Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

What is this?

Less

More

Memberships

Energising Futures

25 members • Free

Renewable Energy Career growth

34 members • $10/month

Energy Data Scientist 2026

466 members • Free

7 contributions to Energy Data Scientist 2026

Notes from Recent Talks: Employment Trends

I pulled together some notes from recent discussions on employment conditions across countries, especially for energy/utility roles. Sharing here in case it helps anyone comparing markets. I have attached the Excel file. The file is broader employment/job-market comparison by country, and only one part of it is energy-related via the “Utility Sector Security” column.Useful if you’re comparing job stability vs compensation in the broader energy sector. Big picture: - USA = highest salaries, but weaker general job security and social safety net - UK / Australia = strong employment protections and very stable utility-sector roles - France = strongest labor protections and very hard to dismiss employees - Switzerland = very high salaries with a strong financial safety net

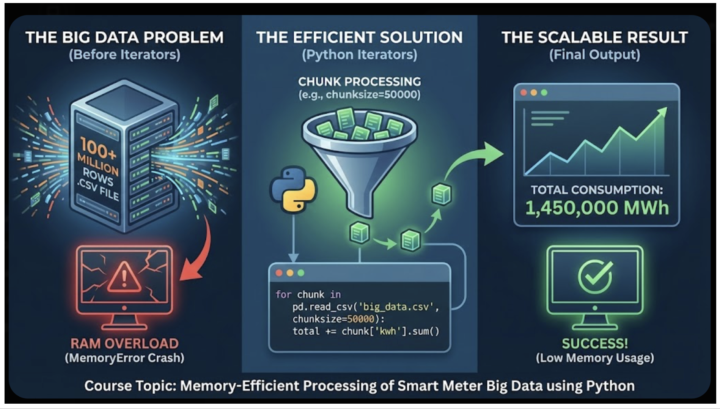

New Online Course: How Big data from Smart Meters are processed efficiently

I’ve just published a new online course about Memory-Efficient Processing of Big Data. This course teaches real-world skills as they are used in practice. Smart meters measure the electricity-consumption data every hour, and store the information in CSV files. These files eventually become very large (big data). The new online course is called "Smart Meter Big Data Efficient Processing" and it is in the Classroom in 1.36. This online course teaches a Python methodology that is used by energy companies in practice to read extremely large datasets (Big Data). Without this technique such files cannot be read because they cause a memory (RAM) error. Companies that sell electricity to consumers are known as 'Retailers' or 'Suppliers'. Such companies have CSV files with hundreds of millions of rows, where each row is the hourly kWh electricity consumption. If they try to load these CSV files, their computers will run out of RAM and crash. So these companies process these files using Python iterators, which enable a memory-efficient and fast processing method. In this course, I show you the industry-standard solution: using Python Iterators to process Big Data in "chunks". See the attached image; this is analysed in detail in the course.

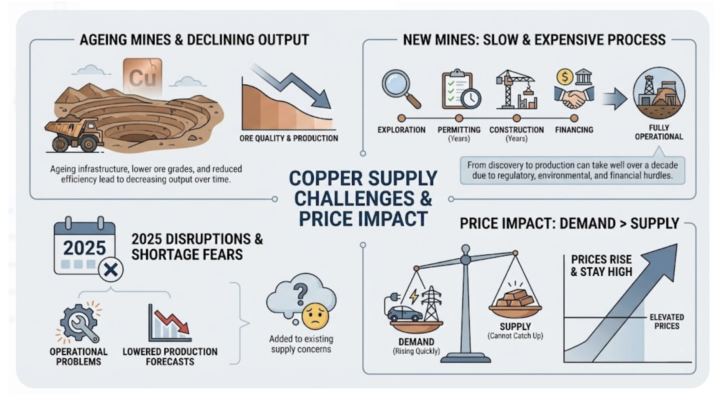

Why Copper Prices increased in 2025

A new report has been published and examines why the prices of copper increased in 2025. Copper is a metal which is used a lot in energy. It is essential for electricity systems and it is used in wiring, motors, and many machines and in Renewable energy systems and electric vehicles. Copper is central to electrification: it is used across clean-energy technologies, and grid expansion. If copper gets more expensive, power grids, renewable projects, electric vehicles, and data centres can cost more. Sharing also a slide about copper supply (source: LSEG) ---------------------------- You can access all energy reports by clicking the 'Classroom' menu and navigating to Section 6.2. These reports have been created using the sources below (Financial Times, etc), along with my comments , all written in simple, beginner-friendly language. If you have any questions feel free to ask. By the way these sources below, all request you to subscribe to read their articles. But you don't need to subscribe because you get all the necessary content by simply reading the reports that I publish and which you can find in Classroom section 6.2. Why read these reports: they are very helpful when you find yourself in discussions related to energy or economics. It displays market awareness. How to read these reports: one read is sufficient. They are written very simply. Also, for any questions feel free to message me. [1]: Financial Times: https://www.ft.com/content/29bc6bce-7188-43f2-9f15-6894cf7aa754 [2]: Bloomberg: https://www.bloomberg.com/news/articles/2025-11-07/copper-s-huge-tariff-bet-is-back-as-traders-bid-for-us-supplies? [3]: Wall Street Journal: https://www.wsj.com/finance/commodities-futures/copper-is-2025s-hottest-commodity-c7c21ec4

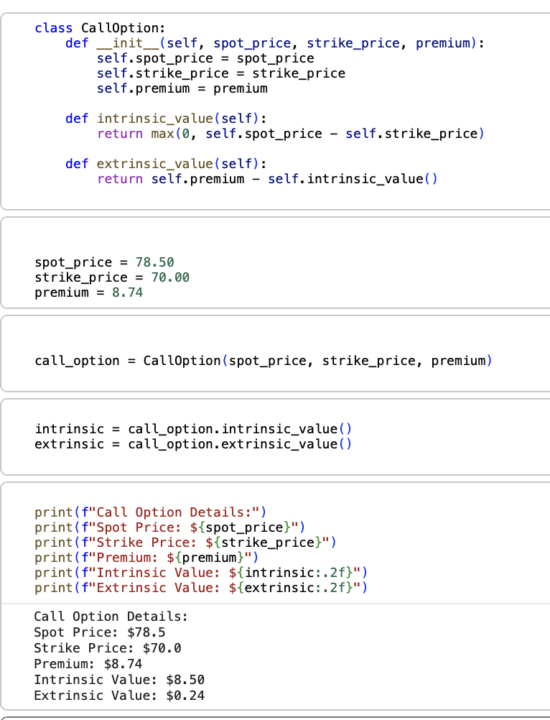

Tutorial: Crude Oil Options in Python

Below is a beginner-friendly Tutorial on Options , which is great for interviews also , and great for modelling Options in Python. It is also included in the online course 5.20, so you will find it in there also. But below it is written in the form of Q&A (questions and answers) for interview preparation. No prerequisites needed. Feel free to save it. Or , again, you will find it in the Classroom. The Python code is attached. ⚠️ What Are Options Contracts? An option is a contract between two parties: an option seller and an option buyer. The option buyer pays a fee (the premium) to the option seller. In return, the option buyer receives the right to purchase or sell an asset (like crude oil) at a specific price. This price is called the strike price. Every option has an expiration date on which it ceases to exist. The option buyer must decide whether to exercise the option before this date passes. ⚠️ What Is Crude Oil? TutorCrude oil is unrefined petroleum extracted from the ground. It’s a fossil fuel formed over millions of years from the remains of ancient marine organisms. Crude oil isn’t useful in itself. Refineries process it into products that are useful: gasoline, diesel, jet fuel, heating oil, and plastics. Crude oil is one of the most actively traded commodities in the world. Its price affects everything from transportation costs to electricity bills. ⚠️ The Option Premium The price at which an option is traded is called ‘option premium’. Let’s say a company that has refineries wants to buy an option on crude oil. And it pays $8.74/barrel to buy this option. It is an American Call option on 1000 barrels of crude oil, at strike price of $70/barrel. This means that the company can exercise the option at any time before it expires, and will buy 1000 barrels of crude oil at $70/barrel. ⚠️ The Option Intrinsic Value So the company exercises the option and buys the crude oil for $70/barrel. Let’s say the spot price of crude oil is $78.5/barrel. This means that the company can immediately sell the crude oil it just bought to the spot market for $78.5/barrel, making a profit of $8.5/barrel. This immediate profit is called the Intrinsic Value of the option.

Analysis of a Research Topic: Investments in Photovoltaics

- Here we analyse, using simple beginner-friendly language, a research paper which focuses on the topic of Energy investments. No need for you to memorize anything. It is enough to read it once and get the main idea. It is considered very valuable at workplace to be informed about research topics - this is why it is strongly recommended to have a quick read. - You can find more than 250 such analyses in the Classroom --> section 6.1 and section 6.4. - Downloadable resource is attached down below (scroll down to download the full paper). No need to read the full paper because below you can find the key points written in beginner-friendly language. - Title of the research paper: Optimal investment decision for photovoltaic projects in China: a real options method - Citation: Zhu, X., & Liao, B. (2023). Optimal investment decision for photovoltaic projects in China: a real options method. Journal of Combinatorial Optimization, 46, 30. https://doi.org/10.1007/s10878-023-01096-5 Introduction to Solar Investment Challenges Renewable energy is essential for fixing climate change and reducing pollution. Solar photovoltaic projects, often called PV projects, are a popular way to generate clean electricity. However, building these solar projects is expensive and it takes a long time to make the money back. Because the cost of technology is dropping and government rules on electricity prices keep changing, investors find it hard to know exactly when to spend their money. This paper looks at how uncertainty makes it difficult for investors to choose the best time to build solar projects in China. The Problem with Traditional Financial Models Investors usually use a method called Net Present Value to decide if a project is worth money. This method works well when everything is certain, but it fails when the future is unpredictable. Solar projects have many unknowns, and once the money is spent, it cannot be recovered. To fix this, the authors use a method called Real Options. This approach treats a physical investment like a financial option, giving the investor the right, but not the obligation, to invest now or wait until later when conditions might be better.

1 like • Dec '25

This is really interesting,what stood out to me is that high solar potential alone is not enough to make projects attractive... The paper shows that policy stability matters just as much as sunlight 💯 because investors need confidence that prices will not drop too quickly. This helps explain why some regions with good resources still see slow solar development

1-7 of 7

Active 12h ago

Joined Dec 16, 2025