA) Chartered Investment Manager (CIM) Founder of 5MinInvesting.com Free webinar - how to get 30%: https://5mininvesting.com/free-case-study/ In April, my goal is to help 20 people without a financial background to master investing. Investing Accelerator is designed for people without a financial background. The goal is to achieve 30% return per year. In the first phase, you will learn long term investing and targeting 30% for tax free compound growth. This will help accelerate your overall wealth. In the second phase, you will learn monthly passive income to provide a more predictable cash flow (target 30% per year) which can cover your expenses. This will help accelerate your retirement goals. If you are interested, then let's hop on a call to see if you can benefit from the strategies in Investing Accelerator and get 30% per year. During the call, we will map out exactly how you can achieve 30%, what you are lacking, how you can improve. If you have any questions about the program, you can ask during the call as well. Schedule a call here: https://bit.ly/48mJlgR Remember to go to the Classroom tab for additional investing resources.

Jeff, Manju, Mike made 43%, 146%, 89% in 2 months

705 - Jeff made 43% from DIS in 2 months 706 - Manju made 146% from DIS in 2 months 707 - Mike made 89% from DIS in 1 month If you track Disney's performance over time, you will observe the key change in trend comes from the change in CEO. The previous CEO was not able to bring the stock price higher after pandemic. Thus, the board decided to bring back the CEO before that (Bob Iger). This shifted Disney's focus from Disney Plus to Theme park and movie revenues. You can also observe that a change in CEO does not result in the stock trend change immediately. But it usually only happens once the CEO starts providing results. Cheers, Eric --- Eric Seto Chartered Professional Accountant (CPA) Chartered Investment Manager (CIM) Founder of 5MinInvesting.com Free webinar - how to get 30%: https://5mininvesting.com/free-case-study/ In March, my goal is to help 20 people without a financial background to master investing. Investing Accelerator is designed for people without a financial background. The goal is to achieve 30% return per year. In the first phase, you will learn long term investing and targeting 30% for tax free compound growth. This will help accelerate your overall wealth. In the second phase, you will learn monthly passive income to provide a more predictable cash flow (target 30% per year) which can cover your expenses. This will help accelerate your retirement goals. If you are interested, then let's hop on a call to see if you can benefit from the strategies in Investing Accelerator and get 30% per year. During the call, we will map out exactly how you can achieve 30%, what you are lacking, how you can improve. If you have any questions about the program, you can ask during the call as well. Schedule a call here: https://bit.ly/48mJlgR Remember to go to the Classroom tab for additional investing resources.

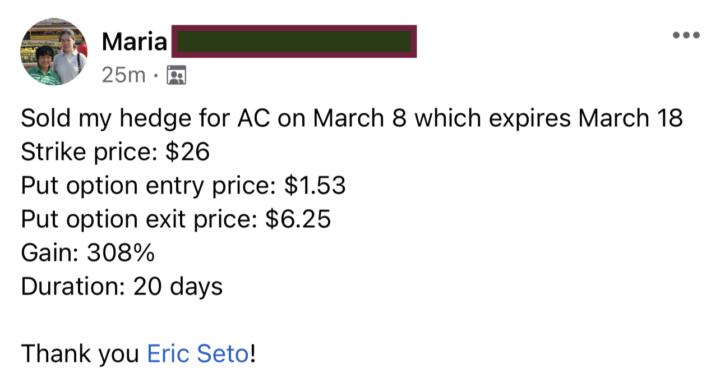

Maria made 308% from AC in 1 month hedge

Hedging is important, especially around earnings or during a bear market. This is less of a concern in the next 2 months as my forecast is generally bullish for S&P 500. However, during earnings season (e.g. drop in Google recently, drop in MasterCard, drop in ENPH and other stocks) - hedging is a great tool for: 1) Reduce your cost basis 2) High % of profit in a short time. When in doubt, consider buying a put. Cheers, Eric Seto, CPA, CIM ----- In November, my goal is to help 20 people without a financial background to master investing Investing Accelerator is designed for people without a financial background. Here's the link to the webinar: https://bit.ly/3i9QT1V We focus on developing financial independence, where you have the ability to invest to earn a higher return. The goal is to achieve 30% return per year. In the first phase, you will learn long term investing and targeting 30% for tax free compound growth. This will help accelerate your overall wealth. In the second phase, you will learn monthly passive income to provide a more predictable cash flow (target 30% per year) which can cover your expenses such as mortgage, utilities, car payments. This will help accelerate your retirement goals. If you are interested, then let's hop on a call to see if you can benefit from the strategies in Investing Accelerator and get 30% per year. During the call, we will map out exactly how you can achieve 30%, what you are lacking, how you can improve. Here’s the link to schedule a call: https://bit.ly/3FMEZ6a

failing market

The market has taken a sharp downturn. I followed the Community posts for past several months, and per the notes and recommendations, I expected the market to do well in Oct and Nov with a slowing of the market in Dec. So, I bought shares in late Sept and early Oct only to discover that the market is now worse at end Oct than in the beginning. On paper, the value of my investments has decreased more in this month alone than in most of the past year. Is it time NOW to invest? or should we wait until the market REALLY hits bottom??

1-10 of 25

@kenneth-mercer-2822

Medicine, photography, nature, reading, writing, music, skiing

Active 643d ago

Joined Dec 25, 2022

Powered by