Write something

Netflix – Long – Swing

HTF CONTEXT: Netflix sold off ~4–5% after earnings and is now trading back into a high-quality higher-timeframe demand zone. Price is sitting near the lower end of this zone, which historically has led to strong reactions. This is higher risk, but the location offers very asymmetric reward if demand holds. KEY LEVELS & ZONES: - HTF Demand Zone: 82.11 – 95.14 - Key Level (Confluence): ~82.35 - Price currently hovering just above the lower demand boundary GAME PLAN: 1. Bias remains long while price holds HTF demand 2. Entry taken early due to location (aggressive by design) 3. Execution via options at market open 4. Stop placed slightly below the demand zone with breathing room 5. Targets are layered higher as price accepts above demand 6. Clean loss of demand invalidates the long thesis TARGETS: 1. 100 2. 103 3. ~114 NOTES: This is a location-based trade, not confirmation-based. Risk is elevated, but the risk-to-reward profile justifies participation.

0

0

ADBE — Cautiously Bullish — Position

- Bias: Bullish only while price holds above 278 - Timeframe: Swing / Position (Daily / HTF) - Zone I’m Watching: 278–297 (HTF Demand) - Invalidation (Line in the Sand): Acceptance below 278 - My Rule: No chase. I only care how price reacts inside the zone. CONTEXT (WHY THIS ZONE MATTERS) In the prior update, 311–334 demand failed, which confirms that zone is no longer supportive and has now contributed to new supply overhead. Price is currently sitting inside higher-timeframe demand at 278–297, which is the origin that previously launched price to the 640 area. This is the last major demand that needs to hold for the bullish thesis to stay alive. That said, broader weekly market structure is weak, so this zone requires caution and proof, not blind buying. KEY LEVELS & ZONES - Key Line (Line in the Sand): 278 - HTF Demand (Critical): 278–297 - Broken Demand (Now Failed): 311–334 - New Supply (Overhead): 343–360 - Major Prior Expansion High: ~640 (context only) GAME PLAN (IF → THEN) 1. IF price holds and shows strength inside 278–297 → THEN the bullish position thesis remains valid. 2. IF buyers fail to defend this zone → THEN I’m not interested in longs; structure is compromised. 3. IF price rebounds but stalls near 343–360 → THEN expect selling pressure from new supply. 4. IF price reclaims acceptance above broken structure → THEN confidence improves, but patience is still required. 5. IF price chops with weak reactions → THEN I wait. No forcing trades.

0

0

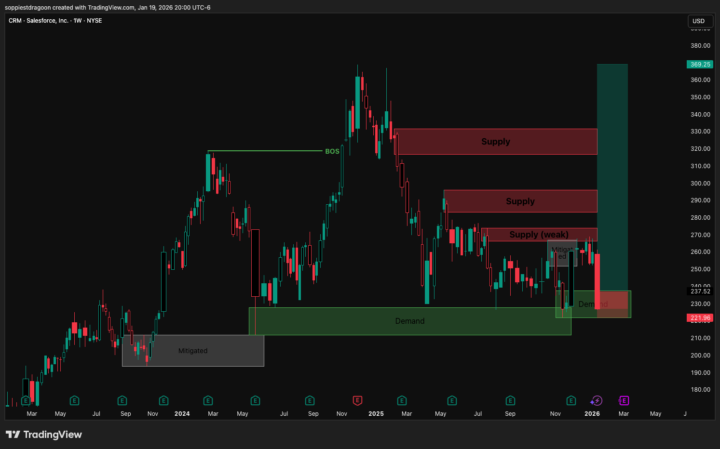

CRM – Neutral to Cautiously Bullish – Position

- Bias: Bullish as long as price stays above 212 - Timeframe: Position (higher-timeframe focused) - Zone I’m Watching: 221–237 (Demand) - Invalidation (Line in the Sand): Price holding below 212 - My Rule: No chasing. I only care how price reacts inside the zone. CONTEXT (WHY THIS ZONE MATTERS) The 212–227 demand is the base that started the entire move up to the highs near 369. That’s the most important level on the chart. Right now, price is pulling back into structure, but with the market being weak overall, I need to see buyers actually show up. KEY LEVELS & ZONES - Key Line (Line in the Sand): 212 - Main Demand: 212–227 - Near-Term Demand: 221–237 - Overhead Supply: 266–274 (tested multiple times) GAME PLAN (IF → THEN) 1. IF price reacts well inside 221–237 → THEN I’m comfortable staying bullish for a position trade. 2. IF price loses 221–237 → THEN I’m watching 212–227 closely for support. 3. IF buyers step in and price starts pushing higher → THEN the repeated tests increase the chances that 266–274 eventually breaks. 4. IF price holds below 212 → THEN this position idea is off. 5. IF price chops or reactions are weak → THEN I wait. No forcing trades. OPTIONAL: MEMBER CHECKLIST - Draw 212–227, 221–237, and 266–274 on your chart - Write your own IF → THEN rule - Decide where you would exit if wrong - Share your plan if you want feedback - If price never hits the zone, do nothing — that’s part of the edge

0

0

SPX 500 – Short-Term Pullback Risk

HTF Context: Price recently reacted to tariff-related news and printed a bearish imbalance to the downside, signaling short-term weakness. While the broader structure is still constructive, momentum has stalled near highs and price is now vulnerable to a retracement into lower demand. This looks more like pause and rebalancing, not trend failure—yet. Key Levels & Zones: - Supply: 6923–6990 Area where sellers previously stepped in. If price pushes higher into this zone, rejection risk increases. - Demand 1: 6820–6842 First downside reaction zone. Shallow pullback support. - Demand 2: 6767–6813 Stronger demand with better risk-to-reward if price continues lower. - Demand 3: 6524–6662 Major demand zone. Deeper pullback scenario if downside momentum expands. Game Plan: 1. Expect short-term downside continuation as the bearish imbalance resolves. 2. First area to watch for stabilization is 6820–6842. 3. If that level fails cleanly, next focus shifts to 6767–6813. 4. A strong sell-off or panic move could open the door to the 6524–6662 demand. 5. Any move back into 6923–6990 supply without strong acceptance increases odds of rejection and rotation lower. Notes:This is a reaction-based environment, not a chase. Let price come into your levels and show intent. Patience matters here—especially with news-driven volatility.

1

0

MLK Day: Markets Closed – Drop Your Tickers for Tomorrow’s Breakdown

US stock markets are closed tomorrow for MLK Day, so there won’t be any new live setups during the session. I’m using the downtime to prep levels and swing plans for the week. If there are specific charts you want me to cover, drop them below with: - Ticker symbol (stock or crypto) - Your rough idea (long / short / unsure) I’ll review them and post my charts, zones, and trade plans for you tomorrow.

0

0

1-30 of 121

powered by

skool.com/the-trading-desk-2388

Swing trade U.S. stocks & crypto around your 9–5 in ~10 minutes a night with a rules-based no-chase method so you stop staring at charts.

Suggested communities

Powered by