Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Owned by Albert

Free swing‑trading school for 9–5 pros who want clear levels, rules, and less screen time using the No‑Chase Swing Method.

Swing trade U.S. stocks & crypto around your 9–5 in ~10 minutes a night with a rules-based no-chase method so you stop staring at charts.

Memberships

AI Automation Society

238.8k members • Free

Creator Accelerator

242 members • $80/m

T-MAX ACADEMY

716 members • $198/m

157 contributions to Swing Trading Desk

[ACTIVE] — NFLX — LONG — SWING

Status: Pending TRADE SETUP (EXECUTION FIRST) • Entry Zone / Trigger: Price trading inside HTF demand, near the lower boundary of the zone. • Stop / Invalidation: Below the HTF demand zone (slight breathing room). • Initial Targets: T1: 100 T2: 103 T3: ~114 • Order Type: Market entry at the open (location-based entry). • Risk / Size Guidance: Max 0.5–1R risk. This is a higher-risk setup by location, sized accordingly. MANAGEMENT PLAN (IF → THEN RULES) • IF entry fills → THEN no changes until price reaches first target or stop. • IF stop is hit → THEN trade is closed, no re-entry unless a new plan is posted. • IF price reaches T1 → THEN partial taken and stop adjusted to reduce risk. • IF price reaches T2 → THEN manage remainder based on momentum and structure. • IF price fails to hold demand → THEN thesis is invalidated. CONTEXT & THESIS (OPTIONAL READ) • Structure: Earnings gap down directly into a high-quality higher-timeframe demand zone. • Level Logic: This zone previously acted as a strong accumulation area and aligns with a key level near 82.35, increasing the odds of a reaction. • Why This Works: This is a location-first trade. Risk is clearly defined below demand, while upside expands meaningfully if buyers defend the zone. • Invalidation Beyond Stop: Clean acceptance below demand would signal structural failure and negate the long thesis. 🔔 Tap the bell on this post to turn on notifications. If you don’t tap the bell, you may miss updates on this trade.

![[ACTIVE] — NFLX — LONG — SWING](https://assets.skool.com/f/9eedb258b74146de93effd8f637d192b/ea7f5e83cb6f44fa860806b4e779048e1f1950fbbf8f44f48f8c62cc5b721ecb-md.png)

[Closed] – PYPL – [Bias: Long] – [Trade Type: Swing / Position]

- Entry: Current levels inside demand (57.68–58.82) - Stop: 56.46 (hard invalidation) - Target(s): Reasoning: Price is trading directly into a higher-timeframe demand zone at 56.51–58.94, with a nested demand forming inside that range at 57.68–58.82. This places PYPL at a clear make-or-break location after an extended selloff. Recent price action has been objectively weak, with prior demand levels failing to hold, which is why this setup is based strictly on location and risk control, not trend strength. As long as price holds above 56.46, buyers have an opportunity to defend demand and rotate price back toward prior structure. A clean break and acceptance below 56.46 would signal failure of demand and invalidate the bullish thesis.

![[Closed] – PYPL – [Bias: Long] – [Trade Type: Swing / Position]](https://assets.skool.com/f/9eedb258b74146de93effd8f637d192b/edef251a619e41e4b5409c26bc9927138358a38a5a31432ca6863aaa401f4cd9-md.png)

Netflix – Long – Swing

HTF CONTEXT: Netflix sold off ~4–5% after earnings and is now trading back into a high-quality higher-timeframe demand zone. Price is sitting near the lower end of this zone, which historically has led to strong reactions. This is higher risk, but the location offers very asymmetric reward if demand holds. KEY LEVELS & ZONES: - HTF Demand Zone: 82.11 – 95.14 - Key Level (Confluence): ~82.35 - Price currently hovering just above the lower demand boundary GAME PLAN: 1. Bias remains long while price holds HTF demand 2. Entry taken early due to location (aggressive by design) 3. Execution via options at market open 4. Stop placed slightly below the demand zone with breathing room 5. Targets are layered higher as price accepts above demand 6. Clean loss of demand invalidates the long thesis TARGETS: 1. 100 2. 103 3. ~114 NOTES: This is a location-based trade, not confirmation-based. Risk is elevated, but the risk-to-reward profile justifies participation.

0

0

ADBE — Cautiously Bullish — Position

- Bias: Bullish only while price holds above 278 - Timeframe: Swing / Position (Daily / HTF) - Zone I’m Watching: 278–297 (HTF Demand) - Invalidation (Line in the Sand): Acceptance below 278 - My Rule: No chase. I only care how price reacts inside the zone. CONTEXT (WHY THIS ZONE MATTERS) In the prior update, 311–334 demand failed, which confirms that zone is no longer supportive and has now contributed to new supply overhead. Price is currently sitting inside higher-timeframe demand at 278–297, which is the origin that previously launched price to the 640 area. This is the last major demand that needs to hold for the bullish thesis to stay alive. That said, broader weekly market structure is weak, so this zone requires caution and proof, not blind buying. KEY LEVELS & ZONES - Key Line (Line in the Sand): 278 - HTF Demand (Critical): 278–297 - Broken Demand (Now Failed): 311–334 - New Supply (Overhead): 343–360 - Major Prior Expansion High: ~640 (context only) GAME PLAN (IF → THEN) 1. IF price holds and shows strength inside 278–297 → THEN the bullish position thesis remains valid. 2. IF buyers fail to defend this zone → THEN I’m not interested in longs; structure is compromised. 3. IF price rebounds but stalls near 343–360 → THEN expect selling pressure from new supply. 4. IF price reclaims acceptance above broken structure → THEN confidence improves, but patience is still required. 5. IF price chops with weak reactions → THEN I wait. No forcing trades.

0

0

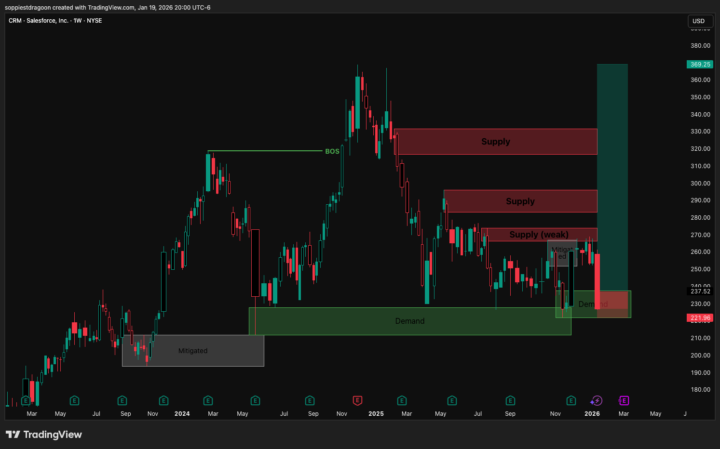

CRM – Neutral to Cautiously Bullish – Position

- Bias: Bullish as long as price stays above 212 - Timeframe: Position (higher-timeframe focused) - Zone I’m Watching: 221–237 (Demand) - Invalidation (Line in the Sand): Price holding below 212 - My Rule: No chasing. I only care how price reacts inside the zone. CONTEXT (WHY THIS ZONE MATTERS) The 212–227 demand is the base that started the entire move up to the highs near 369. That’s the most important level on the chart. Right now, price is pulling back into structure, but with the market being weak overall, I need to see buyers actually show up. KEY LEVELS & ZONES - Key Line (Line in the Sand): 212 - Main Demand: 212–227 - Near-Term Demand: 221–237 - Overhead Supply: 266–274 (tested multiple times) GAME PLAN (IF → THEN) 1. IF price reacts well inside 221–237 → THEN I’m comfortable staying bullish for a position trade. 2. IF price loses 221–237 → THEN I’m watching 212–227 closely for support. 3. IF buyers step in and price starts pushing higher → THEN the repeated tests increase the chances that 266–274 eventually breaks. 4. IF price holds below 212 → THEN this position idea is off. 5. IF price chops or reactions are weak → THEN I wait. No forcing trades. OPTIONAL: MEMBER CHECKLIST - Draw 212–227, 221–237, and 266–274 on your chart - Write your own IF → THEN rule - Decide where you would exit if wrong - Share your plan if you want feedback - If price never hits the zone, do nothing — that’s part of the edge

0

0

1-10 of 157

@albert-wang-6506

9–5 pros: swing US stocks + BTC/ETH.

No‑Chase Method.

Timestamped setups BEFORE trigger.

No scalping, penny stocks, or alts.

Active 29m ago

Joined Aug 20, 2025