Pinned

🚀 It's Live. 50 Founding Member Spots for strIQ [UPDATE: 33 Spots already gone!]

You've been here. You've seen what we're building. Now you can be one of the first 50 to lock it in. UPDATE: 33 of 50 spots claimed! We opened this up just a few hours ago and many spots are already being claimed. If you've been on the fence, now's the time. Founding Members get: ✅ Lowest price we'll ever offer ($599/year vs. $2,388/year at full price) ✅ Locked-in rate for life ✅ First access to every new feature ✅ strIQ exclusive strIQ merch ✅ Direct line to the team shaping what comes next This is our way of saying thank you to the people who've been with us from the start. Once these 50 spots are gone, they're gone. Any next round will be at a higher price. 👉 Grab your spot here: striq.com/founding-member Drop any questions below. We're here all day. -- strIQ Team

Pinned

Welcome to the strIQ Squad! 🎉

Glad you're here. Your first step: Head to the Classroom and complete the Welcome & Start Here course. It takes about 10 minutes and shows you exactly how to get the most out of this community. Once you've done that, come back here and introduce yourself in the comments. Tell us: 1. Where you're located 2. Where you are in your STR journey (learning, preparing, hunting, or scaling) 3. Your 90-day goal See you soon, — Matt

Pinned

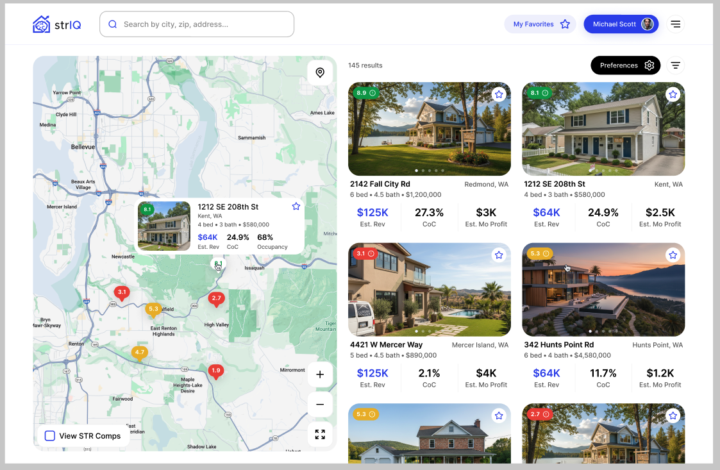

It's Coming... strIQ 2.0 👀

You've seen what strIQ can do. Now we're taking it to another level. We've been heads down rebuilding the entire platform from the ground up — new design, faster performance, web AND mobile fully integrated, and some features I've been wanting to build since day one. Here's a sneak peek of what we're calling "strIQ 2.0" (see below) A few things you'll notice: - strIQ Score (that green/yellow/red badge) — instant 0-10 rating on every property so you know immediately if it's worth digging into - Cleaner interface — everything you need to make smarter and faster decisions - Fully integrated platform with web & mobile — analyze deals from anywhere We're getting close to opening this up for beta testing, and I want you to be a part of this with us. If you want early access, comment "BETA" below or DM me. Excited to see what we can build together as a community. — Matt UPDATE: Beta group is full! 🙌 But we just opened 50 Founding Member spots — early access to strIQ 2.0, locked-in discounted lifetime pricing, and direct access to me. These won't last long. Details here: https://www.striq.com/founding-member Or DM me "FOUNDING MEMBER" and I'll walk you through a live demo.

Introduction

Newbie here, planning to invest in our first STR property. Looking forward to learn and grow with this community. Live in central NJ, exploring Poconos, PA for first STR.

Introduction

Hi everyone! I’m Courtney — excited to be here and connect with you all. I recently joined STR IQ Squad to continue learning, share experiences, and be part of a community of people actively building in the STR space. My husband and I have been involved in short-term rentals since 2018. We currently own seven short term rentals and are about to close on our eighth. We purchased in the Ponte Vedra Beach / Jacksonville Beach area in 2020 and recently relocated to Florida full-time to focus more on this market. I’m also a licensed Realtor in Florida, serving the PVB / Jax Beach area. In addition to growing our own portfolio, we’re expanding our STR management company locally and really enjoy refining operations, systems, and guest experience. We left our packaging engineering careers back in 2021 to pursue this full-time and are big believers in continual learning — through podcasts, networking, and learning from others in the industry. I’m looking forward to connecting and learning from everyone here.

1-30 of 78

skool.com/striq-squad

The free community for STR investors who want to stop guessing and start investing with confidence. Learn together—then use strIQ to execute.

Powered by