Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

What is this?

Less

More

Memberships

Algo Trading

3.3k members • Free

🇪🇪 Skool IRL: Estonia

61 members • Free

The AI Builder Lab

143 members • Free

AI Automation Society

282.4k members • Free

Python for Traders

330 members • Free

Energy Data Scientist 2026

466 members • Free

22 contributions to Energy Data Scientist 2026

Interview with Chevron: Challenges & trends

Recent interview question in Chevron. Happy to have some inputs. Thanks . - Department: Corporate Strategic Planning, interviewing jointly with Chevron New Energies (the division responsible for lower-carbon investments like hydrogen and carbon capture). - Target Role: Senior Quantitative Energy Economist - Interview Stage: Final Round / Executive Panel Presentation. You would likely be standing at a whiteboard in front of 3 to 4 senior directors. - 2 February 2026. - Format: the recruitment coordinator takes your mobile phone, laptop, and smartwatch. There is no AI, no internet, and no Python to run your simulations. You are led into a quiet focus room. On the desk is a printed piece of paper containing "The Carbon vs. Capital Conundrum" prompt, a basic scientific calculator, a notepad, and a pen. You are given exactly 45 minutes to digest the prompt, formulate your economic models from memory, and structure your recommendation.After 45 minutes, you are escorted into the boardroom to face the senior directors. You have nothing but your handwritten notes, a whiteboard, and a marker. Interview Question: " You are presenting to our executive investment committee. We have a strict capital expenditure (CapEx) limit for the upcoming fiscal year and can only fully fund one of two mega-projects. You must recommend which one we choose: Project Alpha (Deepwater Oil & Gas) - Location: Offshore West Africa - Financials: Spectacular projected Internal Rate of Return (IRR) of 20% with a very fast payback period. - Risks & Downsides: The host country is experiencing growing political instability. Furthermore, the project has a massive carbon footprint that will push our corporate emissions well over our stated public reduction targets for the decade. Project Beta (Carbon Capture & Hydrogen Hub) - Location: US Gulf Coast - Financials: The economics are extremely tight. The baseline IRR is only 7%, which barely clears our corporate hurdle rate (minimum acceptable return). - Benefits: It operates in a highly stable geopolitical region, secures massive government tax credits, and practically guarantees we hit our corporate net-zero pledges.

0 likes • 14d

I agree . To solve this, you first lower the oil project's 20% profit estimate down to around 12% by subtracting the future costs of carbon taxes and political risks. And then, you boost the clean energy project's 7% return closer to 10% by factoring in government tax credits and cheaper loans. In the end, you recommend building the oil project but immediately selling off a 40% stake to a partner, using that cash to safely fund the clean energy hub.

New Online Course: Monte Carlo in Energy

A new online course is now available in the Classroom section: "115. Monte Carlo Simulations in Energy". Because we are building directly on our previous work, please make sure you have completed the prerequisite course, "114. Deterministic Optimisation in Energy," before diving into this one. In the real world, sunlight and electricity demand fluctuate constantly. Relying on a single "perfect" forecast leaves power systems highly vulnerable to unexpected costs or failures. This course teaches you how to handle that uncertainty using a Monte Carlo Simulation. We will take our deterministic model and run it 1,000 times, applying random, normally distributed variations to both the electricity demand and the solar output. By analyzing the 1,000 optimal costs through statistics and risk metrics like VaR (Value at Risk) and CVaR, we observe how to observe how sensitive are the economics to uncertainty. Mastering this technique is crucial in the energy sector because it allows to mathematically quantify risk and predict financial stability of energy systems.

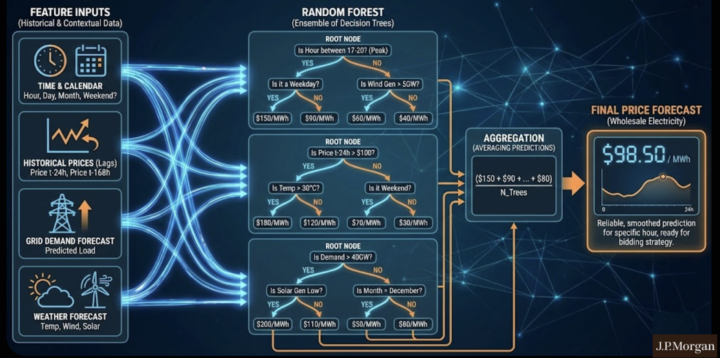

Random Forest (ML) for Energy Trading

I was in a project collaboration (Enel, EDF, JP Morgan, Universities etc) on algorithmic trading, and the use of Machine Learning for electricity price prediction. I am sharing one slide. Why are trading desks using Random Forest so much ?

1 like • 24d

Yes I agree. So they dont like using deep learning because it is like a "black box" . Ie they dont understand how it works. Too complex. But random forest has an explicit node structure as shown above in your image and this allows traders and analysts to interpret the "why" behind a forecast.

Round2 Interview Question

In the interview , for a company (energy investments / commodities) a panel of 3 interviewers asked me the following during a discussion . Panel: Let's talk about some important Python details. It's ok if you don't remember things. Just an approximate answer will be fine for us. So, in Python, what is the difference between a List comprehension and a Generator expression. In a few words... Correct answer: A generator expression is like a list comprehension, except that it doesn't store the list in memory. Panel: Give some example . Write here in the tablet. Answer: list comprehension: simulated_returns = [price * volatility for price in historical_data] portfolio_value = sum(simulated_returns) generator: simulated_returns = (price * volatility for price in historical_data) portfolio_value = sum(simulated_returns)

1 like • Feb 7

@Raheema Rahman I remember them yes. Initially I could not remember them. The secret is to watch the videos that teach code, and then type the code myself as I watch it on screen. When I keep typing the code, the brain after a while presents the code into my brain without my putting any effort. It is the same as when I speak my native language, which simply comes out of my mouth without me having memorised anything in advance. So, it is simply through my daily practice of 1-2 hours, watching videos slowly and typing the code slowly as it is on screen. This boring process is hard to keep consistent , but I managed to stay consistent after a few failures, and it has worked. I recommend that you watch the videos in the Classroom, and make the payment (the subscription cost) your motivation to stay consistent .

New Report on Hydrogen

A new report on energy trends has been published and can be found by clicking on ‘Classroom’ and navigating to Section 6.2 (see the attached screenshot). You can use this report and the visualisations it includes, in your own projects, work, or studies, without limits. This report explains the progress for the UK’s hydrogen rollout. The report includes diagrams and flowcharts that provide context, and also a list of relevant sources that were used to complete this report. These sources are from the Financial Times, Wall Street Journal, the Economist and Investors Chronicle (all sources are available inside the report). Your subscription in this Skool community gives you access to paywalled energy-economics articles from these publications (Financial Times etc) indirectly through these reports. I have also included some explanations and additional text that explains some details. The text is written in beginner-friendly, easy-to-understand language. Reading these reports can help with interviews, meetings, presentations, networking, and public speaking. Strongly recommended.

1-10 of 22

@babette-pascal-9215

Energy engineering student focused on building energy finance models (Intern EDF)

Active 3d ago

Joined Nov 18, 2025

ESFJ

Canada