Extreme Fear = Opportunity (If You Know How to Trade It)

Crypto Fear & Greed: 9/100Bitcoin down 30% from highs. COIN misses earnings… and rallies 17%. Why? Because sentiment was already washed out. Because $3.07B free cash flow matters.Because positioning was extreme. The crowd trades headlines. Professionals trade structure + sentiment + flow. This is not a smooth breakout market. It’s a rotation + tactical execution market. Inside the paid membership we focus on: • Entry zones • Failed breakdown setups • Sector leadership shifts • Risk management around catalysts If you’re in free, you’re seeing the overview. If you want the execution plan — upgrade inside the community. 2026 will reward traders who adapt.

0

0

Energy Is Not a Headline Trade

Venezuela sanctions eased. Chevron authorized. Oil majors cleared. But here’s what matters: • Utilities up 16.8% (sector leader) • 40% of Dow Utilities at all-time highs • Energy + Metals seeing sustained options flow • Gold miners getting aggressive call buying This isn’t noise. This is capital rotation. Meanwhile: Big Tech erased hundreds of billions in market cap. EV makers writing down tens of billions. Different tape. Different leadership. If you're still trading 2024 growth momentum setups in a 2026 rotation market… you’re fighting the tape. Paid members are positioned with the leaders. If you’re serious about trading like a professional, upgrade your membership.

0

0

THE TRUTH ENGINE FEB 13th 2026

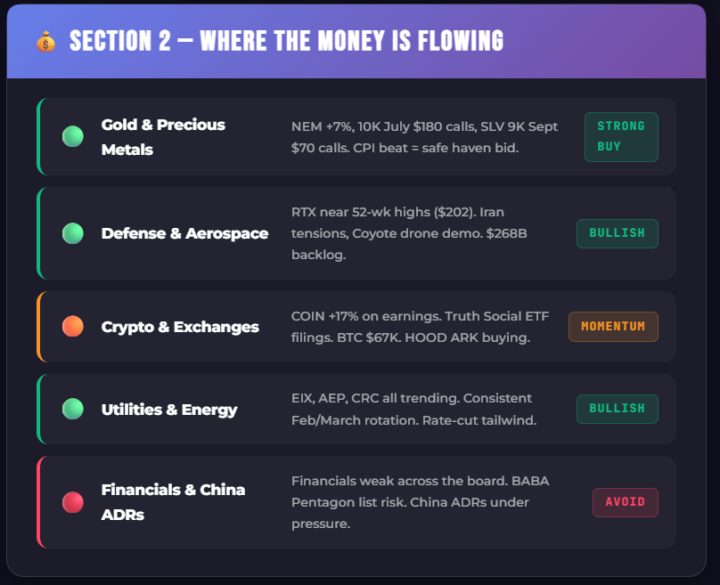

Inflation just printed cooler than expected and the market is celebrating selectively. CPI came in at 2.4% year-over-year versus the 2.5% Wall Street expected — and that lit a fuse under gold, precious metals, and anything tied to rate-cut hopes. Newmont Mining ripped 7% on monster institutional call buying. Coinbase exploded 17% after posting all-time highs in trading volume and subscriptions. But don't let the green fool you — the S&P is flat, the Nasdaq is actually down over 1%, and we're heading into a 3-day weekend with the VIX still hovering near 20. Meanwhile, Trump is making headlines on Iran negotiations, Greenland talks, and the Truth Social crypto ETF filings that just hit the SEC. The smart money isn't chasing — it's rotating into gold, defense, and utilities while tech takes a breather. This is a stock-picker's market, not a buy-everything market. https://dcgelite.io/s/

1

0

The Failed Breakdown Nobody Noticed

Friday wasn’t random. ES swept 6808. Crypto hit Extreme Fear (9/100). Everyone expected continuation lower. Then what happened? • Full reversal • All upside targets hit • Sector rotation broadened • Bitcoin reclaimed $69K That’s called a failed breakdown — one of the highest-probability setups in trading. Most traders saw panic. We saw positioning. Free members get the recap. Paid members get the levels before the move happens. If you want the levels, the flow, and the execution plan in real time… Upgrade your membership inside the community. Rotation markets reward preparation — not reaction.

0

0

DAILY Daily Trading Report Decoded: Thursday, February 12, 2026

The market just shed a cool trillion dollars today, and it was a nasty one for many, with the S&P 500 and Nasdaq taking a hit. AI fears are rattling the tech sector, and you've got a mix of economic signals – a strong jobs report conflicting with plunging home sales and rising unemployment claims. This isn't a time for the faint of heart, but for those who can see through the chop, there are surgical opportunities being carved out. Don't just sit there watching the red; understand what's moving and why.https://opal.google/app/1x5-bZ9ek4i7w4v1nObOBMxtOMMjxO0E4?shared

1

0

1-30 of 404

skool.com/ai-trading

🔹 Learn to trade crypto & options with AI Speed. Become a confident profitable trader who executes with precision. Go from confused to confident in 7

Powered by