Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

Your First $5k Club w/ARLAN

10.5k members • Free

Invest & Retire Community

3.4k members • Free

FG

Free GENEIUS Content

3.8k members • Free

5 contributions to Invest & Retire Community

Monthly Passive Income on MSFT +9% gain in 23 days

Quick update for my monthly passive income portfolio: - MSFT (Jan 25 - Feb 17: 23 days) - Price movement: from $240 to $256 (+4.1%) if only using shares - My advanced monthly passive income strategy. Gain: +9% For the last 23 days, MSFT was quite bullish mainly due to the ChatGPT news and its investment into OpenAI As market is correcting the week after the inflation report, MFST's stock movement was 4.1%. Using monthly passive income strategy, I was able to secure 9% gain over 23 days. For February, I am on track for another 8.83% for the month Since December 2022 when I started sharing my MPI results, the cumulate return up till end of February will be 24% (projected) Cheers, Eric ----------------------------------- In February, my goal is to help 10 people without a financial background to master investing Investing Accelerator is designed for people without a financial background. Here's the link to the webinar: https://bit.ly/3i9QT1V We focus on developing financial independence, where you have the ability to invest to earn a higher return. The goal is to achieve 30% return per year. In the first phase, you will learn long term investing and targeting 30% for tax free compound growth. This will help accelerate your overall wealth. In the second phase, you will learn monthly passive income to provide a more predictable cash flow (target 30% per year) which can cover your expenses such as mortgage, utilities, car payments. This will help accelerate your retirement goals. If you are interested, then let's hop on a call to see if you can benefit from the strategies in Investing Accelerator and get 30% per year. During the call, we will map out exactly how you can achieve 30%, what you are lacking, how you can improve. Here’s the link to schedule a call: https://bit.ly/3Ia1MJZ

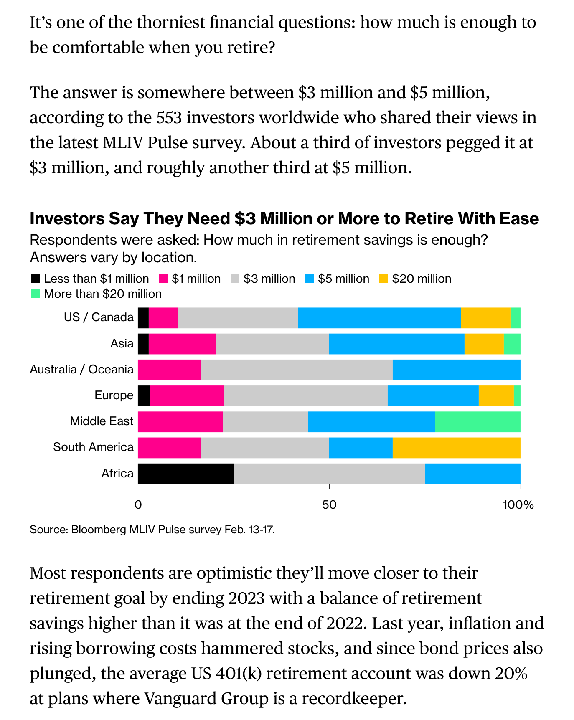

Bloomberg says You Need at Least $3 Million in Savings to Live Comfortably in Retirement

https://www.bloomberg.com/news/articles/2023-02-21/saving-for-retirement-investors-say-you-ll-need-3-million-to-be-comfortable?srnd=premium-canada Recently came across this article where Bloomberg says you need $3M to retire comfortably. If you look at the image below, you will find a good chunk of people in US and Canada think they need to have $5M or more to retire comfortably. This means: - We are in a crisis where the majority of the people cannot retire as most people do not have $5M or more - Inflation is hitting us really hard which makes people want to prepare an enormous nest egg before they can retire To give you a better picture, Canada has a population of 40 million. There's only 91,328 people with a net worth greater than $5M (around 100K people) https://www.thekickassentrepreneur.com/top-one-percent-of-wealth-for-canadians/ This means 100K / 40M = 0.25% of the population in Canada will retire comfortably according to this survey. What do you think? Eric --------------------------------------------------------- When it comes to retirement, it is important to figure out what is the income level you need per month (e.g. $3K , $5K, $10K) and reverse engineer how to get there. It is easy to fall into the trap where we think we need an enormous amount of money in order to retire ($1M, $3M, $5M) without considering what's the cash flow. If you focus on capital gain in your early years (earlier than 50), I would suggest you to focus on cash flow after 50 to achieve retirement faster. Most people I hop on a call with can retire with $5K - $10K per month. Then it is a matter of what kind of investing strategy would offer you $5K - $10K per month with AS LITTLE capital as possible. The traditional finance method assumes 4% return withdrawal rate when you retire

1 like • Mar '23

The concept of "retirement" where did come from? Let's see, Warren Buffet is like 92 years old, he is one of the wealthiest persons in the world and he is still working. Any ideas why a man would do this? If you retire from something to nothing, you'll start dying. You must retire from something to something else. Why is Mr. Warren Buffett still working? I believe he found his work and will gladly do it without pay. Many of us work a job, because we need to earn income. Then we retire from the job to our work. If you find a job in your work, you'll continue working like Warren Buffett. But if your job is not your work, you'll look forward to retiring. So be sure to find your work in your job or while you work in a job, begin to find your work, so that when you retire from your job, you can retire to your work and continue living a productive life, so that you can live longer. What do you all think?

Visiting Philippines for fun and wedding

Next week, I am heading to Philippines for a wedding. Normally, I would watch the market for 5-10 minutes per day. But because the way I organized my monthly passive income trades this month, all the trades will be working for me until the end of the month. This means I am done investing with monthly passive income for now until the end of the month and then - refresh. While March didn't turn out too well - I initially made a mistake with LLY and brought my return down to 0% for March I was able to turn it around and aim for 4% for the month of March. It is still a bit behind of where I would like to be for March but at least I am on target to achieve my desired return. We will have to see if there are any significant surprises with inflation & interest rate before this month's return is finalized. The market is very choppy. So make sure you stick to being conservative for now. Cheers, Eric Seto ------ In March, my goal is to help 10 people without a financial background to master investing Investing Accelerator is designed for people without a financial background. Here's the link to the webinar: https://bit.ly/3i9QT1V We focus on developing financial independence, where you have the ability to invest to earn a higher return. The goal is to achieve 30% return per year. In the first phase, you will learn long term investing and targeting 30% for tax free compound growth. This will help accelerate your overall wealth. In the second phase, you will learn monthly passive income to provide a more predictable cash flow (target 30% per year) which can cover your expenses such as mortgage, utilities, car payments. This will help accelerate your retirement goals. If you are interested, then let's hop on a call to see if you can benefit from the strategies in Investing Accelerator and get 30% per year. During the call, we will map out exactly how you can achieve 30%, what you are lacking, how you can improve. Here’s the link to schedule a call: https://bit.ly/3ZMnz1B

Significant USD/CAD movements. CAD weakens as USD strengthens - lesson on currency exchange

Yesterday, Fed Chair Powell came out and threaten to increase interest rate due to strong economical data. This spook the market significantly as some trades are now betting on a 50 basis point interest rate hike. On the other hand, Bank of Canada said they have done enough and looking to pause + hold rates for now. When you are looking at the exchange rate between two countries, the interest rate is the key factor that determines whether the exchange rate is going up or down. We see that CAD is currently dropping as the Bank of Canada is planning to hold the interest rate while US is looking to increase the interest rate. A lesson in Forex: - To put simply, countries with high-interest rate will attract capital and lead to a stronger currency as investors fled to the country with more return How does that impact your portfolio: - If your portfolio is in USD, then you're fine. You will continue to enjoy the high interest rate offered by US for now. - If your portfolio is in CAD, that's fine as long as your expenditure is in CAD. However, shopping internationally will be worse off for you (especially in US) - If your portfolio is in USD and you live in Canada, then that's great - you will enjoy an increase in value of your portfolio even if you just hold cash (and not investing). If you are investing, then of course - you will benefit from the higher return in US as well (as it attracts more investors) What we did in Investing Accelerator: - For the last year till now, we have been focusing our portfolio exclusively in US stocks. I told my students to convert into USD and hold onto them - Even if the students in Canada didn't invest or just holding cash - waiting for an opportunity, at least they locked in a good rate for USD and can easily convert back to Canada anytime. That's a lesson on FX for you. What do you think? Cheers, Eric, CPA, CIM

is it still possible for an old man to make enough money to retire?

It seems difficult, isn't it?

0 likes • Jan '23

@Peter Tse You keep saying an "old man. Your words are powerful and may be true. But Warren Buffet is 92 and still working. Do you think, he's working for the money? So, please relax. I am sure, you've lived life long enough and have a lot of wisdom to share with the next generation before your time is up. Your strategy I read is fine. But please share some of life's wisdom you've had for the next generation to learn from it. Bless you!

1-5 of 5

@caroline-ayuk-7753

Forex trader, esteemed author, and mentor. Transforming financial futures through expert insights and empowering others to navigate the Forex market

Active 5h ago

Joined Dec 25, 2022

Powered by