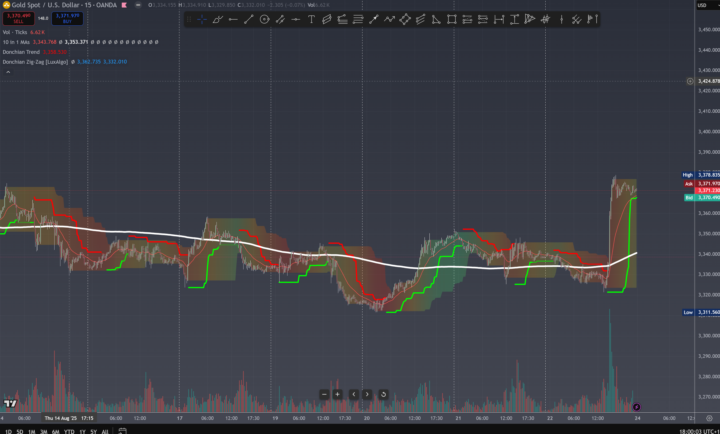

🟢 XAUUSD · M15 — “Retest the Launchpad (Post-Spike LPS)”

🔎 Global Context - Trend: D1 uptrend; price well above EMA200 (white) → structural bullish bias. - Event: M15 breakout spike with volume (Wyckoff SOS). We now expect the LPS/backup into the breakout block. 🔍 Confluence Map - Wyckoff: SOS → buy the LPS back into the last bearish candle before the impulse. - Smart Money: Demand zone overlaps 3,353–3,359. - Fib of 3332→3378: 50% ≈ 3355, 38.2% ≈ 3360 (inside entry box). - Dynamics: EMA200 ≈ 3,353 “catch-up” + Donchian trend flipping support; watch 8/21 EMA (orange/blue) bullish hold on the dip. skool for more] 📈 Trade Parameters - Entry: 3,353 – 3,359 (first touch or rejection wick). - Stop-Loss: 3,332 (beneath M15 base & liquidity shelf). Take Profit Targets: - TP1: 3,378 (spike high) — scale partial; move SL→BE after close above. - TP2: 3,392 (1.27 ext./momentum). - TP3: 3,416 (measured move; primary take-profit). - (Stretch 3R marker ≈ 3,428 if momentum accelerates.) Risk/Reward (mid 3,356): - Risk = 24 to 3,332. - TP2 = +36 → 1:1.5; TP3 = +60 → 1:2.5 ✅. ✅ Execution Checklist - ⏳ Wait for price to retest 3,353–3,359. - 🧭 Candle signal: bullish rejection/engulfing closing above EMA200. - 🔁 8 EMA > 21 EMA and holding on the pullback. - 📊 Breakout volume not collapsing (no heavy sell-delta at the level). - 🚫 Do not chase if the retest fails; no long on a clean M15 close below 3,332. 🧯 Management & Contingencies - Risk per trade: 0.5–1.0%. - After TP1, SL→BE; after TP2, trail beneath the 8 EMA or last M5 HL. - Shallow retest scenario (3,360–3,363): keep invalidation at 3,332; - conservative alt.: wait for a higher low (~3,346–3,350), then re-define size so final RRR ≥ 1:2.5 to 3,416. Trade Confidence: ⭐⭐⭐⭐ (High-probability if the retest holds above EMA200 + 8/21 confirmation) ⚠️ Trading involves risk. Always manage exposure and trade responsibly. 💬 What do you think of this setup? Drop your analysis below! 👇

0

0

Week1: Gold steady 3,390–3,450; oil eyes $67.5; watch Gaza, Alaska, and CPI headlines.

Big Picture - Gaza conflict fuels safe-haven bids in gold and USD. - Alaska peace talks could shake crude oil and defense stocks. - China’s deflation and exports mix signals for commodities and growth. Key Levels Support: Gold: 3,380 Brent oil: 65.0 WTI oil: 62.5 Energy ETF (XLE): 84.0 DXY (US dollar index): 99.5 Defense ETF (EIS): 87.5 Resistance: Gold: 3,450 Brent oil: 67.5 WTI oil: 64.5 Energy ETF (XLE): 86.0 DXY: 100.0 Defense ETF (EIS): 89.0 What Could Move Price (If/Then) - If Gaza tensions escalate → risk-off → gold and USD up; EM assets down. - If Alaska talks firm → crude oil dips; defense stocks weaken. - If US CPI is soft → growth and bonds favored; metals and energy pressured. - If China deflation dominates → bonds/growth favored; mixed impact on commodities. Technical Read Gold trades in a range 3,390–3,450. Above 3,450 means momentum up; below 3,380 signals risk-off. Brent oil is near 66.4; above 67.5 opens a move to 70, below 65 tests lower support. WTI stays firm above 64.5; breaks 62.5 to test 61. Energy ETF XLE breaks 86.0 then fades; breaking 84.0 means risk-off mode. DXY above 100 signals headwinds for risk assets; below 99.5 eases pressure. Setups 🟢 Long #1 — Brent Oil Squeeze - Trigger: Price closes above 67.5. - Entry: 67.5–67.6 zone. - SL: 66.4 - TP: 70.0 - R:R: About 1:4 (high reward if holds). - Why this works: Break above key resistance signals short squeeze and momentum. - Invalidate: Close back below 66.4. 🟢 Long #2 — Gold Range Bounce - Trigger: Price holds 3,380–3,390 with SMI (momentum strength gauge) uptick. - Entry: Around 3,385. - SL: 3,365 - TP: 3,410 / 3,445–3,450 - R:R: Approx 1:1.5 / 1:3.7 - Why: Range support confirmed; safe haven demand rising with geopolitical risks. - Invalidate: Close below 3,365. 🔴 Short #1 — XLE Fade - Trigger: Fails at 86.0 resistance, bearish momentum. - Entry: ~85.9 - SL: 86.5 - TP: 84.0 / 83.0 - R:R: ~1:2 - Why: Resistance cap proven; risk-off pressure returns. - Invalidate: Close above 86.5.

0

0

🔥 The Judas Swing Club

“Sorry boys and girls — not swingers, swing. We trade moves, not morals. What you do with the profits is your business. We don’t judge.” A private Skool community for traders who know the game is rigged — and trade it anyway. We dissect the markets daily:📈 Major FX pairs💰 XAUUSD🧨 Minor movers & select crypto⚔️ + Battle-tested swing and scalp strategies (Judas swings included) No fluff. No Discord noise. Just clean analysis, sharp execution, and real edge. If you’re tired of Telegram circus channels and empty hype — welcome to the club.

0

0

1-3 of 3

powered by

skool.com/the-judas-swing-club-9437

Sorry boys and girls — not swingers, swing. We trade moves, not morals. What you do with the profits is your business. We don’t judge.

Suggested communities

Powered by