Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

What is this?

Less

More

Memberships

Tech Snack University

12.9k members • Free

AI Pathways

219 members • $67/m

5minAI

2.8k members • Free

The Trading Cafe

67.4k members • Free

Invest & Retire Community

3.2k members • Free

High Conviction Investors

1.7k members • Free

Trading Tribe

26.8k members • $1/m

The Vault

24.8k members • Free

Ten Wealth Group

75 members • Free

17 contributions to Invest & Retire Community

Can be costly mistake! Trading error on NTR

Ydy I made a stupid mistake that yield 125% return for holding 1 day on NTR (Nutrient) call. I meant to sell a covered call instead I ended up bought a call instead...🙈. This morning NTR had good earning on bottom line so stock jump 4.5%. I sold that option call this morning and had a realized gain. Consider myself lucky. This trade can be a costly mistake...yike. I thought I share :) Anyone made similar error?

Bloomberg: Larry Fink Calls on Boomer Generation to Fix ‘Retirement Crisis’

https://www.bloomberg.com/news/articles/2024-03-26/larry-fink-calls-on-boomer-generation-to-fix-retirement-crisis?srnd=homepage-canada Key paragraphs from Bloomberg: BlackRock Inc. Chief Executive Officer Larry Fink warned of a looming “retirement crisis” facing the US and called on baby boomers to help younger generations save enough for their own futures. “They believe my generation – the baby boomers – have focused on their own financial well-being to the detriment of who comes next. And in the case of retirement, they’re right.” Young people “have lost trust in older generations,” Fink wrote. “The burden is on us to get it back. And maybe investing for their long-term goals, including retirement, isn’t such a bad place to begin.” “No one should have to work longer than they want to,” Fink wrote. “But I do think it’s a bit crazy that our anchor idea for the right retirement age – 65 years old – originates from the time of the Ottoman Empire.” “The federal government has prioritized maintaining entitlement benefits for people my age (I’m 71) even though it might mean that Social Security will struggle to meet its full obligations when younger workers retire,” Fink wrote. Fink said BlackRock will announce a series of partnerships and initiatives over the coming months to weigh major questions, including the average age of retirement and how to encourage older Americans to continue working if they want to do so. -------------- What do you think? I will add my comments on it later on. Eric

6 likes • Mar '24

The USA has long promised certain benefits to the retired. The retired (at 71) have the least ability to change their circumstances. Change the rules as need be for retirees to come, but unless we are overpaying current retirees, allow them to make their way without reducing benefits!

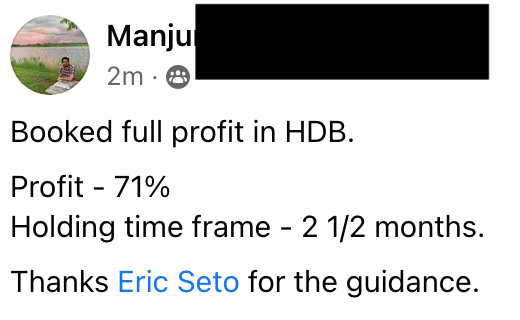

Manju made 71% from HDB in 2.5 months and Mike made 34% from MRK in 7 weeks

716 - Manju made 71% from HDB in 2.5 months 719 - Mike made 34% from MRK in 7 weeks The students select these two stock picks after mastering the long-term investing strategy. Finding blue chip companies at a discounted price can enhance your profitability. Even for a stock with a flatter trend, you can still exit at a relatively high for a profit. (For beginners, focus on the stocks with stronger trend as they are much easier to make money) Cheers, Eric ---- Eric Seto Chartered Professional Accountant (CPA) Chartered Investment Manager (CIM) Founder of 5MinInvesting.com Free webinar - how to get 30%: https://5mininvesting.com/free-case-study/ In March, my goal is to help 20 people without a financial background to master investing. Investing Accelerator is designed for people without a financial background. The goal is to achieve 30% return per year. In the first phase, you will learn long term investing and targeting 30% for tax free compound growth. This will help accelerate your overall wealth. In the second phase, you will learn monthly passive income to provide a more predictable cash flow (target 30% per year) which can cover your expenses. This will help accelerate your retirement goals. If you are interested, then let's hop on a call to see if you can benefit from the strategies in Investing Accelerator and get 30% per year. During the call, we will map out exactly how you can achieve 30%, what you are lacking, how you can improve. If you have any questions about the program, you can ask during the call as well. Schedule a call here: https://bit.ly/48mJlgR Remember to go to the Classroom tab for additional investing resources.

AI Wars - lawsuit against Open AI and Sam Altman

Apparently, Elon Musk has filed a lawsuit against Open AI and Sam Altman for breach of contract. The lawsuit accuses Altman et al with having betrayed an agreement from Open AI's founding to remain as a non-profit company.

Congrats to the Top 10 Contributors for February 2024 and announcing March 2024 Prize

Congratulations to the following 10 people for being the most contributing members of the community: 1) @Rong Zhou 2) @Monica Bernard 3) @Velle SG 4) @Lindsay Talbot 5) @Marc Graybush 6) @Sukhwinder Dhanoa 7) @Eugene Voutchkov 8) @Leon K 9) @Cris Bob 10) @Sandra Van Den Ham I (Michael) will contact you in the chat to provide you with the gifts. You will receive: - 1 share of (SCHW) $66.47 USD To show proof of purchase, you must post in the community that you received the share. For next month March, the prizes will be: - 1 share of (SHOP) If you did not receive a prize this month, don't worry. Points are earned/given by liking posts or comments. 1 like = 1 point for the author. You can be the next top contributor for the next 30 days (https://www.skool.com/invest-retire-community-1699/-/leaderboards) and receive an additional referral prize. Share your referral link in settings and tag them here after they join. Leave a comment below @YOUR FRIEND'S NAME and you and your friend will each receive a $5 Amazon gift card. Cheers, Michael Team @Eric Seto

1-10 of 17

@daniel-corbett-4687

Looking to retire in a few months, love to travel, play video games, improve my health and my financial outlook.

Active 1h ago

Joined Feb 12, 2024

Washington, DC

Powered by