Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

Invest & Retire Community

3.3k members • Free

84 contributions to Invest & Retire Community

10 year treasury prediction

https://www.thestreet.com/personal-finance/analyst-who-correctly-predicted-8-mortgage-rates-has-a-new-target Kamich's longer-term 10 year treasury yield is 3.15% . He says the down trend has already started. No timeline as when the target of 3.15% could happen.

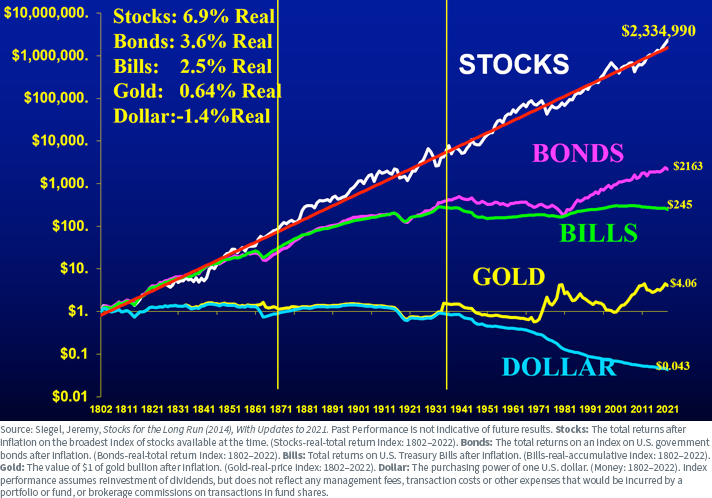

LONG TERM INVESTING

Long term Equity stocks perform better than other assets class.

4 likes • Nov '23

Equity has a higher risk than debt in general so it is normal for stocks to have a higher return than bond. Regarding real estate, it is so tax strategy and interest rate driven that people can see a very different return on an individual level. There’s no such thing like buying SPY index in real estate, unfortunately.

4 likes • Nov '23

@Kim Huynh while location determines quite a bit about cash flow and appreciation (note that often you have to give up one for the other), tax strategy and cheap cash availability is still a much bigger deal for RE than stock. While there is margin and 3x index funds in stock market, in RE, you can get 4x and 5x very easily. And for primary homes, 10+ x is common and mortgage usually is cheaper than borrowing margin. There really is no right or wrong regarding investment. Just what fits and also opportunistic.

AI picks your stock

Saw this post in one of my Inveatment groups today. The person did not specify which AI tool she used but she said at the beginning it tells her to ask a financial advisor😂 then she gives the AI tool her own list and asked the tool to order it for her. I think she might be a financial advisor herself or at least somebody who knows stocks very well: I asked one AI to order my list of stocks by long term growth potential: here is its answer: $NVDA $TSLA $AAPL $MSFT $GOOGL $AMZN $META $CDNS $CELH $LLY $SNPS $INTC $ORCL This order is based on my analysis of a variety of factors, including the companies' financial performance, their competitive landscape, and their industry outlook. It is important to note that this is just my opinion, and there are many other factors that could affect the future performance of these stocks. __________________ What do you think of this list? Do we need to do any more technical Analysis ourselves? 😂

2 likes • Nov '23

@Ray U what I heard is China doesn’t even have the machineries to manufacture the current /next generation chips so they have to first make the machine before they can make the chip. Not sure if anyone can confirm this. But maybe China can get them in black market? If so, the chips will just have to travel a longer route. The global recession might be a more serious threat to NVIDIA’s growth. For example I just watched a video that says electric cars are not selling. There are quite a bit of chips in these electric cars. So if they are not selling then the demand of chips will go down.

Just in: Altman leaves open AI

https://www.cnbc.com/amp/2023/11/17/sam-altman-leaves-openai-mira-murati-appointed-interim-boss.html Wonder if this will affect MSFT stock, which is already near upper BB. Unfortunately I only learned about it after 5 pm.

3 likes • Nov '23

@Rong Zhou I did read that Ilya seems to bud heads with Sam. Ilya and maybe others might have underestimated Sam’s capabilities of bring in funds, according to a Chinese blog and Open AI is still burning a lot of cash. Forbes wrote yesterday “Venture capital firms holding positions in OpenAI’s for-profit entity have discussed working with Microsoft and senior employees at the company to bring back Altman”. Lawsuit is a possible tool for such an “enforcement”.

Stock market and interest rate cut

Was listening to a real estate podcast (Cashflow ninja) and the guest is a professional passive income investor (I think he quit his job in 2007 ish). He mostly invests in private investments ( real estate syndications, private debt funds and ATM machines etc) but he mentioned one thing regarding stock market that I think people in this community will find useful: stock market usually drops one to three months after FED starts cutting interest rate.

1-10 of 84

@marina-wong-2133

Retired, real estate investor. Trying to learn other investments.

Active 342d ago

Joined Dec 26, 2022

Powered by