Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

Invest & Retire Community

3.3k members • Free

Investing Accelerator

431 members • Free

13 contributions to Invest & Retire Community

Interesting news regarding court ruling on day trading in TFSA account

https://www.theglobeandmail.com/business/article-day-trading-tfsa-income-taxable/ Your thoughts?

My biggest concern with SVB collapse - Mass unemployment

As SVB collapse I previously explained here, my biggest concern is the following: What we know so far: 1. SVB is now shut down and being taken over by FDIC 2. Most of the deposits are not FDIC insured as they are mainly corporate accounts and well over the $250K limit 3. Example: ROKU has 26% of its cash stuck in SVB. CIRCLE (a crypto company for USDC) has its cash with SVB 4. Many VC and startup banks with SVB in California. This means these cash-burning companies are not able to access their cash. While Roku may only have 26% of its cash tied up in SVB, this means there are startups which has a significant portion >50% of its cash tied up in SVB 5. On the crypto side, USDC - a stablecoin is now de-pegged. It used to be $1 USDC to $1 USD. Now it is only $1 USDC to $0.93 USD 6. There are rumors/announcements that many start-ups will not be able to execute payroll next week 7. While FDIC insured can probably get their money back next week, most of the money will need to go through bankruptcy court which can take months or even years. Startups that are short on cash will not be able to wait that long 8. With equity markets down and debt interest rate being high, startups have nowhere to find additional capital other than VC or PE or Angel investors. I suspect a lot of VC will have their cash tied up in SVB as well. My biggest concerns: 1. Many tech startups will go under unless Fed comes in and bail them out 2. If many tech startups fail, then we will see mass unemployment in the tech sector. Even a big company like ROKU has 26% cash in SVB. We can imagine the % of cash in SVB for smaller companies will be much higher 3. Domino effect to other banks - Investors including institutions who purchased SVB will lose their investments. Now other analysts are looking at banks to evaluate whether they have a similar bank run risk. This is what I can gather for now. I think we are very close to a 2008 market crash. Safe investing, Eric Seto, CPA, CIM

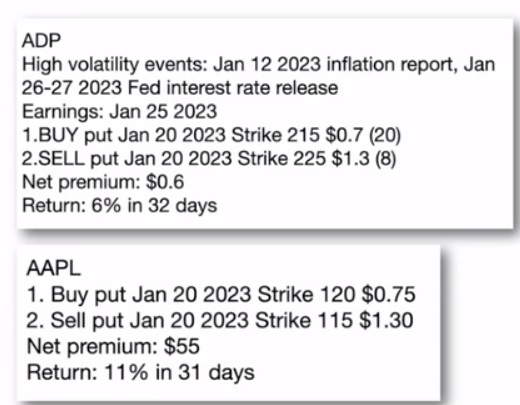

Vertical Spread (MPI)

@Eric Seto In the examples below used in Investing Accelerator webinar, did you use Vertical Spread strategy or single leg? How did you calculated the return %?

MFC/MMM in my RRSP thinking of selling- What do you think?

Eric I want to get rid of MFC and MMM in my RRSP account. Since I dont think they will grow much. By selling, I can get the cash to invest in some other stocks- AAPL/MSFT or TMUS/ADP?. What do you think?

1-10 of 13

@nitin-bhat-4841

A professional engineer. Want to learn more about investing

Active 5d ago

Joined Jan 12, 2023

Powered by