Write something

The Highest-Probability Way to Trade NVDA Earnings Tonight?

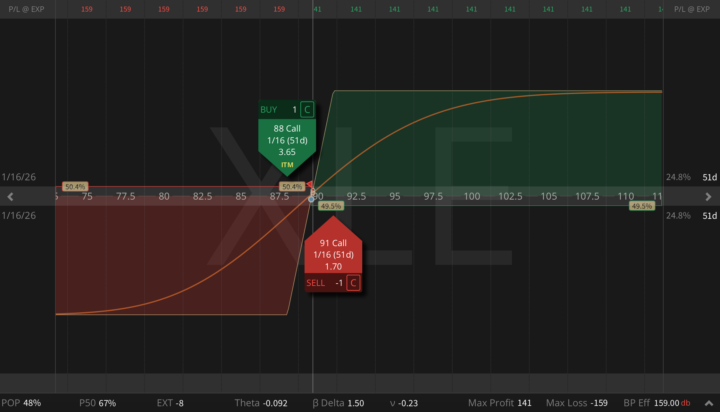

NVDA reports after the bell tonight, and this is the single most important event of the week for the entire technology complex, for AI capex sentiment, and potentially for sector rotation across the market! If NVDA re-prices the AI narrative, QQQ moves, growth vs value rotation shifts, even energy and cyclicals feel it through flows. Now here’s what’s interesting. Consensus is extreme: 65-66B revenue, +66% YoY. EPS up 70%, Data Center nearly the whole engine. The base case is already beat and strong guide. You'd expect options to price this like a bomb, but they aren't! The at-the-money straddle implies roughly a 5-6% move. Over the last 12 quarters, the average implied move was closer to 7.5%. By NVDA's own standards, this event is being priced smaller than usual. That's the first non-obvious signal. The second one is even more important. Historically, NVDA's implied earnings move trades at about 1.5x the tech sector (XLK). This quarter, that ratio is closer to 0.9x. Read that again: the market is pricing NVDA as less idiosyncratic than the sector, at a moment when AI capex concentration arguably makes it more idiosyncratic than ever. Yes, front-week IV is high (72% vs 55% baseline). Yes, there will likely be IV crush. But the lazy trade "short the rich IV" assumes the event premium itself is bloated. This time, the event premium is compressed relative to history and relative to tech. That changes the game, so we're not putting on calendar spreads today. The edge, in my view, sits in: - NVDA vs sector variance - Defined-risk or asymmetric volatility harvesting The market is not overpricing fear, it's compressing NVDA's uniqueness into sector volatility, and if that assumption breaks tonight, the move won't care about your straddle math. Because the event move is priced relatively small (5-6%) and the front-week premium is not unusually fat versus history, forcing a weekly Jade Lizard would mean selling compressed event variance with thin margin for error. So instead of playing the binary print, we step out to April (51 DTE) and build a safer Earnings Jade Lizard.

CRM Earnings Put Ratio Into Agentforce Test

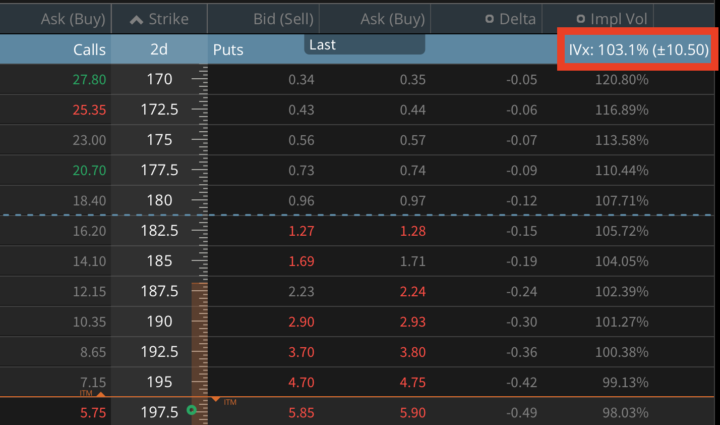

CRM reports after the bell, and the setup is actually fascinating. The stock sits around $235, down 36% from highs and 30% YTD. Growth has slowed, but fundamentals aren't broken. They're just… less sexy. IV is pricing a 7-8% move, skew is modest, and this is exactly the type of environment where I want to be slightly long CRM and short rich downside vol, with a wide cushion if we get a controlled pullback. Let's see what Marc Benioff brings us tonight!

1

0

A Sector Spread With Teeth: XLV-XLE Pair Trade

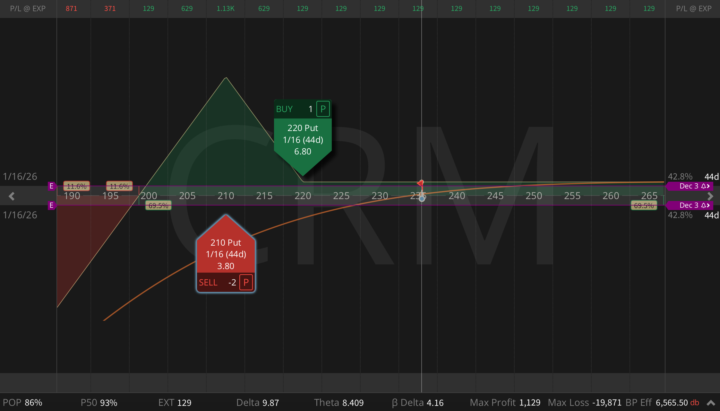

Hey, in the previous posts, I shared that rotation charts are finally giving us clean signals: XLV (Healthcare) keeps gaining relative strength, while XLE (Energy) is recovering after weeks of underperformance. Both sectors moved into a decision zone, and today I'm showing the exact structure I'm using to trade that divergence in the hedge fund. Part 1: XLE Call Debit Spread (Defined-Risk Snapback Play) - Buy 88C / Sell 91C Jan 16 (51 DTE), Debit: $1.59, Max Profit: $141 - A clean, defined-risk way to play the standard Energy bounce inside a choppy, low-volatility range. If XLE mean-reverts toward 90–92, this structure pays quickly Part 2: XLV Call Ratio Spread (Harvesting Exhaustion) - Buy 160C / Sell 2× 163C Jan 16 (51 DTE), Max Profit: $357, Max Risk is undefined (but extremely manageable in XLV). - XLV is extended, overbought, and showing early fatigue. Elevated IV makes upper-strike calls expensive, perfect for a ratio spread that benefits from slowing momentum or shallow consolidation. Why it works as a pairs trade? These aren't two isolated ideas, they're one combined expression: - XLE - defined-risk long delta where bounce probability is high - XLV - premium capture where trend exhaustion is visible - Combined - smooth Greeks, positive theta, and exposure to sector divergence rather than index direction. This is how you express rotation and sector behavior without guessing the market's next move. A clean, elegant pairs structure built for this macro regime.

1

0

GOOGL Earnings: Volatility Term Structure Arbitrage?

Hi, earnings season keeps delivering setups, and tonight's main event is Alphabet (GOOGL). After a 38% run in Q3 and record-high IV into the print, it's the perfect playground for advanced volatility structures. One of my favorite plays here (definitely not for beginners) is the Calendarized Call Ratio Spread. This trade doesn't play direction, but volatility term structure. Ahead of earnings, front-month (Nov) options trade at much higher implied volatility than back-month (Dec). We're selling two overpriced short-term calls to finance one longer-term call, building a temporary edge as front-end IV collapses right after earnings. So, you're essentially selling panic to buy time. Note: this is a very advanced structure with unlimited risk to the upside. It requires active management!

1-5 of 5

powered by

skool.com/painlesstraders-8746

I've been trading for twenty years, I'll share my experience.

Suggested communities

Powered by