Write something

Pinned

Start Here — Post #2: How The Desk Works (Read Second)

Read this after you complete Post #1 (paper trade + proof). Then we switch to one LIVE trade per week. Where everything lives - Weekly Watchlist — what I’m watching with thesis + zones marked - Trade‑Signals — every trade + all updates (one thread per trade) - Trade‑Reviews — your First‑Win proof + your closed trades and lessons - Office Hours Q&A — message me in this thread for help - Wins & Accountability — Weekly Scorecard (post every Sunday) - Announcements — 7‑day nudges + important updates - Signals 101 — read “How Trade Signals Work + Notifications” (pinned in Trade‑Signals) before following signals How to use the Desk (no chasing) - Pick 1–2 tickers from the Weekly Watchlist - Plan your entry, stop, and target the night before - Place the LIVE trade per your plan; let it play—don’t tinker intraday - After it closes, post a Trade‑Review: setup → execution → result → lesson - Need help? Message me inside the Office Hours Q&A thread Your weekly rhythm - Sunday: read Weekly Watchlist, post your Weekly Scorecard commitment in Wins & Accountability - Mon–Fri: execute the plan; no chasing - Upon close: post your Trade‑Review and one key lesson - Next Sunday: post your new Weekly Scorecard Progression and rewards - Core Method course unlocks at Level 3 (≈20 points via community engagement) - Stay active and ship weekly reviews—simple consistency = better results

0

0

Pinned

Start Here — Post #1: Your First Win in 7 Days (Do This Now)

Goal: place ONE paper trade this week, post proof in Trade‑Reviews, and book your Day‑7 Graduation. We start with a paper trade so you get a quick win now—not months from now. What to do (20–30 minutes) 1. Watch the 12‑minute setup: https://www.skool.com/the-trading-desk-2388/classroom/34d0689d?md=ccdb6e829c4444f7a0ec5b7a420b7bd8 2. Fill the 1‑page No‑Chase Plan for 1–2 tickers you understand: https://www.skool.com/the-trading-desk-2388/post-trade-breakdown-template?p=3a60ff18 3. Place ONE paper trade using your plan - Decide your entry, stop, and target before the session - Place the trade in your paper account and let the plan work—no chasing 4. Post proof in Trade‑Reviews (use the pinned thread: “First Paper Trade — Post Your Proof Here”) - Paste your 1‑page plan - Screenshot of your paper order (before or just after it fills) - Screenshot of the open or closed position Need help? DM me. I'll verify your paper trade and schedule your Day‑7 Graduation What unlocks when you post proof - Core Method course (unlocks at Level 3 via simple engagement) - 10‑minute trade audit slot

0

0

Pinned

How Trade Signals Work + Notifications (Read Before Following) 🔔

- Every trade (Swing, Position, Day) is posted here. - Titles show trade type + directional bias + status (Active / Pending / Closed). - All updates (entries, stop moves, exits) stay in the same thread for clarity. - Notifications: open the specific Trade‑Signal you care about and tap the bell to follow it. Fewer follows = less noise. - Tip: Download the Skool mobile app and allow push notifications for faster updates. 📱

0

0

GRAB – Long – Position

Big Picture (HTF): GRAB continues to hold a bullish higher-timeframe structure. The area between 4.73–5.01 is the key demand zone that originally drove price up toward the 6.62 highs. That gives this zone real importance from a cause-and-effect standpoint. Price has now retraced back into this demand and is starting to show early signs of a potential reversal, which keeps the higher-timeframe bullish thesis intact for now. What Changed Recently: After trading into HTF demand, price formed new demand at 4.82–5.06, with 4.84 acting as the key level inside that zone. This tells me buyers are attempting to defend higher lows instead of letting price break down immediately. We also have a POC around 5, which adds confluence to this area as a zone where price may continue to respond. What I’m Watching: As long as price can hold above current demand, I’m watching for continuation higher toward the 6.02–6.24 supply zone. That’s the next area where price could react or slow if momentum carries through. Risk / Alternate Scenario: If this demand fails to hold, I’m stopped below the current structure. In that case, a deeper retracement toward the 4.2 area becomes possible, and I’d reassess from there rather than forcing anything. Plan: This remains a position-style long. The focus is on whether buyers can continue to defend this area and push price back toward overhead supply. If structure breaks, I step aside and wait.

0

0

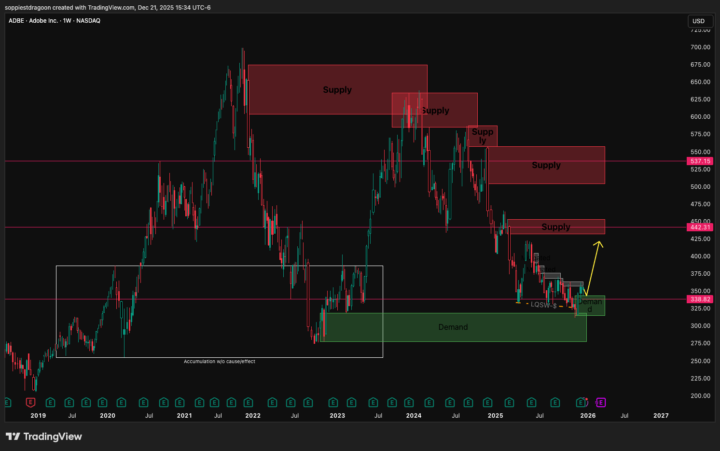

ADBE – Long – Position

Big Picture (HTF): On the higher timeframe, 278–318 is the key demand zone that mattered. This was the area that originally drove price up into the 604–675 supply zone, where sellers took control and the larger selloff started. That gives this demand zone real weight from a cause-and-effect standpoint. Price has since retraced all the way back into that 278–318 demand, and from there we’re starting to see buyers respond again. What Changed Recently: After tapping into HTF demand, price formed new demand at 315–343, with 338 acting as the key level inside that zone. This tells me buyers are starting to defend higher prices rather than letting price slide back into the lows. What I’m Watching:If price retraces back into the 315–343 area, that’s where I’m interested in adding to my position trade, as long as price continues to respect structure and buyers show up. What’s Above Price: - 432–453 supply (key level 442) - 504–557 supply (key level 537) Near-term supply has already been mitigated, so I’m not expecting a lot of immediate resistance if buyers stay in control and momentum continues. Plan: This remains a position-style long. I’m not chasing strength — I’m waiting for price to come back into demand and then evaluating adds based on how price behaves.

0

0

1-30 of 118

powered by

skool.com/the-trading-desk-2388

Weekly watchlist w/ exact levels, live trade alerts, reviews + weekly Q&A. Bonus course (early access). Start 7-day trial

Suggested communities

Powered by