Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

CoinPicks Genesis

2.6k members • $1/month

The AI Trader's Fast Track

100 members • Free

5 contributions to The AI Trader's Fast Track

Would You Like Me To Drop Random Lives -

If i go live are you willing to join me on lives randomly through the day?

Weekly Trading Plan Updated For January 11th 2026 Trading Week

Dcg.Report Current PAID Members Of The AI Trading Reports - Please reach out for the weekly code to Dcg.Report

ANYONE WHO WANTS TO MAKE MONEY - DCG NOVEMBER

A little snippet from our live call this morning November is going to be a great a month, every day trading together. DCG MASTERMIND TRADING RECAP & GAMEPLAN October 30th, 2025 - Morning Guidance Call Analysis Report Generated: October 30th, 2025 | 10:13 AM PSTMarket Session: Intraday Active | Post-London Close AnalysisLead Analyst: Jamar's DCG Update 📊 EXECUTIVE SUMMARY Market Sentiment: Bearish Bias / Defensive PostureES Futures Status: Trading below 6910 resistance, choppy trend daySector Leadership: Gold, Defensive (WMT), Critical MineralsPrimary Strategy: Safety plays, gold miners, selective shorts on weakness The October 30th session opened with extreme sell programs and bearish momentum following Trump-Xi trade developments. While a one-year rare earth truce was announced, markets remained cautious as META tanked -12% on AI capex concerns, triggering tech sector weakness. ES futures failed at 6910 resistance multiple times, confirming sellers in control. Gold and defensive stocks emerged as safe havens with strong buy programs. 🎯 OPENING PORTFOLIO STATUS & RISK MANAGEMENT Jamar's Live Positions (Morning Call - 7:30 AM) Active Longs (Profitable): - CRML (Critical Minerals): $12 calls - Up 11%, breaking resistance at $13 - SMR (Small Modular Reactor): Bounced off $40 support, trading at $43 (+7.5%) - NEM (Newmont Gold): Strong momentum, holding above key support - BARRICK (Barrick Gold): Gapped up, participating in gold sector strength

Dirty Little Trading Secret - Tradingview Volume Scanner

I run my ai scanner against Trading view volume scanners every morning. Volume Gainers screen on Tradingview shows me the most traded stocks premarket. then the AI DCG momentum scanner shares with me the best trades of the day, and it barely takes 10 minutes to do. Will review wed night.

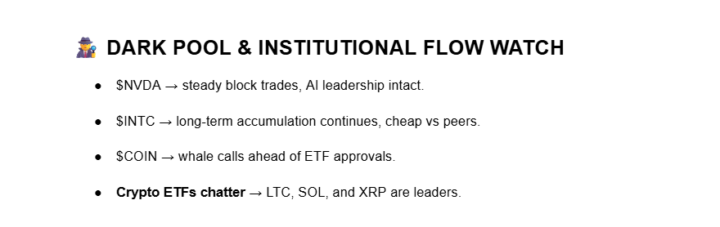

Rotation Alert: Tech & Healthcare Lead, Energy & Financials Lag

Fund flows today made the story clear: money is moving out of Energy and Financials and rotating into Healthcare, Tech, and Utilities. Options sweeps in $NVDA, $INTC, and $COIN signal where institutions see momentum building. Traders should align with these shifts as Q4 positioning accelerates.

1-5 of 5

@paul-hardaway-jr-6046

Consistency is key, but honesty with oneself is better.

Active 8d ago

Joined Oct 1, 2025

Powered by