Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by Jamar

🔹 Learn to trade crypto & options with AI Speed. Become a confident profitable trader who executes with precision. Go from confused to confident in 7

Memberships

Venture Acquisition Playbook

190 members • $59/month

The AI Creators Club (Public)

190 members • Free

3X Freedom

1.5k members • Free

OfferLab

9.5k members • Free

Skoolers

190.1k members • Free

AI Automation Agency Hub

292.3k members • Free

Aminos Community

6.2k members • Free

300 contributions to The AI Trader's Fast Track

Truth Engine Report February 9th 2026

Today alone, our report flagged a government shutdown risk (DHS funding expires Feb 13, markets pricing 72% chance), $7.8 TRILLION sitting in money market funds waiting to deploy, and $650 BILLION in Big Tech AI capex creating the next wave of opportunities. You either see this information BEFORE the open... or you spend all day reacting to it. By the way, the alligator eats in the morning inside DCG. Not at 2 PM when everyone else finally figures it out. → importanthelp.com — Join the DCG Mastermind To Trade Live With Us. How did YOU trade today's open? Drop it below 👇 🐊

0

0

Money Plays This Week - Gameplan From Live Trading Call February 9th 2026

Market Strength Right Now: SPY reclaimed $692 (+1.9%), sitting right at the $696 MVC resistance. Nasdaq up +2.1%. VIX futures down -3.6%. Breadth is positive but grinding — TICK hit +649 midday. This is a steady buy-the-dip recovery, not a face-ripper. The setup favors continuation into close but don't chase extended names. Top 3 Sectors to Focus On: Storage & Memory (9.5/10) — This is THE sector from your call this morning. WDC, NTAP, PSTG, CSCO, ANET. "Every day we'll have a trade in one of these." Institutional flow confirms it with IGV seeing $1.5B inflows in 48 hours and IGV +2.5% pushing to highs. MU breaking out at $397 with 8K+ weekly $400 calls active. Semiconductors (9.3/10) — TSM, AMAT, ARM, LRCX. SMH bouncing off the 50-day MA with 13K March $450 calls bought and 1K September $425 bull synthetics opening at credits. AMAT opened at $322 and is ranging up to $330. This group has earnings catalysts stacked all week. Precious Metals (9.0/10) — Gold above $5,050, silver exploding past $83 (+6.7%). SLV seeing 25K June $120 calls bought at $4.65-$5. But be careful — these are extended intraday. The play here is flagging dip entries, not chasing the 6% move. Best Plays Right Now: HOOD at $84.40 is your highest conviction swing (9.5/10, Cash Cow). Earnings tomorrow after close. You're positioned with April calls for time buffer. No action needed today — just hold and let it set up. The $82-85 zone is your base. GOOGL at $323 is the freshest MOMO play. Bull reversal stick forming, $100B bond demand catalyst, 14K May $370 calls bought at $8.50+. Green on the day and running to highs. If you're looking for an afternoon entry, a pullback to $320 is the spot. NVDA at $185 is up 7.9% with a $1.6M call position opened plus 25K March $195 calls. Strong but extended — better as a pullback buy toward $182-185 if it gives you one into close. MU is the sleeper — watching $397 for the monthly value high breakout. 8K weekly $400 calls active early. If it clears $400, that's a clean MOMO trigger for a quick scalp.

1

0

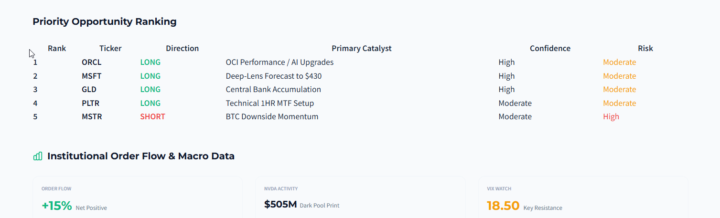

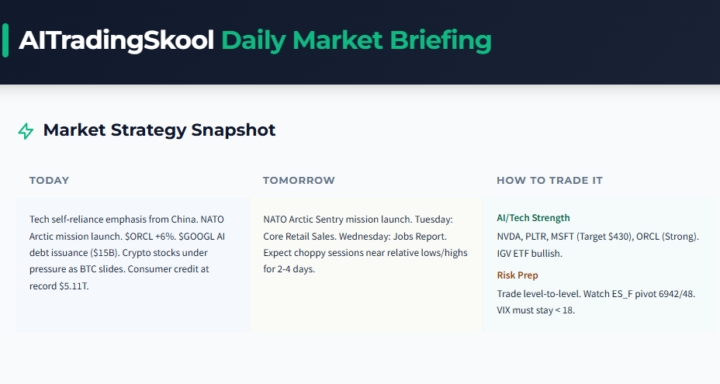

WHAT TO TRADE TODAY

AI/Tech Strength NVDA, PLTR, MSFT (Target $430), ORCL (Strong). IGV ETF bullish. Risk Prep Trade level-to-level. Watch ES_F pivot 6942/48. VIX must stay < 18.

1

0

HOW TO TRADE IT TODAY Feb 9th 2026

Tech self-reliance emphasis from China. NATO Arctic mission launch. $ORCL +6%. $GOOGL AI debt issuance ($15B). Crypto stocks under pressure as BTC slides. Consumer credit at record $5.11T. NATO Arctic Sentry mission launch. Tuesday: Core Retail Sales. Wednesday: Jobs Report. Expect choppy sessions near relative lows/highs for 2-4 days.

1

0

SUPERBOWL AD CURSE IS REAL

Every Billion-Dollar Ad Is a Psychology Lesson - We Just Had a DCG Mindset Call and Decoded The Superbowl COmmercials. Companies spent $7–8 million per 30-second spot. They weren't selling products — they were engineering emotional responses. That's exactly what the market does to you every single day. The question is: are you the one watching the ad… or the one who built it? While 113 million viewers sat on their couches reacting to celebrity cameos and CGI spectacles, a parallel universe of financial intelligence was playing out in real time. Every ad placement, every brand strategy, every audience reaction was broadcasting institutional-grade trading psychology — and almost nobody was listening. This is the DCG difference. We don't watch the Super Bowl. We decode it.

1

0

1-10 of 300

@jamar-james-4449

Trading Is A Lifestyle - Utilizing A.I. To Trade Less Than 2 Hours A Day - Making A Full Time Income - Download My Ai Trading Routine. DcgDeal.com

Active 2h ago

Joined Aug 21, 2025

san diego

Powered by