Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

What is this?

Less

More

Memberships

Invest & Retire Community

3.5k members • Free

746 contributions to Invest & Retire Community

Congrats to the Top 10 Contributors for Feb 2026 and announcing March 2026 Prize

In Investing Accelerator, we are starting a new monthly prize pool for top 10 most active members Congratulations to the following 10 people for being the most contributing members of the community: 1) @Rong Zhou 2) @Leon K 3) @Lindsay Talbot 4) @Sharon Yuen 5) @Monica Bernard 6) @Kim Huynh 7) @Cris Bob 8) @Sukhwinder Dhanoa 9) @Kevin Esmati 10) @Sandra Van Den Ham I (Michael) will contact you in the chat to provide you with the gifts. You will receive: 1 share of IBIT $37 USD To show proof of purchase, you must post in the community that you received the share. For next month March, the prizes will be: 1 share of IBIT (iShare Bitcoin Trust by BlackRock) (https://www.skool.com/investing-accelerator/-/leaderboards) Investing Accelerator Incentives: Get Richer by Helping Others Succeed 1. 🎁 Join Investing Accelerator for Free: Share the "How to Join Investing Accelerator for Free" guide with a friend. If they join, you both earn the referral fee. Learn More (https://www.skool.com/invest-retire-community-1699/how-to-join-investing-accelerator-for-free) 2. ⏱️ Speed & Success Bonus: Complete the program within 90 days and pay off the remaining balance to get 10% off the balance. 3. 📈 Trading Milestone Rewards: - First 30% Return from a Single Trade: Share your success in the community to receive a free stock. - 30% Portfolio Return in One Year: Achieve a 30% annual return to earn another free stock (once per year). 4. Student Referral Program: Refer a friend to join Investing Accelerator and you both earn $1,000 USD + a free stock each. Learn More (https://5mininvesting.com/free-case-study/)

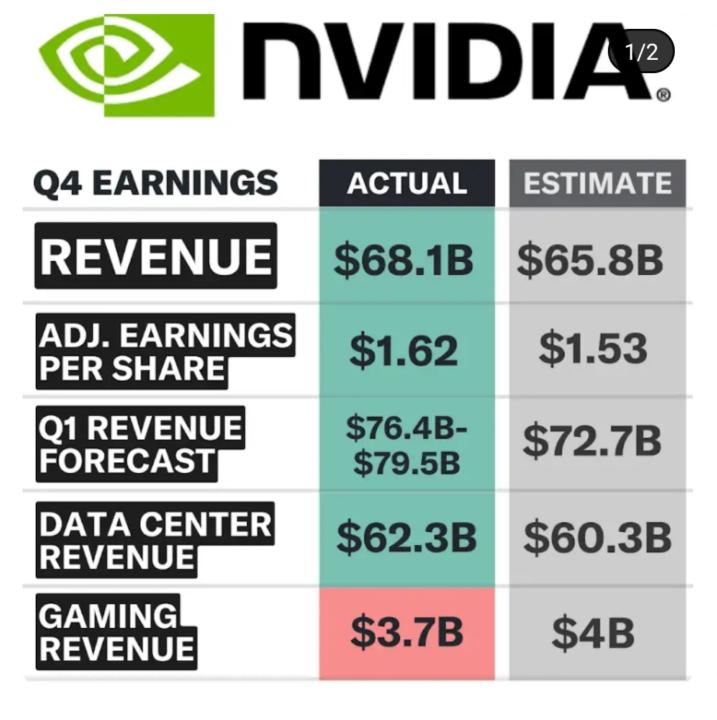

Nvda Q4 earning

Will Nvidia lifts all tides? Their guidance is raised 5bbbbillions from estimate!! 👍💪💪💪

Macro - Iran under attack (28 Feb)

It looks like both Israel and the US are hitting Iran. Markets likely to be volatile. Gold and Oil likely to spike until things settle.

Morningstar (MORN)

It looks and feels like they finally shook off all weak hands. I started buying.

2 likes • 18d

@Leon K Morningstar seem to have a mispriced. It is all time 5yrs low!! EPS growth rate was negative until it is reversed in this recent earning. Decent revenue growth year over year and relatively low forward PE. Goodluck Leon , seem like it is a good entry at this point. One negative about MORN , i just dont understand why this type of service subscription business has such high debt level compared to their cash on hand.

PFE and MRK

I checked prior discussions on MRK and PFE before posting. We’ve covered both Pfizer and Merck extensively since 2023 across various threads, and a new post in those would likely get buried or lack context. MRK and PFE report earnings this week and next, respectively. Both stocks have been climbing steadily, mirroring gains in XLV (Health Care Select Sector SPDR Fund) and XBI (SPDR S&P Biotech ETF). It seems they’re finally attracting buyers. Both companies face a common challenge: patent expirations. To address this, they’re actively acquiring other firms to bolster their pipelines. I’m looking forward to their earnings reports. Thoughts on their outlook or recent moves?

1-10 of 746

@kim-huynh-9986

Semi-retired pharmacist. Passionate in learning and earning passive investment income.

Active 10m ago

Joined Feb 17, 2023

Canada GTA

Powered by