Pinned

🚨 Start Here First (Takes 2 Minutes)

Welcome to Tradeline Secrets, here’s what to do next: Step 1 👉 Book Your Free 1-1 Onboarding Call. Everyone that joins gets a special gift. Step 2: Watch the short video below Step 3: What do you need immediate help with first 💰 Type FUND → if you want help with funding (need 680+ score) 🔧 Type REPAIR → if you want help with credit repair Step 4 👉 Run Your Free AI Business Credibility Check Let our AI scan your setup and flag what's holding you back (still in beta) Have fun, The Tradeline Secrets Team (@David Ramirez & @Anshjeet Singh) PS: Are you pumped to be here?

Poll

102 members have voted

Pinned

The Road to 2 Million in Funding....

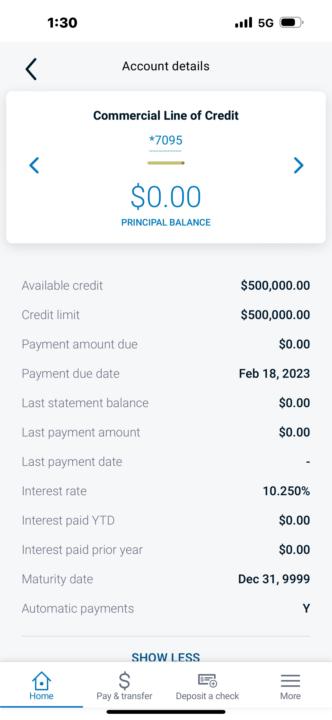

If you follow the course material and apply and ask good questions, you can literally get access to $500k, $1M pretty easily. Ive been in the funding space and have worked with David for the last 3 years and can tell you the roadmap is proven!

Pinned

The Call w/David Gave Me Exactly What I Needed

So after seeing the post from earlier about the AI Funding Agent moving to Premium it caught my attention enough to book a call w/David. We hopped on a Zoom and I literally asked everything I needed to ask. i didn’t feel rush, he didn’t talk over my head, and didn’t dodge a single question. He really took the time to explain how the system works and how it fits both personal and business credit strategy cuz I have interest in both After the walkthrough, it was a no brainer to upgrade. I also decided to start mentorship with him because the level of knowledge he has and the way he explains things is hard to find in this industry especially at the current price point he has it at. I’m excited to learn and build inside the program. Tysm again David! I appreciate you.

Live Q&A This Friday 3/05/2026

Hey everyone I’m doing a live Q&A. I was going to do it in the afternoon but I’ll be busy from 3pm MST until 9pm MST. So I will be doing it at 10:30am MST - 11am MST. This is just the first one. But after this week I will pick a day and time. And we’ll have weekly calls.

3

0

1-30 of 131

skool.com/tradelinesecrets

💰 Access $250K+ in capital

💳 Build an 800+ credit score

🤖 AI-powered funding

👇 JOIN BELOW

Powered by