Sep 4 • General discussion

Understanding more about the 1099-A and C

This is directly from the IRS.

“Coordination With Form 1099-C

If, in the same calendar year, you cancel a debt of $600 or more in connection with a foreclosure or abandonment of secured property, it is not necessary to file both Form 1099-A and Form 1099-C, Cancellation of Debt, for the same debtor. You may file Form 1099-C only. You will meet your Form 1099-A filing requirement for the debtor by completing boxes 4, 5, and 7 on Form 1099-C. However, if you file both Forms 1099-A and 1099-C, do not complete boxes 4, 5, and 7 on Form 1099-C. See the Specific Instructions for Form 1099-C , later.”

5

5 comments

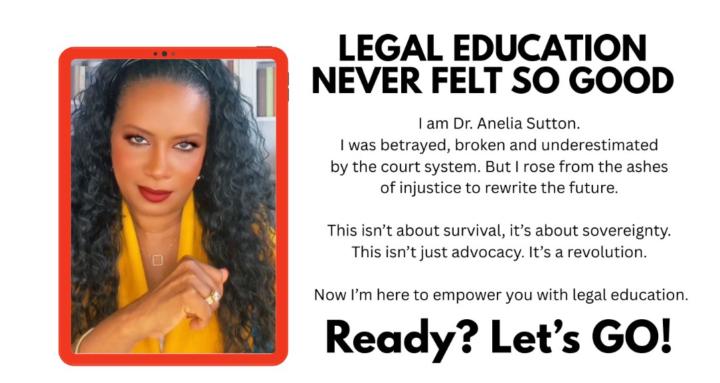

skool.com/aneliasutton

Learn legal power moves, share wins, and rise together as unstoppable warriors.

Powered by