Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

What is this?

Less

More

Memberships

ConstruPRO

354 members • Free

The AI Builders Lab

2.9k members • $49/month

Energy Data Scientist 2026

465 members • Free

13 contributions to Energy Data Scientist 2026

Reminder: Global Energy Market & Job Search

Just a little reminder ! I was in an energy conference in Australia travelling, and it was about energy jobs. Here are some points from top recruiters (eg director of HR in Chevron, director of HR in Total etc): --> energy is a global marketplace. Companies in Australia/Europe/Asia/Africa/America hiring people from all over the world And they sponsor VISAs. And no lay offs! No AI threat. Energy is considered TOO critical and humans are needed. Also be careful with CVs!!! dont just send randomly ! Many people apply to 20, 50, even 100 jobs…And still get no response. Why? Because job application today is not about volume it’s about alignment. Are you: • Applying to roles that truly match your experience? • Reading the job description carefully? • Positioning yourself based on what the employer is actually asking for? • Following application instructions properly? One small mistake in your application can cost you an interview. So you must: • Apply strategically instead of randomly • Align your experience with job requirements • Structure strong application responses • Navigate remote, hybrid, and on-site roles confidently Job searching is competitive, but with the right approach, you can stand out. I strongly recommend you use the service of CV feedback here. Everytime you apply for a job! Don't just send a CV. Same for interview! And last: BELIEVE THAT YOU CAN GET THE JOB. Stop thinking negatively. Tell yourself "I DESERVE THIS JOB."

New Report: Solar PV in space

Space based solar power means to deploy large solar photovoltaics panels on satellites to collect sunlight and then beam the energy to Earth in the form of microwaves. On earth, huge ground receivers would convert it into electricity for the grid. It could help provide steady low carbon power and might become cost competitive by 2040, but early systems would be very expensive and face major technical, safety, and space security risks. See the attached screenshot for how it will work. A new report about this topic has been published in 'Classroom' , at the very end In the section "Energy Industry Support" (a special section with reports that explain the current status and trends in the energy sector). It is written in simple, easy-to-understand language with every terminology/jargon explained. It has been written by compiling data from official sources (Financial Times, Bloomberg, Wall Street Journal, the Economist, Forbes, Investors Chronicle etc). Feel free to use this report in your projects, work, or studies. Reading these reports can help with interviews, meetings, presentations, networking, and public speaking, so it is strongly recommended. “

Optimization Solver: CPLEX

I have found the manual for the solver 'CPLEX' , which is an alternative to 'Gurobi'. Both solvers are considered the best in Optimization and they are very popular. Using one of the two makes little difference. Both are fantastic. In practice, both are top tier commercial solvers for LP, MILP, QP, MIQP, and related classes. This is an AMPL focused quickstart guide that shows how to install and run CPLEX from Python via AMPL’s Python package (AMPLpy). I am sharing the CPLEX solver manual that I found.

New Report on Energy Trends: CfDs in the Energy Market

A new report on energy trends has been published in the Classroom, at the very end, in the section “Energy Industry Reports.” It is written in simple, easy-to-understand language, with all terminology and jargon clearly explained. It also includes diagrams and draws on official sources such as the Financial Times, Bloomberg, Wall Street Journal, The Economist, Forbes, Investor’s Chronicle, and others. Feel free to use this report in your projects, work, or studies. As shown in the attached diagram, this report focuses on how the UK is using Contracts for Difference (CfDs) to accelerate new low-carbon electricity generation as it targets power sector decarbonisation by 2030. It explains the outcomes of the latest auction, including record solar awards (4.9GW) alongside onshore wind (1.3GW) and tidal power (about 21MW), and discusses what current strike prices suggest about market conditions. It also highlights key delivery risks, especially grid connection backlogs and planning delays, which could slow down project build-out. Reading these reports can directly help with interviews, meetings, presentations, networking, and public speaking, so it is strongly recommended.

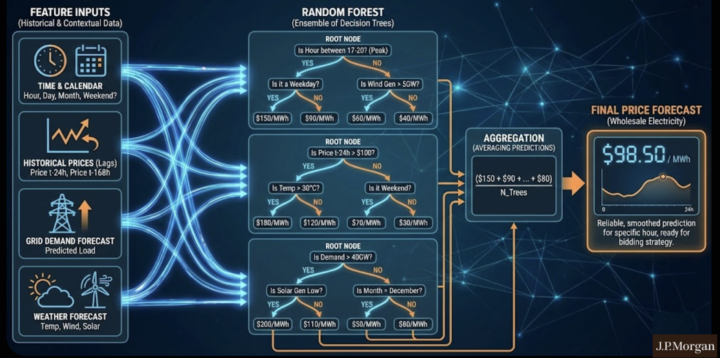

Random Forest (ML) for Energy Trading

I was in a project collaboration (Enel, EDF, JP Morgan, Universities etc) on algorithmic trading, and the use of Machine Learning for electricity price prediction. I am sharing one slide. Why are trading desks using Random Forest so much ?

1-10 of 13

@aless-romano-3254

Python Expert for Commodities markets - Enel @ Milan

Active 4d ago

Joined Oct 30, 2025

INTJ

Italy