Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

What is this?

Less

More

Owned by John

I've been trading for twenty years, I'll share my experience.

Memberships

75 contributions to PainlessTrader

The Highest-Probability Way to Trade NVDA Earnings Tonight?

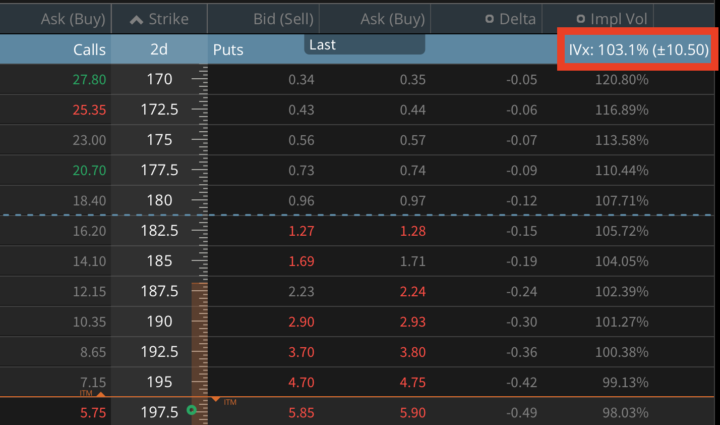

NVDA reports after the bell tonight, and this is the single most important event of the week for the entire technology complex, for AI capex sentiment, and potentially for sector rotation across the market! If NVDA re-prices the AI narrative, QQQ moves, growth vs value rotation shifts, even energy and cyclicals feel it through flows. Now here’s what’s interesting. Consensus is extreme: 65-66B revenue, +66% YoY. EPS up 70%, Data Center nearly the whole engine. The base case is already beat and strong guide. You'd expect options to price this like a bomb, but they aren't! The at-the-money straddle implies roughly a 5-6% move. Over the last 12 quarters, the average implied move was closer to 7.5%. By NVDA's own standards, this event is being priced smaller than usual. That's the first non-obvious signal. The second one is even more important. Historically, NVDA's implied earnings move trades at about 1.5x the tech sector (XLK). This quarter, that ratio is closer to 0.9x. Read that again: the market is pricing NVDA as less idiosyncratic than the sector, at a moment when AI capex concentration arguably makes it more idiosyncratic than ever. Yes, front-week IV is high (72% vs 55% baseline). Yes, there will likely be IV crush. But the lazy trade "short the rich IV" assumes the event premium itself is bloated. This time, the event premium is compressed relative to history and relative to tech. That changes the game, so we're not putting on calendar spreads today. The edge, in my view, sits in: - NVDA vs sector variance - Defined-risk or asymmetric volatility harvesting The market is not overpricing fear, it's compressing NVDA's uniqueness into sector volatility, and if that assumption breaks tonight, the move won't care about your straddle math. Because the event move is priced relatively small (5-6%) and the front-week premium is not unusually fat versus history, forcing a weekly Jade Lizard would mean selling compressed event variance with thin margin for error. So instead of playing the binary print, we step out to April (51 DTE) and build a safer Earnings Jade Lizard.

AS A BEGINNER

🔹 Idea #1 – Upgrade the Discussion Title:🧠 Instead of “Nice” — Let’s Start Thinking Like Investors I’ve noticed a lot of us comment “Nice” or “Yes” on market updates. What if we upgraded the discussion? Instead of:• “Nice” Try:• What liquidity level are you watching?• What invalidates this setup?• What’s your risk plan if support fails? We don’t grow from agreement.We grow from analysis. Let’s start commenting with:1️⃣ What we think2️⃣ Why we think it3️⃣ What would prove us wrong That’s how we level up as a community 🚀 🔹 Idea #2 – Beginner Friendly Value Title:If You’re New and Just Experienced Your First Dump — Read This A market dump doesn’t mean:❌ Crypto is dead❌ You failed❌ It’s over It usually means:• Leverage got wiped• Liquidity shifted• Emotions took control Real question:Did you have a plan before entering? If not — the problem isn’t the market.It’s the lack of structure. Before your next trade ask: Where is my entry? Where is my stop? Where is my invalidation? Volatility is tuition.Learn from it. 🔹 Idea #3 – Improve Comment Quality (Direct Solution) Title:🔥 Quick Idea to Improve Our Community Engagement What if we start replying to market posts with this format: 🧩 My Bias:📍 Key Level:⚠️ Risk Factor:🔄 What Would Change My Mind: This would:• Improve discussion• Help beginners learn thinking process• Reduce low-value comments• Increase real skill building Just an idea — what do you think? 🔹 Idea #4 – Psychology Angle (Very Strong) Title:The Real Reason Most People Lose in Crypto It’s not:• Charts• Indicators• News It’s position sizing + emotion. Most people:• Enter too big• Have no invalidation• Panic sell• FOMO buy Until risk management becomes boring…Profit will stay inconsistent. What’s one risk rule you follow no matter what? If USDT growth is cooling, would you expect weaker altcoin rallies first before BTC??????

1-10 of 75

@john-plough-5717

The original PainlessTrader , yes there are fakes... Not a "Day Trading Group" - Prefer a few weeks to months positions. Wykoff / Livermore Style.

Active 2d ago

Joined Aug 10, 2024

INTJ