🔮 YOUR 2026 TRADING ROADMAP IS READY — ACCESS IT NOW

Stop guessing. Start knowing. We've mapped out the ENTIRE year — every month, every sentiment shift, every high-probability window — so you can trade with confidence while others trade with hope. Inside the 2026 Oracle Trading Forecast, you'll see: ✅ Month-by-month market sentiment ✅ When to be aggressive vs. when to protect capital This is how professionals plan their year. Now it's yours. 👉 ACCESS YOUR 2026 FORECAST HERE The traders who win in 2026 will be the ones who saw the map before the journey started. You can login and get access here. https://dcgoracleoutlook.com/get-started

WHAT TO TRADE TODAY

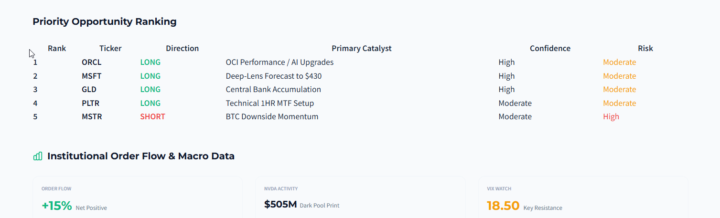

AI/Tech Strength NVDA, PLTR, MSFT (Target $430), ORCL (Strong). IGV ETF bullish. Risk Prep Trade level-to-level. Watch ES_F pivot 6942/48. VIX must stay < 18.

1

0

Super Bowl Ads Meet AI Trading = Profits: Join in on Tonight's Q&A!

Hey Traders! 🏈 Who's excited for the Super Bowl ads tonight? I'm always looking forward to seeing which companies are dropping big bucks on those spots. Now that I'm using AI to fast-track my research and trading, I can get a jump on the list of advertisers ahead of time and prep my gameplan for the week ahead! New to AI Trading? New to Trading altogether? Got struggles or need help? Join us for our Sunday Night AI-Powered Q&A in the Skool group – let's build our Sunday Night Gameplans together! What's your biggest obstacle this week? Drop it in the comments, and let's chat about it tonight. Class kicks off at 7p CST / 8p EST. See you there! https://www.skool.com/live/5CFdR6qNrHf 🚀

0

0

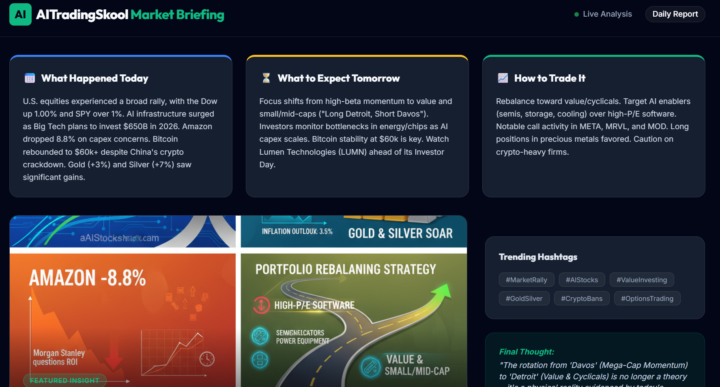

AI: Daily Briefing February 6, 2026

How to Trade It Rebalance toward value/cyclicals. Target AI enablers (semis, storage, cooling) over high-P/E software. Notable call activity in META, MRVL, and MOD. Long positions in precious metals favored. Caution on crypto-heavy firms.

Investment Roadmap 2026 -

How the investment has changed and how to make a ton of money in 2026. This is not investment advice, this is educational awaremess in 2026 and allowing you to see market maturity. Please do not be blind and miss out on opportunities..

3

0

1-30 of 126

skool.com/ai-trading

🔹 Learn to trade crypto & options with AI Speed. Become a confident profitable trader who executes with precision. Go from confused to confident in 7

Powered by