Write something

Your "safe" short strangles just lost 2x more than your stress test predicted?

Hi, I just finished modeling the SPY Volga surface into the close (see attached). Now imagine this: you sold the OTM strangles, you stress-tested a 5-point volatility move, looked at the potential drawdown, and you accepted it. Then the spike actually hit, and you lost double. Why? Because your platform lied to you! Most retail brokers show you a static snapshot of your exposure RIGHT NOW. They don't show you what happens to that exposure when IV moves from 15 to 25. The reality is Vega isn't a constant. When volatility rips, the entire surface reprices, your short Vega becomes significantly more negative exactly when you need it to shrink. That's Volga (also known as Vomma). Think about it: if Delta has Gamma, Vega has Volga. It's the second-order Greek that measures how your Vega changes as volatility moves. If you're short the wings, you are Short Volga. My rule: don't size off today's Vega. Ask: What is my Vega if IV jumps 20-30 points? If you haven't modeled that, you don't know your true position size!

1

0

AS A BEGINNER

🔹 Idea #1 – Upgrade the Discussion Title:🧠 Instead of “Nice” — Let’s Start Thinking Like Investors I’ve noticed a lot of us comment “Nice” or “Yes” on market updates. What if we upgraded the discussion? Instead of:• “Nice” Try:• What liquidity level are you watching?• What invalidates this setup?• What’s your risk plan if support fails? We don’t grow from agreement.We grow from analysis. Let’s start commenting with:1️⃣ What we think2️⃣ Why we think it3️⃣ What would prove us wrong That’s how we level up as a community 🚀 🔹 Idea #2 – Beginner Friendly Value Title:If You’re New and Just Experienced Your First Dump — Read This A market dump doesn’t mean:❌ Crypto is dead❌ You failed❌ It’s over It usually means:• Leverage got wiped• Liquidity shifted• Emotions took control Real question:Did you have a plan before entering? If not — the problem isn’t the market.It’s the lack of structure. Before your next trade ask: Where is my entry? Where is my stop? Where is my invalidation? Volatility is tuition.Learn from it. 🔹 Idea #3 – Improve Comment Quality (Direct Solution) Title:🔥 Quick Idea to Improve Our Community Engagement What if we start replying to market posts with this format: 🧩 My Bias:📍 Key Level:⚠️ Risk Factor:🔄 What Would Change My Mind: This would:• Improve discussion• Help beginners learn thinking process• Reduce low-value comments• Increase real skill building Just an idea — what do you think? 🔹 Idea #4 – Psychology Angle (Very Strong) Title:The Real Reason Most People Lose in Crypto It’s not:• Charts• Indicators• News It’s position sizing + emotion. Most people:• Enter too big• Have no invalidation• Panic sell• FOMO buy Until risk management becomes boring…Profit will stay inconsistent. What’s one risk rule you follow no matter what? If USDT growth is cooling, would you expect weaker altcoin rallies first before BTC??????

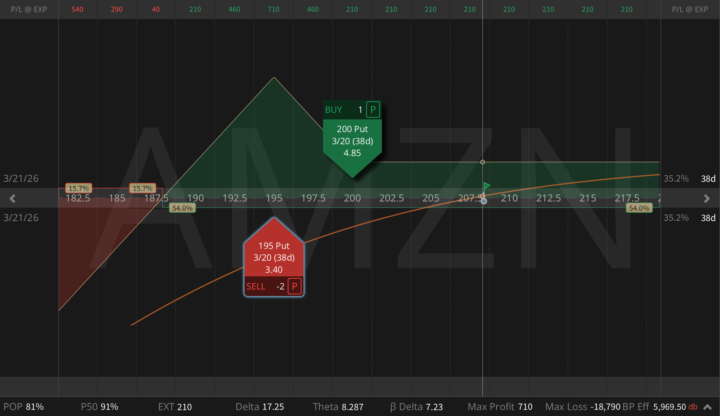

Amazon After Earnings: When Ratio Risk Beats Naked Risk

Last week we skipped trading AMZN earnings. Options were pricing 7.5%, reality was -14%, so short gamma was not the place to be. In my personal view it was only a repricing of capex and FCF timing, nothing more. AWS re-accelerated, ads keep growing >20%, NA retail margins are improving, but the market suddenly realized buybacks and FCF are pushed out by heavy AI capex. Post-earnings, the setup changed. The shock is out, downside skew is still rich, and fundamental downside convexity is much lower than before the print. That's why ratio risk now beats naked risk, so today I'm expressing this via a March put ratio:

1

0

1-30 of 38

powered by

skool.com/painlesstraders-8746

I've been trading for twenty years, I'll share my experience.

Suggested communities

Powered by